By Mark O'Keefe

In the short term, fewer pigs mean less demand for pig feed and the U.S. whey products that fortify that feed. But USDEC sees longer-term opportunities.

South Korea confirmed a sixth case of African swine fever on Wednesday in a town near its border with North Korea. This follows an acknowledgement last week of the first case in South Korea, indicating the deadly virus is spreading in Asia, with rippling effects on global markets, including dairy.

"There is no treatment or vaccine available for this disease," says the U.S. Department of Agriculture in an AFS fact sheet. "The only way to stop this deadly

disease is to depopulate all affected or exposed swine herds."

More than 20,000 pigs had been slaughtered in South Korea as of Tuesday, with about 30,000 more expected to be culled as a preventative measure, according to a report by Reuters news agency. Meanwhile, China's pig herd is down about one-third from a year ago, according to the Chinese government. Outside analysts have suggested that number is most likely too low, and that the ASF toll will get worse before it gets better.

"We hold the view that it will take over five years for China’s pork production to recover fully from ASF," Rabobank said in a recent analysis.

What does this mean for U.S. dairy exports?

In the short term, fewer pigs mean less demand for pig feed and the U.S. dairy whey products that fortify that feed.

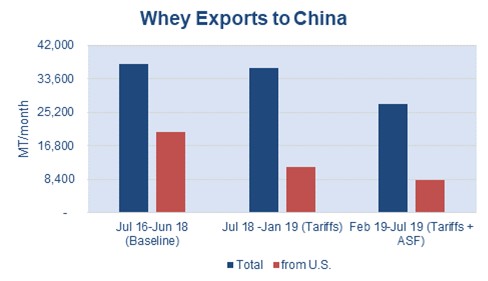

"Swine fever and retaliatory tariffs have imposed a double-whammy on U.S. whey exports," said Al Levitt, U.S. Dairy Export Council vice president of market analysis.

China’s whey imports have declined by about 10,000 tons a month since February, when ASF began to spread more aggressively, according to an analysis by Levitt.

Includes exports of HS 040410 from U.S., EU, Belarus, Argentina, Ukraine, Australia. Source: USDEC, Global Trade Atlas.