Commodity Programs

To explore the countercyclical performance of commodity programs, Production Flexibility Contract (PFC), Direct Payment (DP) and cotton transition program payments that existed between 1996 and 2014 were removed. Their payment rate was fixed per output unit no matter the price or revenue, and thus could not be countercyclical. With these payments removed, commodity program payments (see Data Note 2) were and remain countercyclical for the cost of production crops as a group. Explanatory power of the negative regression relationship was 28% before 2007 and 59% since 2006. Both were significant with 99% statistical confidence.

Ad Hoc & Emergency Programs

Payments by Ad Hoc & Emergency Programs are not available until 1998. Thus, only nine observations exist before 2007. Nevertheless, a strong negative (i.e. countercyclical) relationship existed between ad hoc & emergency payments and private market net return (left panel, Figure 2). Explanatory power was 75%; statistical confidence was 99%.

Since 2006, explanatory power of the relationship is only 14% (right panel, Figure 2). Statistical significance is 86%, which is below the lowest commonly-used statistical test level (90%). Since 2006, ad hoc & emergency payments have thus not been statistically significantly countercyclical.

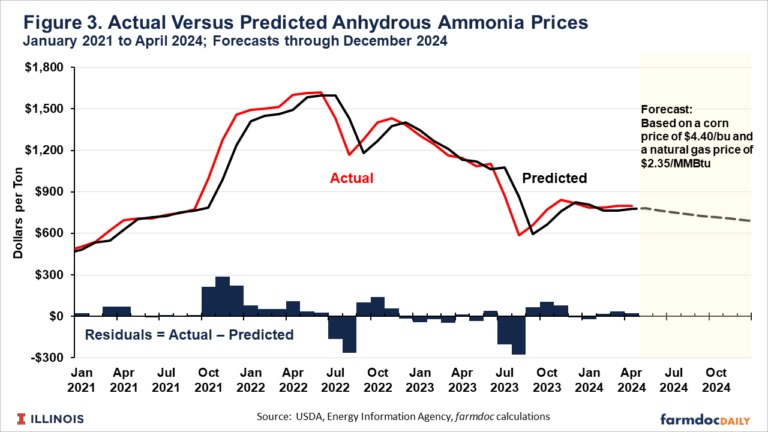

Crop Insurance

The initial analysis for crop insurance used 1975-2006 and 2007-2023, but the results pointed to different subperiods: 1975-1996 and 2003-2023. Prior to 1997, crop insurance insured only yield loss. Net crop insurance indemnities to the US cost of production crops as a group were countercyclical to private market net return (left panel, Figure 3). Statistical confidence was 99%. In 1997, revenue insurance was introduced. By 2003, it accounted for two-thirds of insured liability for the nine crops. Since then a positive relationship exists (right panel, Figure 3). Statistical confidence is 98%. If the outlier, the high crop insurance payment year of 2012, is removed, the relationship is no longer significant as statistical confidence is 77%. Thus, since revenue insurance became dominant, crop insurance is not countercyclical to private market net return for

Policy Implications

Commodity programs remain countercyclical to private market net return at harvest, but ad hoc & emergency programs and crop insurance have not been countercyclical to net return since 2006. They are the reasons the aggregate crop safety net is no longer countercyclical to private net return.

The policy question is simple, “Does society (do farmers) want a countercyclical crop safety net which makes high payments when private market return is low and low payments when private market return is high?” Historical policy evolution suggests “no” but it is not clear that the question has ever been debated.

If a countercyclical safety net is desired, this study suggests:

- Ad hoc & emergency payments should be made only after commodity and crop insurance payments are known and should not result in combined private market return and crop safety net payments above the economic cost of production. This determination can be expedited by moving commodity program payments forward. The farmdoc daily of October 30, 2024 proposed using harvest futures prices to make commodity program payments at harvest.

- Crop insurance can be made countercyclical by insuring only yield. Confirming analysis is needed, in part because returning to only insuring yield loss would reverse the historical evolution of the crop insurance program.

Data Note 1: Cost of Production Crops

Cost of production crops are barley, corn, cotton, oats, peanuts, rice, sorghum, soybeans, and wheat.

Data Note 2: Commodity Programs

Commodity programs in this analysis are Average Crop Revenue Election (ACRE), Agriculture Risk Coverage (ARC), certificate exchange, cotton, cotton ginning, cotton transition, countercyclical (CCP), feed grain, loan deficiency, marketing loan, Price Loss Coverage (PLC), rice, and wheat.

Source : illinois.edu