By Don Shurley

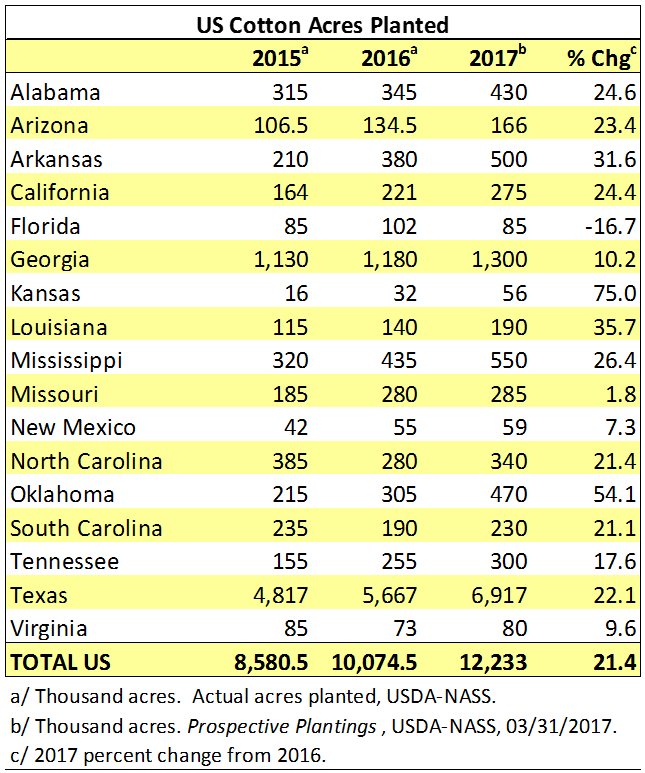

US cotton producers say they intend to plant 12.23 million acres of cotton this year—up 21.4% from last year. This number, released March 31, is higher than most pre-report expectations.

The National Cotton Council survey-based estimate back in early February was 11.0 million acres. USDA-ERS in its Outlook Forum later that same month projected a higher number at 11.5 million based on higher prices since the NCC survey.

I believe most analysts expected today’s report to fall in the 11.8 to 12 million acre range.

The Prospective Plantings report is based on a survey conducted February to mid-March. During this time, cotton futures (Dec contract) were mostly 73 and 74½ cents, compared to around 60 cents for the same period last year. For the 2016 crop, Dec futures did not break above 70 cents until July. Prices are now 3 to 5 cents higher than during the earlier NCC survey period.

In summary, double-digit increase is expected in most states. Increase is expected in all states but Florida, which is a bit of mystery. As expected, increase is projected for the Mid-South where acreage looks to shift mostly from corn to cotton. Texas looks to plant almost 7,000 acres, which would be the highest acreage since 2011, and prior to that, the highest since the late ‘70’s – early ‘80’s. If realized, US cotton plantings this year will be the largest since 2012, and would extend a rebound in acreage from just 2 years ago when we planted only 8.58 million acres.

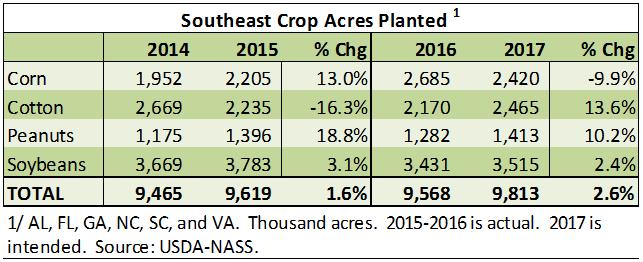

Especially in the Southeast, peanuts can be an important factor in the cotton acreage decision. Relatively high peanut prices, or high PLC payment incentive can increase peanut acres, potentially shorten rotation, and increase competition for cotton and corn.

Farmers are optimistic about peanuts and this is clearly reflected in the planting intentions. Initially, it was thought that increased peanut acreage could come at the expense of cotton and corn and, to lesser extent, soybeans. The recent strength in cotton prices makes cotton more competitive with peanuts, however, and perhaps contributed to higher than expected cotton acreage along with the increase in peanuts. In the 6-state Southeast area, peanuts are expected to increase 10.2% but cotton also increase 13.6%– a combined increase of 426,000 acres. Corn is expected to decrease 265,000 acres.

