By Michael Langemeier

Center for Commercial Agriculture

Purdue University

COVID-19 has resulted in a dramatic decline in fed cattle prices putting a damper on net return prospects for 2020. In a farmdoc article published in early January (January 10, 2020), we were expecting net returns to average approximately $40 per head in the first quarter and approximately $10 per head in the second quarter of 2020. As discussed below, first quarter net returns were a negative $10 per head, and the prospects for the second quarter are very dismal. In addition to discussing net return prospects, this article discusses trends in feeding cost of gain, the feeder to fed price ratio, and breakeven prices.

Several data sources were used to compute net returns. Average daily gain, feed conversion, days on feed, in weight, out weight, and feeding cost of gain were obtained from monthly issues of the Focus on Feedlots newsletter (here). Futures prices for corn and seasonal feed conversion rates were used to project feeding cost of gain for the next several months. Net returns were computed using feeding cost of gain from monthly issues of the Focus on Feedlots newsletter, fed cattle prices and feeder cattle prices reported by the Livestock Marketing Information Center (LMIC) (here), and interest rates from the Federal Reserve Bank of Kansas City.

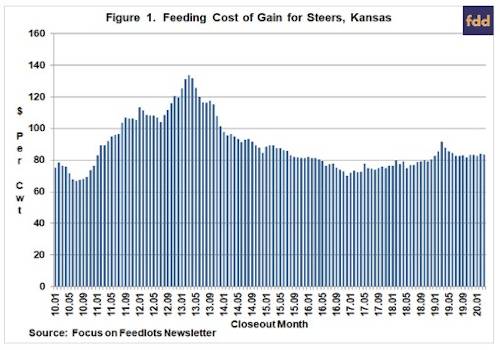

Feeding Cost of Gain

Figure 1 illustrates monthly feeding cost of gain from January 2010 to March 2020. Feeding cost of gain averaged $84.37 per cwt. in 2019 ranging from a low of $81.61 in October to $91.67 in March. During the first 3 months of 2020, feeding cost of gain averaged approximately $83.25 per cwt. Given current corn and alfalfa price projections, feeding cost of gain is expected to drop substantially later this year. In the second quarter, average feeding cost of gain is projected to be approximately $77.00. For the third and fourth quarters of this year, average feeding cost of gain is projected to be approximately $71.75. Feeding cost of gain is sensitive to changes in feed conversions, corn prices, and alfalfa prices. Regression analysis was used to examine the relationship between feeding cost of gain, and feed conversion, corn prices, and alfalfa prices. Results are as follows: each 0.10 increase in feed conversion increases feeding cost of gain by $1.24 per cwt., each $0.10 per bushel increase in corn prices increases feeding cost of gain by $0.88 per cwt., and each $5 per ton increase in alfalfa prices increases feeding cost of gain by $0.50 per cwt.

Feeder to Fed Cattle Price Ratio

The ratio of feeder to fed cattle prices since 2010 is illustrated in Figure 2. During the ten-year period, this ratio averaged 1.21. The feeder to fed price ratio was one standard deviation below (above) this average for 16 (17) months during the ten-year period. The average net return for the months in which the ratio was below one standard deviation of the average was $135 per head. In contrast, the average loss for the months in which the ratio was above one standard deviation was $256 per head. The average ratio for the 17 months with a feeder to fed price ratio that was above one standard deviation of the ten-year average was 1.49. The feeder to fed cattle ratio averaged 1.22 in the first quarter of this year. Since late March, fed cattle prices have dropped from $119 per cwt. to $98 per cwt., or 18 percent. As a result, the feeder to fed cattle ratio in the second quarter of this year is expected to increase sharply, from 1.22 in the first quarter to 1.45 in the second quarter. Using current LMIC fed cattle price projections, the feeder to fed cattle ratio in the third and fourth quarters is expected to be 1.23 and 1.06, respectively.