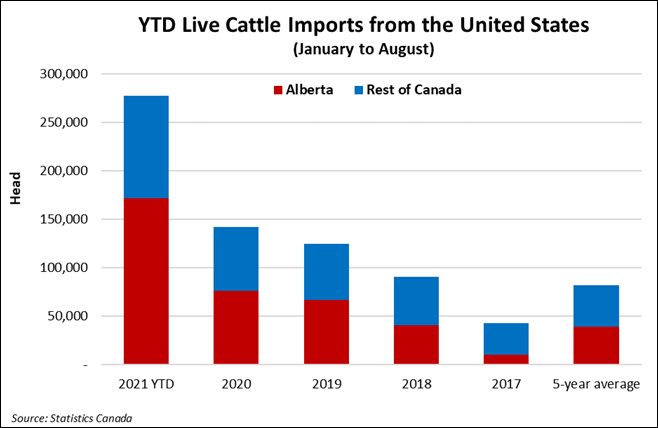

Figure 1. YTD Live cattle imports from the United States

‘The demand for feeder cattle continues to grow in Canada and specifically Alberta,’ says Wood. ‘Alberta feedlot bunk capacity was reported at 1,530,900 head on January 1, 2021, an increase of 41,200 head from January 1, 2020. Bunk capacity has increased in response to an increase in slaughter capacity and strong basis levels in recent years.’

Western Canada beef processing plants are currently operating near capacity to satisfy strong consumer beef demand, which in turn is driving demand for more fed cattle. In 2021, western Canada federally inspected beef processing plant utilization rate was 97.7%, up from 95.2% in 2020 (6-week COVID-19 plant disruption removed) and significantly higher than the 5-year average utilization rate of 86%.

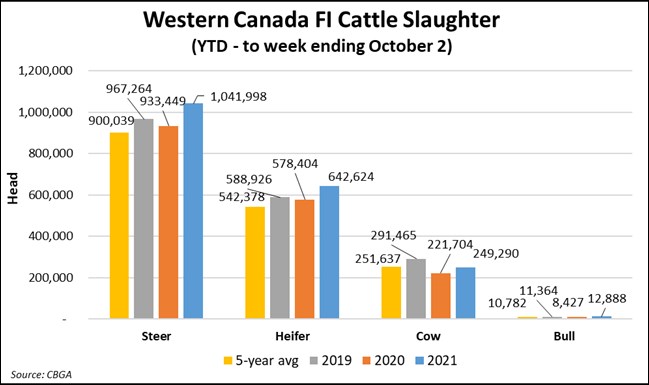

Western Canada cattle slaughter

‘Higher utilization rates equal higher slaughter and increased beef production,’ explains Wood. ‘To the week ending October 9, 2021, western Canada cattle slaughter is 1.947 million head, up 11.8% compared to 2020, 4.7% higher than in 2019 and 14.2% higher than the 5-year average.’

Total YTD western Canadian beef production is 758,445 tonnes, up 12% from 2020, while total YTD Canadian beef production is up 11% from 2020 at 965,500 tonnes.

Figure 2. Western Canada federally inspected (FI) cattle slaughter

‘Increased beef production has benefited Alberta beef exports which are up 38.4% by value and 25.5% by volume compared to 2020 for the January to August period. Looking back to 2019, beef exports in 2021 are 37.6% higher by value and 15.8% higher by volume. Increased global and domestic demand for beef and the lack of expansion in the Canadian beef cow herd are 2 factors that will continue to support higher imported volumes of U.S. live cattle,’ says Wood.

Source : alberta