Since the start of the pandemic, as waves of virus transmission have ebbed and flowed throughout different states and regions, research has started to help us understand how the pandemic and related public health policies have shaped a variety of food acquisition behaviors. Grocery shopping has been impacted by the pandemic in several ways. In May 2020, an online consumer survey in two major metropolitan U.S. cities found that three quarters of respondents shopping were influenced by grocery shortages and that 47% were buying more food than usual and 33% were stockpiling food (Chenarides et al., 2021). The same study also found that while 66% of respondents were going to the grocery store less often, 21% were going more, all while online grocery delivery and pickup increased as well. Another study that used an online framed choice experiment found that rates of Covid-19 transmission impacted consumer preferences for home grocery delivery (Grashuis, Skevas and Segovia, 2020). Other studies have also found that restaurant dining, carry out, and delivery have also been greatly impacted by the pandemic.

The pandemic has changed a lot since early 2020, and Covid-19 vaccines are now widely available to adults and adolescents in the U.S. While availability of the vaccine in the U.S. is generally quite good, vaccine rates have been slowing over the summer months, though the rise of the Delta variant has spurred an increase in vaccinations again (Caldwell, 2021). As more consumers become vaccinated, food acquisition behaviors, including grocery shopping and dining out socially, may change. Vaccination may increase a person’s willingness to dine in restaurants, for example. On the other hand, vaccination may reduce the need for more isolated food acquisition behaviors like shopping for groceries online. In this article, we’ll explore how consumers who are already or plan to be vaccinated expect their food acquisition behaviors to change post-vaccination.

Survey Design and Sample Characteristics

We conducted an online survey with 1,000 U.S. consumers in mid-March, 2021. Respondents were recruited to match the U.S. population in terms of gender, age, income, and geographic region.

In the survey, participants were asked “Do you intend to be vaccinated against Covid-19, once a vaccine is available to you?” Response options were Yes, No, Unsure, and I have already received a vaccine (1 or 2 doses). Respondents who answered Yes or I have already received a vaccine were then asked a follow-up question about their expected changes in food acquisition activities. Specifically, “How do you think being vaccinated will change how often you do each of the following activities?” The eight food acquisition activities are listed below; for each activity, respondents indicated whether they would engage in the activity more, less, or the same amount once they are vaccinated.

- Shop for groceries in person

- Shop for groceries online

- Order from a meal kit service (e.g., Blue Apron, Hello Fresh)

- Order take-out from a restaurant

- Eat at a restaurant and sit indoors

- Eat at a restaurant and sit outdoors

- Visit a food bank

- Visit a farmer’s market

Results

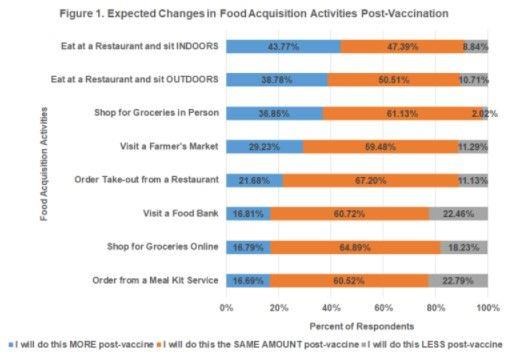

In total, 693 participants (out of 1,000) indicated that they had already received or intended to receive the Covid-19 vaccine. Figure 1 shows how this subset of participants expected their food acquisition behaviors to change post-vaccination.

From Figure 1, we can see that nearly 44% of respondents expected to increase indoor dining activities after vaccination, followed by outdoor dining and shopping for groceries in person (39% and 37% of respondents expected to do these activities more often post-vaccination, respectively). Activities that respondents expected to engage in less often were ordering from a meal kit service (23%), visiting a food bank (22%) and shopping for groceries online (18%). It is also worth noting that, across all activities, a majority share of respondents did not expect vaccination to change their food acquisition behaviors.

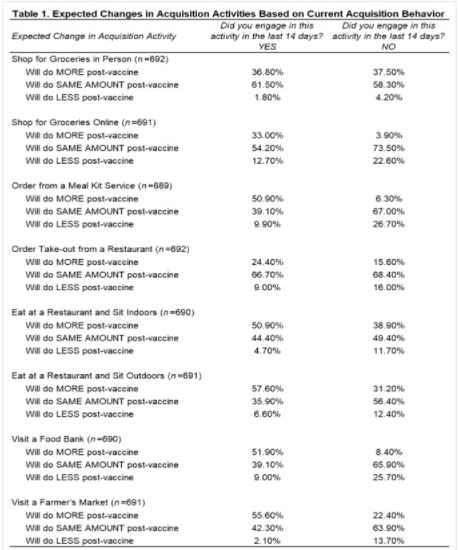

While Figure 1 provides a broad indication of how acquisition activities may or may not change post-vaccine, we do not know 1) how frequently respondents currently engage in each food acquisition activity and 2) whether these respondents engage in each food acquisition activity at the same rate as individuals who are unsure or do not plan to be vaccinated. In this survey, we did not explicitly ask respondents about the frequency of each acquisition activity, but we did ask respondents whether they had engaged in each of the eight activities in the last 14 days. In Table 1, we split our already/plan to be vaccinated sample into two groups: 1) respondents who completed a given acquisition activity in the last 14 days and 2) respondents who did not complete a given acquisition activity in the last 14 days. We look at the expected changes in acquisition behavior reported by each group. Then in Figure 2, we compare food acquisition activities completed in the last 14 days by vaccination status (unsure/do not plan to be vaccinated vs. already/plan to be vaccinated).

