Impact on storage capacity

New crop supplies felt the sting of the drought and derecho, but the damage was not limited to farm fields. The derecho also destroyed some crop handling and storage facilities. In fact, that damage is still being assessed as farmers, elevators, and terminal locations prepare to take in this year’s crops. Early estimates for Iowa indicated roughly 120 million bushels of storage capacity was lost due to the derecho, with approximately half coming from on- farm storage and half from commercial operations. Losing storage capacity is not the same as losing bushels in storage. So it’s an open question how much of the crops stored going into the derecho were lost in the storm and how many bushels had to be quickly moved into the market because of the storage damage. The Grain Stocks report provided the initial answers to those questions and traders were surprised by the answers.

Supplies and stocks

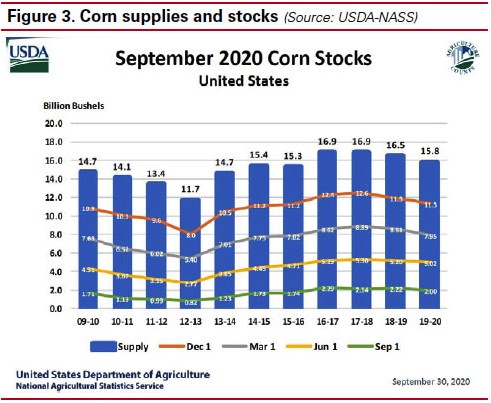

The 2019/20 ending stocks for corn were estimated at 2 billion bushels. That is 200 million to 300 million less than the trade expected. And smaller stocks tend to lead to higher prices. While corn usage for ethanol and export shipments were reduced over the June-August period, the derecho impact and livestock feed needs drove corn disappearance higher and stocks lower. While COVID-19 continues to shape corn usage, through the impacts of reduced travel on ethanol demand and increased feed needs as the livestock industry works to clear the animal backlog from processing plant closures, the derecho forced more corn out into the market as it busted bins and raised quality concerns for the corn suddenly exposed by the storm. Based on historical patterns, Iowa corn stocks dropped by 50-100 million bushels more than usual for the June-August period, highlighting the storm’s impact.

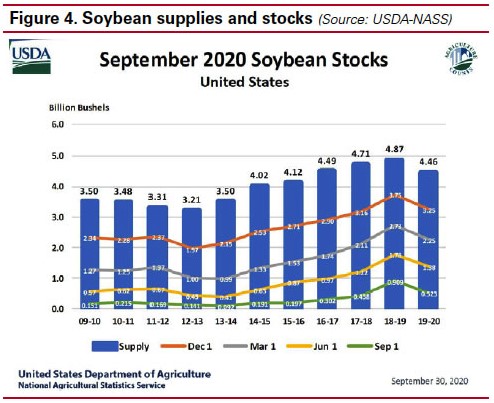

Soybean stocks revealed a similar story. The USDA found less soybeans in storage than the trade expected. The increased disappearance was a combination of increased feed use and storage crop losses. And Iowa’s stocks dropped a bit more than usual due to the derecho’s impact on storage facilities.

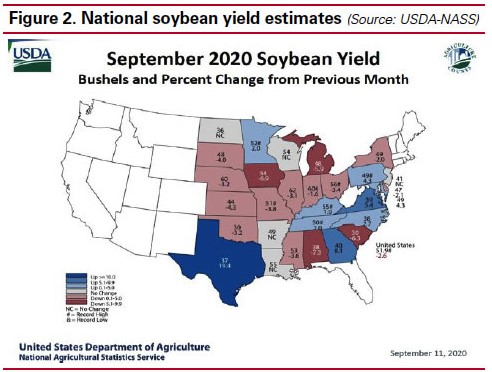

Before the derecho, national corn supplies for 2020/21 were estimated at 17.531 billion bushels. Now, the estimate currently stands at 16.92 billion bushels. That 611 million bushel drop is mainly due to the drought and derecho. Similarly, soybean supply estimates declined 204 million bushels over the same time period. Those supply reductions, along with a boost in export sales, have provided a contra-seasonal boost to prices. While USDA has season-average price estimates of $3.50 per bushel for corn and $9.25 per bushel for soybeans, the futures markets indicate season-average prices in the $3.70 per bushel range for corn and nearly $10.00 per bushel for soybeans, providing a late season opportunity to put in some price protection before the bulk of the harvest comes in.

The price rallies are both good and bad news to Iowa crop producers. For those not dramatically impacted by the drought and derecho, the price rallies set up the potential for increased revenues this crop year. But for those who bore the brunt of weather conditions this year and are relying on crop insurance for a majority of their revenue, the price recovery is coming at an inopportune time. The harvest price for crop insurance is being set in October. Price rallies this time of year tend to lower crop insurance payments for those producers who bought revenue insurance. And that is what is happening for corn farmers right now. That will continue to be the case unless or until the rally pushes the harvest price above the spring insurance price of $3.88 per bushel. Current soybean prices have already rallied past the spring insurance price of $9.17 per bushel.

Source : iastate.edu