The U.S. is the main alternative for China filling a possible corn supply gap as Brazil, the world’s second-largest exporter, has limited room to increase its sales, according to Andre Pessoa, head of the Brazilian forecaster Agroconsult. Guidelines established in a protocol for Brazil’s corn exports to China currently hampers the trade.

Overall, demand for corn from the U.S., Brazil and Argentina soared in the past weeks as the war escalated, but purchases have slowed down recently, Pessoa said. Brazil will ship around 2 million tons of corn in March and April, which is very unusual for those months, he said.

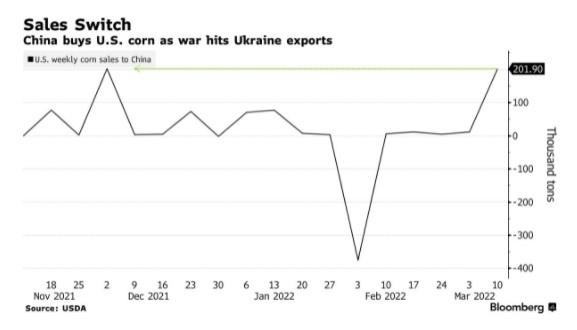

Read More: China Buys Up U.S. Corn, Soybeans as Ukraine War Roils Trade

Corn futures in Chicago extended gains after the U.S. export sales data and as the International Grains Council slashed its outlook for world supplies due to the war. May-delivery futures rose 3.2% to $7.5325 a bushel, while wheat gained 2.2% soybeans climbed 1.2%.

“From a fundamental perspective you have a different situation in wheat and corn,” said David Brock, marketing advisor and principle at Brock Associates in Milwaukee. “The corn market will be focused on just how massive the sowing is over the coming weeks. On the other hand we are a few months from winter wheat harvest and Ukraine’s deputy ag minister said crops look good.”

There are growing worries that weather woes will stay pressuring available supplies in the near-term, especially with poor crop ratings and logistics disruptions.

Click here to see more...