Figure 1. South Dakota Soybeans-price received, measured in $/Bu.

As indicated in Figure 1, soybean price received by South Dakota producers maintained a high level between January 2011 and May 2014. Soybean price dropped sharply in 2014 and stabilized at a low level in recent years with monthly prices mostly fluctuating between $8 and $10 dollars during 2015-2020 period (Figure 1). Annual soybean prices received by producers in South Dakota averaged 8.99, 8.95, 8.95, 8.72 and 8.00 (Unit: $/Bu) for 2015, 2016, 2017, 2018, and 2019 respectively. According to USDA/NASS data, South Dakota Soybeans-price received in September 2020 was $8.99/Bu, up 86 cents from the previous month. Lower production and ending stocks during 2020/21 will likely contribute to the increase in soybean price. Based on the most recent World Agricultural Supply and Demand Estimates on November 10th, 2020, the forecasted U.S. season-average soybean price for 2020/21 is $10.40/Bu, up 60 cents from the previous month (USDA, 2020).

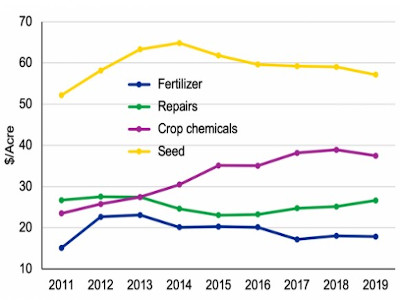

A positive correlation exists between soybean price and soybean production costs. During 2011-2014, the soybean price received remained at a high level, and its production costs had also increased substantially. After the soybean price sharply decreased in 2014, the main components of production costs also declined slightly (Figure 2). In contrast to the cost increase of 33%, 24% and 29% respectively on fertilizer, seed and land rent during 2011-2014 period, expenditure on these three components have declined by 12%, 8% and 3% respectively between 2015 and 2019.

Meanwhile, the chemical use increased by 6.78% during the 2015-2019 period, much lower than the increasing rate of 29.70% during the 2011-2014 period. The increase in chemical use is likely due to the increasing usage of herbicide, which could be attributable to the expansion of herbicide resistant weeds (Livingston et al., 2015). Meanwhile, even though machinery repairs cost decreased by 8% during the 2011-2014 period, it has increased by 15% during 2015-2019. Due to the reducing farm income margins and continuously rising prices of new farm equipment in the recent years, more farmers choose to keep the older machines, which contributed to an increase in repair costs (Shepel, 2020).

Input Expenditure Comparisons Between High- and Low-Profit Producers

Figure 2. Four most expensive production cost categories after land rent for soybean production in Minnesota, North and South Dakota, 2011-2019, measured in $/acre.

Input usage and expenditures vary greatly among producers. Based on the data analyses of 1,274 cash-rent farms from Minnesota in 2019, the net returns over direct expenses were $98/acre on average, $204/acre for the 20% most profitable producers, and $8/acre for the 20% least profitable producers. After further deducting overhead expenses, the net returns were $36/acre on average, $153/acre for the 20% most profitable producers, and -$74 for the 20% least profitable producers. Profits for these two groups have increased by $31 and $27 respectively when compared with the 2015 net returns, which was $122/acre for the 20% most profitable producers, and -$101 for the 20% least profitable producers. As soybean prices in 2019 slightly decreased when compared with 2015, such an increase in profit could be attributable to the reduction in input expenditures.

Profit differences between farms indicated a potential to increase profit for farms in the less-profitable group. To better understand the source of cost discrepancies, Table 1 provides a comparison of soybean production costs between the 20% most profitable producers and the 20% least profitable cash-rent soybean producers in 2019. In terms of the cost difference in dollars per acre, land rent ranks first among all the direct expense cost categories. Other main categories with the largest cost differences between the two groups include fertilizer, repairs, operating interest, and seed. Among these, fertilizer, repairs, and seed are also among the top three highest cost categories after land rent (Figure 2), suggesting managing those expenses may effectively reduce total costs. Ironically, despite the higher input costs incurred by the 20% least profitable producers, they generated an average yield of 42 Bu/acre, which was 10 Bu/acre less than that of the 20% most profitable producers.

TABLE 1. DIRECT EXPENSE COMPARISONS BETWEEN HIGH 20% AND LOW 20% CASH-RENT SOYBEAN PRODUCERS, BASED ON 1274 FARMS FROM MINNESOTA IN 2019. UNIT: $/ACRE.

| Direct Expenses | 20%

Least Profitable | 20%

Most Profitable | Difference |

| Land rent | 184.88 | 162.26 | 22.62 |

| Fertilizer | 28.78 | 15.64 | 13.14 |

| Repairs | 35.69 | 22.77 | 12.92 |

| Operating interest | 15.51 | 6.82 | 8.69 |

| Seed | 57.97 | 52.99 | 4.98 |

| Hired labor | 5.68 | 1.77 | 3.91 |

| Fuel & oil | 18.62 | 14.91 | 3.71 |

| Crop chemicals | 42.17 | 39.05 | 3.12 |

| Custom hire | 10.02 | 8.11 | 1.91 |

| Miscellaneous | 3.07 | 1.60 | 1.47 |

| Hauling and trucking | 1.93 | 0.49 | 1.44 |

| Machinery leases | 3.13 | 1.93 | 1.20 |

| Crop insurance | 18.36 | 17.83 | 0.53 |

| Marketing | 1.29 | 1.01 | 0.28 |

| Drying expense | 0.33 | 0.15 | 0.18 |

| Cover crop expense | 0.19 | 0.20 | -0.01 |

| Utilities | 0.84 | 0.88 | -0.04 |

| Storage | 0.58 | 0.65 | -0.07 |

Compared to the cash-rent producers in Minnesota, South Dakota cash-rent producers paid lower land rents which averaged $133/acre and $122/acre respectively for the 20% least profitable and 20% most profitable. The yields were 48 Bu/acre and 58 Bu/acre for the 20% least profitable and 20% most profitable producers in South Dakota, as of 2018. Nevertheless, the least profitable South Dakota producers, similar to Minnesota farms in 2019 (Table 1) incurred higher input costs on land rent, crop chemicals, seed, repairs and fertilizer, but did not produce higher yields as a result.

To determine the potential to increase net profit from soybean production, individual soybean producers are encouraged to compare their own yields and input costs with these benchmark levels. Recommendations for producers to reduce input cost and increase profitability include eliminating application of nitrogen fertilizer, reducing planting rates, rotating crops and reducing/eliminating tillage operations (Staton, 2020).

Source : sdstate.edu