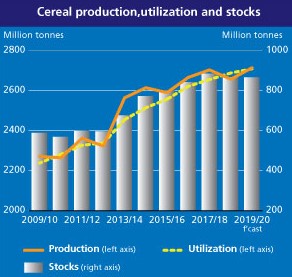

FAO’s latest forecast for 2019 world cereal production is pegged at an all-time high of 2 714 million tonnes, up some 0.4 percent from the November figure and now almost 57 million tonnes (2.1 percent) above the reduced outturn in 2018. The month-on-month increase primarily reflects an upward revision to world coarse grains production, associated with higher-than-previously predicted yields in China, the Russian Federation and Ukraine. At the current level, the forecast for world production of coarse grains stands at nearly 1 433 million tonnes, 1.7 percent (24.5 million tonnes) higher year-on-year and marginally short of the record high level registered in 2017.

Global wheat production forecast for 2019 has also been raised slightly since the previous month, to 766.4 million tonnes, 4.8 percent (34.8 million tonnes) above the previous year’s outturn. The bulk of the monthly revision resulted from upward adjustments to the production estimates in the European Union (EU), which more than offset a trimming of the output estimate in the United States.

Planting of the 2020 wheat crops, for harvest next year, is well underway in Northern Hemisphere countries. In the United States, winter wheat sowings were almost complete at the end of November, a faster pace than the previous year but in line with the average timing. Early indications suggest that the area sown may contract on lower price prospects compared to last year, while crop conditions were reported to be slightly inferior to normal levels. In the EU, following early-seasonal rainfall deficits, improved precipitation in November helped to recuperate soil moisture levels, benefiting winter crop establishment. In far eastern and western parts of the EU, however, dry weather persisted, resulting in suboptimal planting conditions that may impede early crop development. Conditions of the winter wheat crop were favourable in the Russian Federation, which, coupled with continued government support aiming to stimulate export growth, could boost the area sown. By contrast, in Ukraine, limited rains and warmer-than-average temperatures hampered planting of the winter wheat crop in key producing areas.

In the Southern Hemisphere, coarse grain crops are being currently sown while wheat crops will be planted later in the year. In South America, elevated grain prices, underpinned by robust export demand, are expected to sustain high levels of maize plantings in Argentina, despite unfavourable rainfall that hindered sowing operations, and in Brazil. Similarly, in South Africa, the largest maize producer on the Africa continent, remunerative grain prices are foreseen to spur an increase in maize sowings, with preliminary indications pointing to an area that would surpass the five-year average. However, the short-term weather forecast indicates likely reduced rains, a factor that may represent a downside risk to the production outlook in 2020. FAO’s forecast of world rice production in 2019 has been increased from November by 1.6 million tonnes to 515 million tonnes, implying a mere 0.5 percent output decline from the 2018 all-time high. Adverse weather and tight water supplies for irrigation dampened the outlook for off-season crops in Thailand and Viet Nam this month. However, these adjustments were outweighed by area-based output upward revisions for Pakistan and various African countries, namely Egypt and Nigeria, which together with Madagascar are now set to spearhead a rebound in African rice production this season.

World cereal utilization in 2019/20 is forecast at 2 709 million tonnes, nearly unchanged from the previous month; still a record of around 21 million tonnes higher than in 2018/19. At 758 million tonnes, the forecast for global wheat utilization in 2019/20 has been slightly lowered since last month, but still a record exceeding the 2018/19 estimated level by 1.4 percent. The forecast for total utilization of coarse grains in 2019/20 is pegged at 1 434 million tonnes, up only marginally from the previous season with an expected decline in feed use of maize more than outweighed by a foreseen rise in feed use of other coarse grains, barley in particular. Higher than previously predicted food intake is behind an almost 1 million tonne increase in FAO’s latest forecast of global rice utilization in 2019/20, which now stands at a record 517 million tonnes.

The forecast for world cereal stocks by the close of seasons in 2020 has been raised by almost 14 million tonnes (1.6 percent) since the previous month to 863 million tonnes; marginally down from the previous season and the third highest on record. At this level, the global cereal stock-to-use ratio would also approach a relatively high level of 31 percent, underscoring a comfortable supply situation. The forecast for world wheat inventories has been scaled up by 3 million tonnes since the previous month to close to 278 million tonnes, mainly on expectations of larger stock build-ups in several major exporting countries. At just over 403 million tonnes, total coarse grain inventories are also seen higher than earlier anticipated by almost 10 million tonnes, reflecting upward revisions to maize inventories especially in China and, to a lesser extent, in the United States. Despite another small upward revision, world rice stocks at the close of 2019/20 could still fall by 0.8 percent from their record opening levels to 182 million tonnes; on expected stock reductions in rice importing countries, in particular China and Indonesia.