U.S. pork exports were record-large in July while beef exports were relatively steady with last year’s strong results, according to data released by USDA and compiled by USMEF.

July pork exports surged to 233,242 metric tons (mt), up 32% year-over-year and topping the previous record from April 2018. Export value was $623.3 million, up 34% and breaking the previous high reached in November 2017. These results pushed January-July exports 2% ahead of last year’s pace at 1.48 million mt while value was down 2% at $3.77 billion.

Pork export value averaged $58.92 per head slaughtered in July, up 22% from a year ago and the highest in five years. January-July export value averaged $51.33 per head, down 5% from the same period last year. July exports accounted for 29.3% of total U.S. pork production (up from 24.7% a year ago and the highest since April 2018) and 25.9% for muscle cuts only (up from 21.7% and the highest ratio in five years). For January through July, exports accounted for 26.3% of total pork production and 22.9% for muscle cuts (down from 27% and 23.3%, respectively, a year ago).

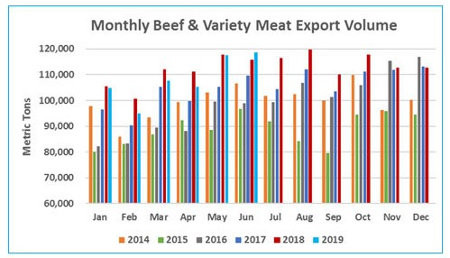

Beef exports increased 1% year-over-year in July to 117,842 mt. Export value ($720.4 million) was down slightly from a year ago but still the seventh-highest monthly total on record. January-July beef exports were down 2% from a year ago in volume (766,607 mt) while export value ($4.75 billion) was slightly below last year’s record pace.

Beef export value per head of fed slaughter averaged $308.47 in July, down 7% from a year ago, while January-July export value averaged $311.51 per head, down 2%. July exports accounted for 14.4% of total U.S. beef production and 11.8% for muscle cuts only, down from 15.1% and 12.9%, respectively, last year. For the first seven months of the year, exports accounted for 14.1% of total beef production and 11.6% for muscle cuts — each down one-half percentage point from a year ago.

Momentum builds for U.S. pork in Mexico and China; Japan results steady

Since Mexico lifted its 20% retaliatory duty on U.S. pork in late May, exports have rebounded significantly. In July, exports to Mexico reached 67,161 mt, up 19% from a year ago, while value surged 38% to $126.7 million. January-July results still trail last year by 12% in volume (411,944 mt) and 14% in value ($700.7 million), but exports to Mexico are well-positioned for a strong second half of 2019.

“USMEF anticipated a rebound in Mexico once duty-free status was restored for U.S. pork,” said USMEF President and CEO Dan Halstrom. “But I want to emphasize that we did not take this recovery for granted. While those retaliatory duties were in place, USMEF ramped up our outreach with processors and other major buyers in Mexico and worked closely with them to keep product moving south, and with the duties removed we’re seeing the results of these efforts. Now ratification of the U.S.-Mexico-Canada Agreement is critical to ensure long-term duty-free access to this key market.”

Although held back by China’s retaliatory duties on U.S. pork, exports to China/Hong Kong contributed mightily to the July volume and value records. Exports to the region were a record 68,657 mt in July, more than tripling from a year ago, while value climbed 173% to a record $152.5 million. For January through July, exports to China/Hong Kong were up 23% in volume (292,666 mt) and 3% in value ($580.3 million). China’s hog prices soared to record levels in August, and retail pork and poultry prices are also trending sharply higher as China’s African swine fever-related hog shortage intensifies.

In leading value market Japan, where no new duties have been imposed but U.S. pork faces higher tariff rates than its competitors, July exports were steady with last year at 31,019 mt, while value was up 5% to $133.2 million. Through July, exports to Japan were down 3% in volume (222,300 mt) and 4% in value ($906.7 million). The White House recently announced an agreement in principle with Japan that is expected to bring tariffs on U.S. pork and beef in line with competitors’ rates, but the agreement still must be finalized and the timeline for implementation is not yet known.

Other January-July highlights for U.S. pork include:

- Led by strong results in mainstay market Colombia and exceptional growth in Chile and Peru, exports to South America climbed 30% above last year’s record pace in volume (95,152 mt) and 32% higher in value ($237.3 million).

- Australia and New Zealand continue to shine as important destinations for hams and other pork muscle cuts used for further processing. Exports to Oceania are on a record pace as volume increased 41% from a year ago to 69,978 mt, while value was up 32% to $192.5 million.

- Despite facing higher tariffs since April due to a safeguard threshold, pork exports to Panama increased 41% from a year ago to 8,245 mt, while value was up 33% to $20.5 million. This helped push exports to Central America 15% above last year’s record pace in volume (52,820 mt) and 17% higher in value ($127.5 million). In addition to Panama, exports trended higher year-over-year to Costa Rica, Guatemala, Nicaragua and Honduras.

- Exports to Canada remained above year-ago levels in July, even after Canadian pork lost access to its top export destination — China — in late June. Through July, exports to Canada were up 11% from a year ago to 124,017, while value increased 8% to $454.1 million.

Another record month for U.S. beef in Korea

South Korea continues to be the growth pacesetter for U.S. beef exports, as July volume reached 25,104 mt (up 6% from a year ago). This included 24,192 mt of beef muscle cuts, also up 6% and setting a new monthly volume record. Export value was $181.3 million, up 7% from a year ago and breaking the record set the previous month. For January through July, beef exports to Korea climbed 11% in volume (151,983 mt) while export value ($1.1 billion) exceeded last year’s record pace by 14%.

“The Korean market is a remarkable success story and a blueprint for what U.S. beef can achieve when consumers are not shouldering such a heavy tariff burden,” Halstrom said. “With the duty rate now less than half of its pre-FTA level, U.S. beef is enjoyed by more Korean consumers than ever, and in a wider variety of venues. This will also happen in Japan when duty rates come down, but on an even larger scale.”