From Table 1, we highlight a few key insights. First, there were three acquisition activities that a large proportion of respondents (30% or greater) in both groups expected to engage in more frequently post-vaccine: grocery shopping in person, eating at a restaurant and sitting indoors, and eating at a restaurant and sitting outdoors. In an earlier wave of this survey, Ellison and Ocepek (2020) found that over 90% of respondents reported grocery shopping in person in the last 14 days. Thus, the fact that respondents plan to increase this activity suggests they are not getting to go grocery shopping as often or at as many retail locations as they would like. The expected increases in restaurant dining are likely a product of increased confidence from vaccination and the easing of restrictions for many states.

Second, respondents who had engaged in a particular acquisition activity in the last 14 days were more likely to report an expected increase in this activity post-vaccine. More recent experience with an activity may be a signal of more comfort with that activity, which can lead to respondents expecting to perform that activity more in the post-vaccine future.

We also asked our respondents to share how their recent shopping experiences have changed and 22 mentioned the vaccine. A few illustrative quotations highlight how much comfort respondents are finding living post-vaccine or in communities where the vaccine is widely available. One respondent provided details about receiving their first vaccine and noted, “Before my shot, I usually shopped online and then picked up my groceries — or had them delivered. I finally felt safe enough to enter the grocery store to shop (and take my time) for the first time in almost one year.” Another answered that their shopping was “more relaxed because of the fact that I knew more people were protecting themselves by getting the Covid shot.” Of course, not everyone is ready to fully embrace a return to normal. Another respondent shared, “I will wait to enjoy shopping again when most people are vaccinated. Until that time, even though I have received the vaccine, I will continue to go early, be quick, wear a mask and practice social distancing.” This supports and provides richer details to the quantitative data presented in Table 1.

Finally, the expected declines in acquisition activities appear to be driven by respondents who did not regularly engage in those activities. For example, only 9.9% of respondents who recently ordered from a meal kit service expected to engage in this activity less post-vaccine compared to 26.7% of respondents who had not ordered from a meal kit service in the last 14 days. We observe similar trends in online grocery shopping and visiting a food bank.

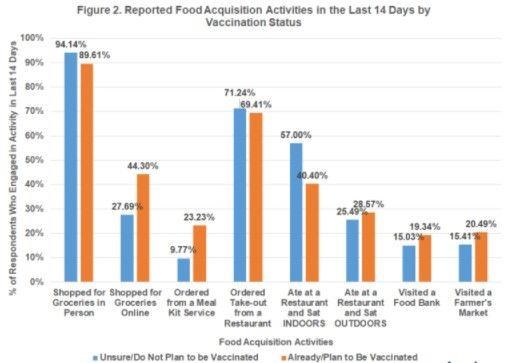

When we compare reported food acquisition activities by vaccination status in Figure 2, the shares of respondents who shop for groceries in person and eat at a restaurant and sit indoors were lower among those who are already or plan to be vaccinated, though grocery shopping in person was the most common activity across both groups. Further, respondents who were already vaccinated or plan to be vaccinated were more likely to report engaging in more isolated or socially-distanced activities like shopping for groceries online and ordering from a meal kit service. Taken together, this offers evidence that this group of consumers may be more risk averse than those who are unsure or do not plan to be vaccinated.

Conclusion

Widespread vaccine dissemination has allowed many states to loosen restrictions, providing individuals more flexibility to travel and engage in activities (for example, eating in restaurants) that were previously deemed non-essential. For individuals who are or plan to be vaccinated, it appears some food acquisition activities are more likely to change than others. Respondents are eager to do more grocery shopping in person and eat in restaurants (indoors and outdoors). Individuals in this group engaged in these activities at lower rates than their unvaccinated counterparts, suggesting demand for these activities is likely to grow as vaccination rates increase. Activities that may be more likely to see a decline are online-oriented – grocery shopping online and ordering from meal kit services.

One important caveat to our findings that must be acknowledged is the Delta variant that is rapidly spreading across the U.S. The sharp rise in Covid-19 cases, attributed to the Delta variant, has resulted in the CDC and some states bringing back mask mandates and the implementation of vaccine mandates for some professions. Such actions may again dampen enthusiasm for restaurant dining and in-person grocery shopping, particularly for those consumers who may be immunocompromised or have unvaccinated individuals (e.g., children under 12 who are not eligible to be vaccinated) living in their households.

Source : illinois.edu