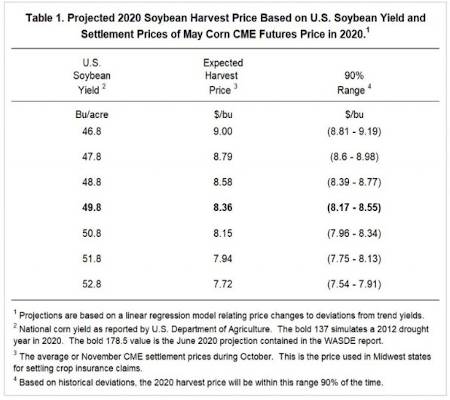

Table 1 shows harvest price projections for different U.S. soybean yields. The June WASDE report has a yield estimate of 49.8 bushels per acre. At that yield, the expected harvest price is estimated at $8.36 per bushel (see Table 1). In this case, the harvest price is the expected average of settlement prices in the month of October for the November soybean contract traded on the CME. The harvest price is used to calculate crop insurance indemnity payments on soybeans in the Midwest states. An $8.36 harvest price would be 91% of the $9.17 projected price for 2020. Revenue Protection (RP) policies, even at the highest coverage level of 85%, would not trigger payments at an $8.36 price without yield declines below guarantee yields.

Actual harvest prices can vary from the expected $8.36 harvest price. The statistical model suggests that 90% of the time the harvest price will be in a range from $8.17 per bushel to $8.55 per bushel (see Table 1).

Higher yields will result in lower expected harvest prices. A 46.8 U.S. soybean yield has an expected harvest price of $9.00 per bushel, a 47.8 bushel yield would suggest an $8.79 harvest price, and so on (see Table 1). Table 1 shows a range of U.S. soybean yields from 46.8 to 52.8 bushels per acre. Given fairly normal weather, U.S. soybean yield likely will be in this range.

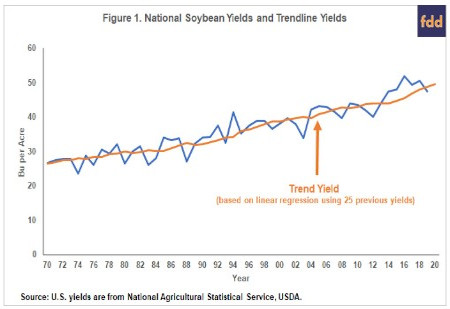

U.S. Soybean Yields and Trend Yields

The statistical model was fit using yield data from 1985 to 2019. For each year from 1985 to 2019, a trend yield was calculated based on a linear regression of data from the previous 25 years. For example, the 2019 trend yield was estimated using yields from 1994 to 2018. In 2019, the trend yield was 48.7 bushels per acre. The actual 2019 yield was 47.4 bushels per acre, meaning that the actual yield was 1.3 bushels per acre below trend. Note that the trend yields used here will not fall on a straight line over time because the sample used to estimate the trend yield is changing (see Figure 1). Historically, more years are above the trend than below the trend (see Figure 1). From 1985 to 2019, actual yields were above trend in 66% of the years.

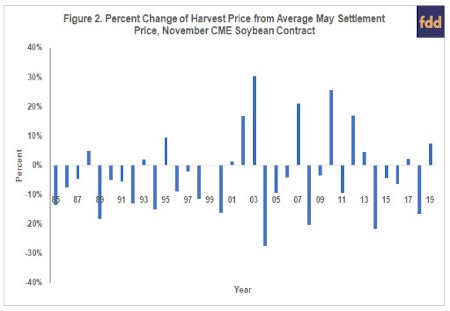

Deviations from May Settlement Prices and Harvest Prices

The average settlement prices of the November CME contract during the month of May were calculated for each year from 1985 to 2019. This May average will condition each year’s estimate of harvest price based on events that have occurred so far through the marketing year. The year 2020 has been a momentous year with the events surrounding the Coronavirus.

Percent changes were calculated between the actual harvest price and the average May settlement prices over the 35 year period. Take 2019 as an example when the May average was $8.62 per bushel, and the harvest price was $9.25 per bushel. The deviation during this year was 7% ($9.25 harvest price / $8.62 May average – 1). Figure 2 shows the percent deviations from 1985 to 2019.

Relationship Between Price Changes Given Actual Yield Differences Between Trend Yields

A linear relationship was fit in which the percent changes from the average settlement price in May to the average settlement price in October (harvest price) for the December corn contract were explained by the deviation from trend yield (actual yield minus trend yield). There is a strong relationship between price and yield deviations (see Figure 3). The price changes and yield deviations have a -.54 correlation coefficient. As is expected, price changes tend to be positive when actual yield is below the trend yield.

Summary

Given current yield estimates, a statistical model suggests that the harvest price for crop insurance in Midwest states will be near $8.36 per bushel. Higher yields, above current estimates, would be expected to result in lower prices and vice versa. Thus, higher prices could happen if 2020 yields are lower than the trend. Conversely, an above trend yield would likely result in lower prices. A harvest price below $8.00 per bushel is a distinct possibility with above trend yields.

Source : illinois.edu