The global balance sheet for wheat is down 10.0 MMT in 2022/23 compared to 2021/22 at 1.06 billion metric tons (MT). Beginning stocks this season are the lowest since 2017/18 while ending stocks are expected to be the tightest since 2016/17. Despite Russia’s huge wheat crop and rebounds in production for both the U.S. and Canada, reductions in the European Union (E.U.), Argentina, and Ukraine are helping to keep prices firm.

U.S. wheat production is up this year, increasing almost 4 MMT to 48.5 MMT according to USDA. Exports are expected to increase slightly to 22.5 MMT. According to the latest world agricultural supply and demand estimates (WASDE), production for all classes of U.S. wheat is expected to increase this year except for hard red winter (HRW) wheat which is estimated down 21%. Kansas, the primary HRW growing state, remains dry even as winter wheat planting is underway.

Black Sea Grain Corridor

Russia’s invasion of Ukraine has had the biggest effect on upending the global wheat market. The United Nations brokered an agreement to establish a grain corridor in the Black Sea. As a result, Ukraine has shipped more than 7 MMT of grain since July, when the agreement was signed according to APK. However, Putin’s criticism of the grain deal and escalation of the war on his neighbor have once again roiled markets and sent futures higher.

Russian Potential

Russia has produced its largest wheat crops ever. The USDA forecasts Russian wheat production at 91 MMT this month while the European Union’s crop monitoring service, MARS, projects the Russian wheat crop will total 95 MMT. The USDA predicts exports could reach 42 MMT. But Russian exports so far this season have been slow to move. According to IKAR, a Russian analyst, Russian wheat exports are expected to reach 4 MMT in September, well behind the 4.7 MMT exported a year ago. Russian wheat exports are not under any western backed trade sanctions, but shipping companies, insurers, and banks are still cautious to do business with Russia.

Input Costs

High gas prices could affect access to nitrogen-based fertilizers. Yara International, a Norwegian-based fertilizer producer warned that the gas situation in Europe could create shortages and add to risk. Gas prices on the continent have risen 45% since June when Russia curtailed shipments following E.U. sanctions. Yara said it expects to pay $1.1 billion more for natural gas in the third quarter than a year ago. Natural gas is a key ingredient for making nitrogen-based fertilizers.

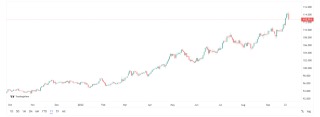

The Rising U.S. Dollar

Overall, the U.S. Dollar (USD) continues to strengthen. Yet in this environment even subtle changes up or down in USD value can move U.S. and global wheat prices.

Click here to see more...