The market expected an acreage increase. The only surprise is the increase is roughly 350,000 acres more than most expected. So, how does this impact the market and why?

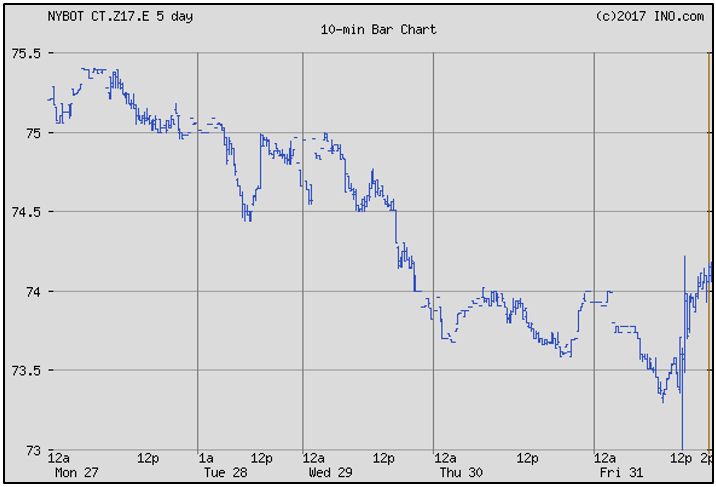

New crop Dec futures closed at just over 74 cents (74.09) on March 31. This was down 140 points for the week. Most of this loss came on Wednesday with prices dropping 79 points, and this was followed by another 41 point drop on Thursday. April 1, in spite of the USDA report, prices actually rallied and closed up 40 points—recovering the loss from Thursday.

Last week’s action, especially in light of the higher than expected acreage numbers, is significant because cotton traded as low as 73 cents before rallying back above 74 cents at 74.09.

This rally, in the face of the large acreage number, seems irrational—but when you look at things from the perspective of the total week, perhaps some of the mystery is explained. Prices were down Wednesday and Thursday a total of 120 points. Despite another round of good export numbers on Thursday, prices dropped anyway.

The losses on Wednesday and Thursday could have been in anticipation of Friday’s report. On Friday, the rally could have been a delayed reaction to the good export numbers that came out on Thursday. Thursday’s export report showed for the prior week ending March 23rd, new sales were a strong 414,500 bales and shipments were 414,200 bales.

As of March 23rd, export sales now total 13.2 million bales—100% of USDA’s projection for the 2016 crop marketing year with 4 months (April-July) still left to go. Shipments total 8.5 million bales—64% of the USDA projection.

We all like to talk about planted acres, but we know the market will eventually swing based on yield and acres actually harvested. Let’s assume the pre-report expectation for planted acres was 11.9 million acres (I’ve seen that figure floated out there in various media outlets, so let’s go with that). Last week’s number was 333,000 acres more. Assuming 10% abandonment and an average yield of 825 lbs, this would equate to approximately ½ million bales more cotton than we thought the 2017 crop might give us pre-report.

That’s not an insignificant number. In fact, applying these same yield and abandonment assumptions to the entire 12.23 million acres intended this year gives a crop of 18.9 million bales compared to 17.23 million bales for 2016. So, why did today’s report seem to not impact the market?

Last weeks’ numbers are not insignificant. Eventually, the market will react to crop conditions, yield, and acres to be harvested. In looking for a possible answer to the question, look at exports. Exports are currently projected at 13.2 million bales. US ending stocks projected at 4.5 million bales or a 27% stocks/use ratio. It is likely that USDA could further raise its export projection in thier April report. If so, this lowers ending stocks carried into the 2017 crop year and tightens the stocks/use ratio.

If exports are raised and ending stocks lowered, this offsets some of the larger than expected plantings and potential 2017 crop. The lower the carry-in, the more value is placed on new crop. With exports doing so well, perhaps the market chooses to ignore the possibility of a big 2017 crop—for now.

Friday’s fall to 73 cents before the saving rally, illustrates there is downward potential. Having said that, there seems to be support at 72 cents; but last week’s slide and Friday’s wide action, if only temporarily, broke the strong uptrend we’ve been in since the first of the year.

If intentions hold, growers will increase planting by 21.4% this year. If it’s worth planting, it’s worth protecting. As we move forward, prices will key on US planting progress and crop conditions, continued exports, and sales and impact of sales from China’s government reserve.