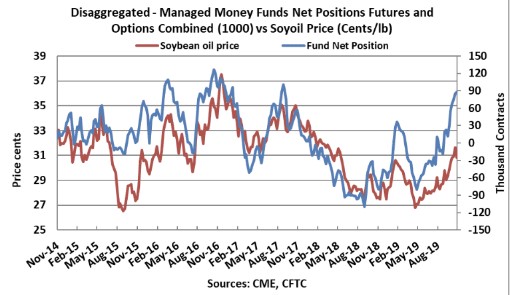

According to the latest Commodity Futures Trading Commission (CFTC) Disaggregated Commitments of Traders report, the managed money group has been building on their sizeable net-long position in the Chicago soybean oil market in recent months. According to data as of November 12, funds are holding a net-long position of 88,097 futures and option-equivalent contracts. This position was up 3,454 contracts in the reporting week and now stands at the highest net-long holding since 92,870 contracts in September 2017. The managed money group has only held larger net-long positions of 92,870 and 100,435 in mid-September 2015 and carried a net-long position in excess of 100,000 contracts for multiple weeks both in December 2016 and April 2016. The gross long position of 120,101 contracts is the group’s largest holdings in the soybean oil market since 133,472 contracts in November 2016.

Global vegetable oil prices have been trending higher after palm oil futures in Malaysia put their calendar-year-lows in late June while soybean oil futures traded in Chicago posted their 2019-lows earlier in mid-May. The palm oil market has found renewed buying interest in recent months as forecasts for slowing output and growing demand primarily from China and the Southeast Asian biodiesel sectors have begun to ease traders’ supply ideas. Declining U.S. soybean oil supplies had been projected by the U.S. Department of Agriculture (USDA) and market analysts for much of the 2018/19 marketing year, but the overhang of unknown demand for U.S. soybeans provided funds with ample room to carry a net-short position in the soybean oil market as recently as mid-September before building up their latest net-long position. Supportive soybean demand has been corresponding with the recent buying spree from funds, featuring including modestly declining U.S. crop ideas along with an uptick in U.S. soybean shipments at the tail-end of the 2018/19 U.S. marketing year.