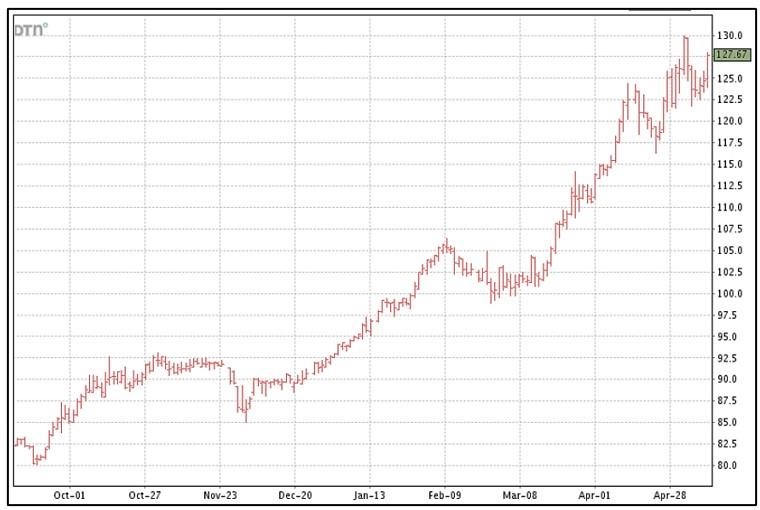

I consider this a mixed outlook for the 2022 crop market. If price is to maintain its upward path, more focus will have to shift to the condition and size of the US crop. Because the demand outlook seems cautious.

US acres planted this year are estimated up 1 million acres and yield projected up 6%. But, due to drought conditions, acreage abandonment is projected at 25% compared to only 8.5% last season. Acres planted could be reduced.

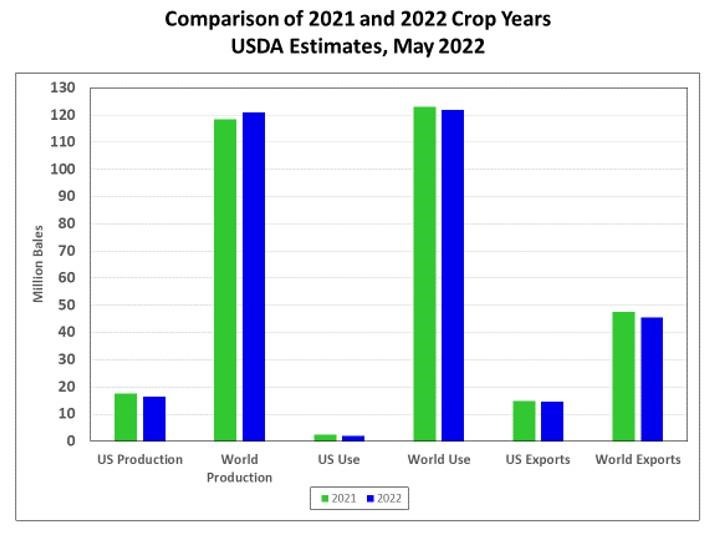

US production concerns, coupled with reduced carry-in stocks, creates a tighter supply situation for 2022. This is supportive of prices but the demand/use situation appears to be weakening somewhat. Granted, the May numbers cut 2021 crop year use by only 1% and the forecast for the 2022 crop year is down less than another 1%. But taken in the context that this price buildup is largely based on demand, well, it’s a bit worrisome at least to me.

Growers should consider where the market is, how much of expected production you have priced, and the risk you are willing to take that prices could go even higher vs. move lower.

Source : ufl.edu