Growers are reminded that the LDP (or POP as it’s often called) acts as protection against low prices. The LDP is received in lieu of putting cotton in the Loan. If the Adjusted World Price (AWP) is less than the Loan Rate, that’s what generates the LDP, and that also means that cotton can be stored in the Loan, free of cost to the grower. If you take the LDP and then continue to hold cotton in storage, you have no protection from prices going lower and you also accrue storage charges. If your plan is to hold cotton for higher prices, you would likely be better off to just put the cotton in Loan rather than take the LDP. With the cotton in Loan, if the AWP remains below the Loan Rate, you’ll have a MLG (Marketing Loan Gain)—the math works exactly the same as with the LDP.

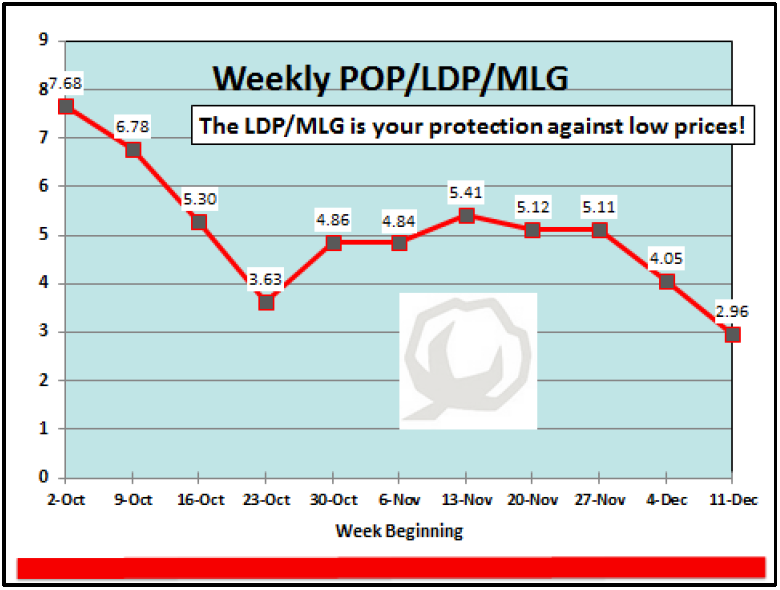

Here’s what the LDP has been each week since the beginning of October. Prices and the LDP move in opposite directions. The LDP goes up because prices have gone down. The LDP goes down because prices have gone up. If you take the LDP, to play that game you need to understand the timing of what to do. You need to be prepared to sell those bales or otherwise, just recognize that you no longer have protection for declining prices and you’re incurring storage charges.

Most recently, for example, the LDP was 4.05 cents/lb for the week ending Dec 4. It dropped to 2.96 cents effective today. It dropped because prices were higher this week than the week before.

Growers are reminded that the LDP (or POP as it’s often called) acts as protection against low prices. The LDP is received in lieu of putting cotton in the Loan. If the Adjusted World Price (AWP) is less than the Loan Rate, that’s what generates the LDP, and that also means that cotton can be stored in the Loan, free of cost to the grower. If you take the LDP and then continue to hold cotton in storage, you have no protection from prices going lower and you also accrue storage charges. If your plan is to hold cotton for higher prices, you would likely be better off to just put the cotton in Loan rather than take the LDP. With the cotton in Loan, if the AWP remains below the Loan Rate, you’ll have a MLG (Marketing Loan Gain)—the math works exactly the same as with the LDP.

Here’s what the LDP has been each week since the beginning of October. Prices and the LDP move in opposite directions. The LDP goes up because prices have gone down. The LDP goes down because prices have gone up. If you take the LDP, to play that game you need to understand the timing of what to do. You need to be prepared to sell those bales or otherwise, just recognize that you no longer have protection for declining prices and you’re incurring storage charges.

Most recently, for example, the LDP was 4.05 cents/lb for the week ending Dec 4. It dropped to 2.96 cents effective today. It dropped because prices were higher this week than the weCapturing the most money in your pocket is the result of timing. If prices are going up during the week, you can be assured that the LDP will decline for the following week—they will offset. So, the only way you can gain is to be prepared to take the LDP and sell those bales while the market is up and before the LDP can adjust down.

If prices are trending down during the week, the best strategy is to just hold off because the LDP will be higher the next week. The LDP is your friend. If prices are going up during the week, you could take the LDP and sell those bales while prices are up and while the LDP is higher, before it goes down the following week.

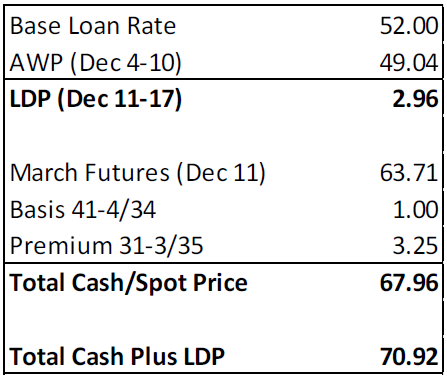

Assuming premiums for good quality cotton, here’s what the “total money” looks like presently:k before.

This total is 2-3 cents less than what it would have been yesterday, or Wednesday before the market went down yesterday, and today and before the LDP went down today.

Source:ufl.edu