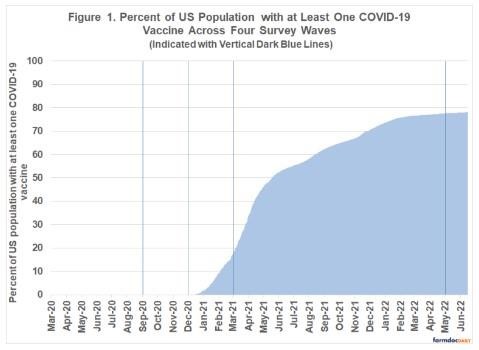

These four survey waves all came at unique times during the COVID-19 pandemic. In particular, vaccine availability differed, which impacted food acquisition (e.g., farmdoc daily 2021). Figure 1 shows the timing of each survey wave with the proportion of the US population with at least one dose of a COVID-19 vaccination (CDC, 2022). In September 2020, cases were relatively low, concerns and unknowns about COVID-19 were high, and vaccines were unavailable. In December 2020, the US experienced its first large surge in cases and some of the population (e.g., health care workers and long-term care residents) were able to be vaccinated. In March 2021, cases were falling and vaccines were becoming more widely available. Finally, in May 2022, vaccines and boosters were available for most Americans.

In all four waves, we investigated eight food acquisitions activities:

- Shopping for groceries in person

- Shopping for groceries online

- Ordering from a meal kit service (e.g., Blue Apron, Hello Fresh)

- Eating at a restaurant and sitting indoors

- Eating at a restaurant and sitting outdoors

- Ordering take-out from a restaurant

- Visiting a food bank

- Visiting a farmer’s market

Participants were asked if they had completed each of the activities within the last two weeks. They were able to answer ‘Yes’, ‘No’, or ‘I don’t remember’. In each period of the survey we recruited approximately 1,000 US consumers to participate in the survey and fielded responses to match the US population in terms of gender, age, income, and geographic region. We did not recruit the same individuals to participate in each wave of the survey.

Here, utilizing the four survey waves we show how food acquisition activities changed across the pandemic.

Food Acquisition Activities Across the Pandemic (2020-2022)

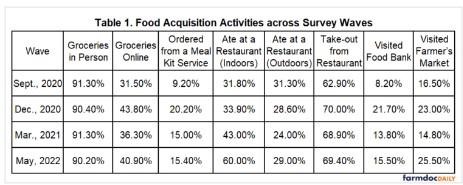

In Table 1, we present the proportion of US consumers that indicated they had engaged in each of the food acquisition activities for all four waves.

Throughout the pandemic, shopping for groceries in person and ordering take-out from restaurants have been the most common food acquisition activities. Low-contact activities such as shopping for groceries online and ordering from a meal kit service peaked in December, but rates of usage remain higher in May 2022 relative to September 2020. In our most recent survey, 40.9% of consumers engaged in online grocery shopping, up 9.4 percentage points from September 2020; further,15.4% of consumers used a meal kit service, up 6.2 percentage points from September 2020. One explanation for this may be that consumers who tried new forms of food acquisitions, initially to reduce their risk of COVID-19, found other benefits too (e.g., convenience) and continued usage.

Restaurants were hard-hit by the COVID-19 pandemic (e.g., Dube, Nhamo, and Chikodzi, 2021; Song, Yeon, Lee, 2021). Our results from May 2022 indicate that indoor dining at restaurants has rebounded. Most recently, we find that 60% of US consumers indicated they had eaten in a restaurant indoors in the last two weeks, compared to just 31.8% in September 2020 – an increase of 28.2 percentage points. Similarly, US expenditure on food away from home, which decreased drastically during much of the pandemic, is now higher than pre-pandemic spending levels (USDA ERS, 2022). Outdoor restaurant dining has been steadier throughout the pandemic and is likely influenced by differences in weather across the country in addition to case rates.

Similar to many other food acquisition activities, our results indicate that the share of consumers visiting a food bank was highest during December 2020 at 21.7%. As the pandemic has progressed, the share of consumers visiting a food bank has decreased to 15.5% in May 2022, though this is still nearly double the share reported (8.2%) in September 2020.

The rate of visiting a farmer’s market varied across the four waves. We found that 16.5% engaged in this activity in September 2020, 23.0% in December 2020, 14.8% in March 2021, and most recently, 25.5% in May 2022. Some of this variation is likely due to weather and seasonality (e.g., winter holiday markets, produce availability).

Concluding Remarks

We are more than two years into the COVID-19 pandemic, and consumers’ food acquisition behaviors continue to evolve. Grocery shopping in person remains a primary acquisition activity, yet a significant share of consumers continues to utilize online grocery shopping as well, at rates much higher than pre-pandemic levels. Restaurant dining behavior appears to be returning to some level of ‘normal’, as a growing share of consumers feel comfortable dining indoors again. This is in addition to a continued use of restaurant take-out options. Other acquisition activities like using a meal kit service and visiting a food bank are operating below their peak levels in December 2020, yet we observed a greater share of consumers engaging in these activities relative to the early stages of the pandemic (September 2020), before the first large surge in cases. The Gardner Food and Agricultural Policy Survey will continue to monitor food acquisition behaviors as we move through the ebbs and flows of the COVID-19 pandemic.

Source : illinois.edu