- “self-certified unpriced inventory that an eligible producer has vested ownership in as of January 15, 2020” (Final Rule, p. 30826), or

- 50 percent of the eligible producer’s 2019 production of the commodity.

The final rule defines “unpriced inventory” as “any production that is not subject to an agreed-upon price in the future through a forward contract, agreement or similar binding document” (Final Rule, p. 30831). This adds no small amount of complexity and the potential for confusion, and will no doubt raise many questions as the program is implemented. FSA has added further that eligible inventory must be subject to price risk as of January 15, 2020, which means “any production, sales, and inventory that is not subject to an agreed-upon price in the future through a forward contract, agreement, or similar binding document” and “must still be at risk of price fluctuations after January 15, 2020, to be eligible for payment” (USDA FSA, CFAP Notice).

CARES Act funds are used for payments on half of the producer’s eligible inventories, while CCC funds are used for payments on the other half of eligible inventories. These two sources for the payments – CARES Act funds and CCC funds – are summed to provide the total payment received by the farmer.

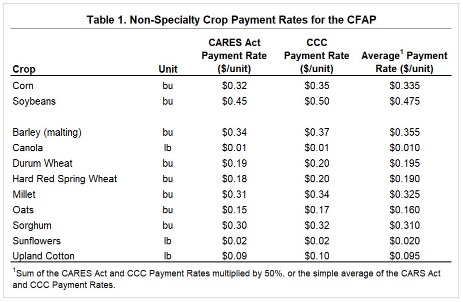

Note that in the case of non-specialty crops, the total CFAP payment can be simplified by multiplying eligible inventories by the simple average of the CARES Act and CCC Payment Rates. The CARES Act, CCC, and average payment rates are provided below in Table 1.

As an example, take an illustrative CFAP payment for corn. Calculations will be illustrated on a per acre basis. A farmer had 200 bushels per acre of production in 2019, meaning that the maximum bushels available for CFAP payments is 100 bushels per acre (200 bushels of production times 50%). The farmer had 140 bushels of unpriced inventory on January 15, which means that the producer’s eligible corn inventory is 100 bushels per acre (lower of 1/15/20 unpriced inventory or 50% of 2019 production). The total CFAP payment is

$33.50 per acre (100 bushels x $.335 average rate).

Payments will be made in two installments:

- $26.80 per acre, which is 80% of $33.50. This is the guaranteed installment.

- $6.70 per acre, which is 20% of $33.50. This second installment is contingent on sufficient funding being available.

There are a number of questions remaining for non-specialty grains, with most of those questions revolving around the definition of unpriced grain.

Cattle and Hog Payments

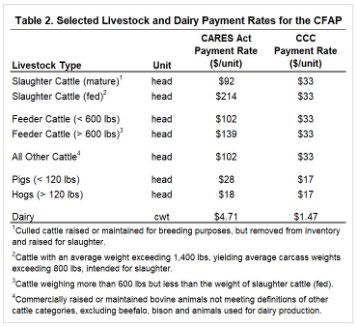

For cattle and hogs, the CARES Act payment portion is calculated by multiplying the CARES Act payment rate for the relevant species times total head sold from January 15th to April 15th, 2020. The CCC portion is calculated by multiplying the CCC payment rate times the highest inventory held between April 16th and May 14th, 2020. CARES Act and CCC payment rates for cattle and hog categories are provided in Table 2.

As a simple example, take a feeder cattle finisher who:

- Sold 500 head of finished cattle between January 15 and April 15. These cattle had an average weight over 1,400 pounds, meeting the definition of Slaughter Cattle (fed) in Table 2. The total CARES Act payment on these sales would be $107,000 (500 head x $214).

- Had a maximum of 250 cattle on hand between April 16 and May 14. These cattle will receive a CCC payment of $33 per head, for a total of $8,250

The total CFAP payment then is $115,250 ($107,000 +$8,250). This payment will be received in two installments:

- $92,200 or 80% of $115,250. This is the guaranteed installment.

- $23,050 or 20% of $115,250. This second installment is contingent on sufficient funding being available.

Dairy Payments

For dairy, the CFAP payment is based on production during the first quarter of calendar year 2020. CARES Act funds are used to compensate total first quarter production at a rate of $4.71 per cwt (first quarter production x $4.71). CCC funds are used to compensate 101.4% of first quarter production at a rate of $1.47 per cwt (1.014 x first quarter production x $1.47).

The total CFAP payment rate on first quarter production is $6.20 per cwt ($4.17 + 1.014*$1.47). The first installment would be $4.96 per cwt (80% x $6.20), while the second installment would be for the remaining $1.24 (20% of $6.20).

Application, Producer Eligibility and Payment Limits

To be eligible for a CFAP payment, a person or legal entity must complete a CFAP application between May 26th and August 28th. Applications will become available on Tuesday, May 26th from FSA but producers can begin pulling together the needed information at any time.

The adjusted gross income limit for payment eligibility is $900,000 using the average of the 2016, 2017, and 2018 tax years. This limit does not apply if 75 percent of AGI comes from farming, ranching, or forestry.

Total CFAP payments, across all eligible commodities, are limited to $250,000 per person or entity. For corporate entities, including limited liability companies and limited partnerships, a maximum of three shareholders are eligible for a total payment limit of $750,000. Eligible shareholders must contribute at least 400 hours of active management or labor. USDA continues the provision for joint ventures and general partnerships that permit multiplication of payments for each general partner.

Finally, the Farm Service Agency has provided a helpful webinar for CFAP with basic information on preparing for signup (USDA FSA, CFAP Introductory Webinar). As it becomes available, more information will be provided.

Conclusion

After Memorial Day, farmers can begin to enroll in the Coronavirus Food Assistance Program (CFAP) for direct payments on 2019 crop inventories that have not been sold or contracted, or up to 50% of the total production in 2019. For corn farmers, the payment rate is $0.335 on the eligible inventory and for soybeans it is $0.475 per bushel. Information on total production in 2019, and unpriced inventories as of January 15th will be needed from the farmer to process payments. In its cost-benefit analysis for the final rule, USDA estimates that $2.293 billion in CFAP payments will go to corn, $845 million to soybeans, and $442 million for cotton.

Total non-specialty crop payments are projected at up to $3.758 billion. Note these estimates do not incorporate the effect of payment limits, and assume payments are made on the cap of 50% of 2019 production. Note also that CFAP payments are in addition to any ARC/PLC payments triggered for the 2019 crop year, as well as 2019 MFP and WHIP support.

CFAP payments for cattle and hogs will be based on two pieces of information required from the farmer. These are sales between January 15th and April 15th, and unpriced inventories from April 16th to May 14th. USDA estimates a total off $5.06 billion in payments to cattle producers, and $1.6 billion for hogs. Dairy producers will need to provide information on milk production from the first quarter of calendar year 2020, and are projected to receive $2.77 billion in CFAP payments. Note that USDA’s aggregate payment estimates for livestock account for the effect of payment limits.

Many questions remain regarding program implementation and payment calculations, many of which are surrounding the definition of “unpriced inventories” used for non-specialty crops and livestock.

Source: farmdocdaily