By Jessica Groskopf

Nebraska wheat producers may want to consider marketing assistance loans (MALs) as a part of their post-harvest marketing plan this year. Recent price levels at or below the loan rate make the loan program or the loan deficiency payment (LDP) a relevant part of a producer’s marketing decisions.

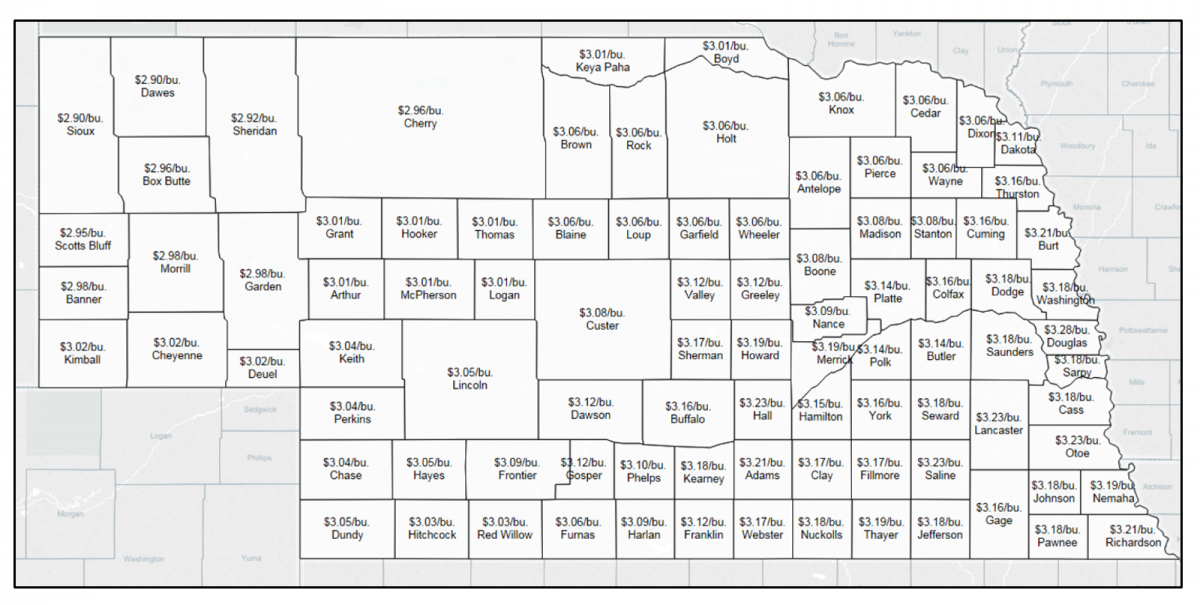

A marketing assistance loan is a nonrecourse loan offered through the USDA Farm Service Agency. After harvest a farmer may apply for a marketing assistance loan at an interest rate of 1.625%. The farmer has nine months to repay at the lower of 1) the loan plus interest or 2) the posted county price (PCP) or forfeit the wheat as repayment. The principal of the loan is determined by the “loan rate” which varies by county. Figure 1 shows the loan rate for hard red winter wheat by county.

Low interest rates make marketing assistance loans an attractive option, reducing interest and storage costs to the farmer. Marketing assistance loans create a price floor at the county loan rate, minus the interest cost of the loan. This allows farmers to store grain and wait for prices to recover from harvest lows. Usually, winter wheat prices will increase 8-10% from July 1 to late October. However, price patterns vary slightly every year and there is no guarantee that winter wheat prices will improve.

If farmers choose not to use a marketing assistance loan, they qualify for a Loan Deficiency Payment (LDP). An LDP payment is available when the PCP falls below the county loan rate.

For more information about marketing assistance loans and LDPs contact your local USDA Farm Service Agency office. Producers need to apply for any marketing assistance loans or LDP assistance before losing beneficial interest in the commodity, so it is important to contact the Farm Service Agency office before implementing any other marketing decisions.

Source:unl.edu