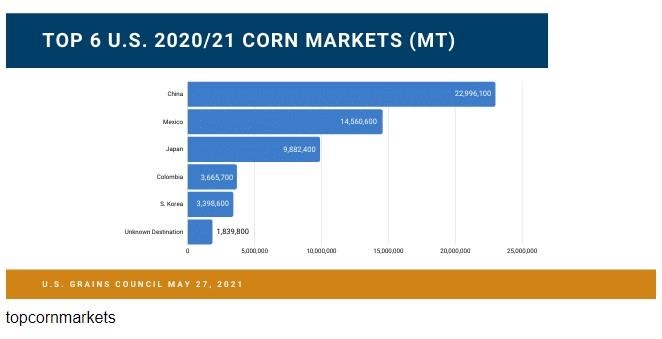

China’s most recent purchase of U.S. corn on May 20 marked its ninth consecutive business day of marketing year 2021/2022 corn buying, adding to 22.996 million metric tons (MMT) of U.S corn (905.31 million bushels) already sold in the 2020/2021 marketing year, 59 percent of which has been shipped.

China’s purchase of 10.744 MMT of corn (422.97 million bushels) for 2021/2022 – more than three months before the new marketing year even begins – sets a historic pace for U.S. export sales. Mexico, the second-highest U.S. corn purchaser, had also bought more than 1.808 MMT of corn (71.18 million bushels) for the new marketing year as of May 20.

Some of China’s recent purchases of U.S. corn will likely go into the country’s state reserves, but much will go directly to the feed and livestock industry.

“No one knows how much of China’s corn imports are going into official state reserves, but the amount going into reserves may be just for annual replenishment rather than for rebuilding depleted reserves,” said Bryan Lohmar, U.S. Grains Council (USGC) director in China.

“Private stocks held by end users, however, are growing, prompted by the depletion of the temporary reserves built up in the early part of the last decade and sold off at auctions held every summer since 2016.”

With these temporary reserves depleted, private end users are more exposed to supply shocks and, therefore, may be increasing their own private stocks and pipelines.

“The concern over depleted temporary reserves and greater exposure to supply shocks may be affecting official reserve decisions, too, so they may also be growing. We just don’t know.”

Corn feed demand in China has also increased due to the expansion of poultry production and the Chinese government’s aim to modernize its pork production. U.S. corn imports have been going directly to feed mills to support this demand.

“Higher corn inclusion in feed rations is associated with the larger, more modern, production facilities that are rapidly expanding at the expense of more rudimentary, village-level production that was hit hard by the African Swine Fever (ASF) outbreak,” Lohmar said.

While stock replenishment suggests some corn demand is short term and will not continue in future years, a large amount of wheat and rice going into feed rations could indicate that feed grain demand growth is real.

“USDA estimates 40 MMT of wheat (1.47 billion bushels) used for feed – far greater than any future year, and estimates at least 9 MMT of rice used for feed, also far greater than previous years,” Lohmar said. “Industry estimates are even greater. But these two food grains are even more sensitive than corn, so many expect that large substitution of wheat and rice into feed rations to replace corn will not last for more than one or two years, providing more opportunity for corn demand growth even as corn stocks rebuilding is satiated.

“Since things like recycled food waste – which may well have been a significant component of feed in village-level operations – is a clear vector for ASF, it is strictly outlawed and even village-level producers have strong incentives not to use it. This is generating expanded inclusion of corn in feed rations and will cause corn demand to grow as swine inventories recover from the ASF outbreak.”

The United States has also shipped 5.8 million metric tons (228.33 million bushels) of sorghum to China as of May 20, with another 937,400 metric tons (36.9 million bushels) in outstanding sales.

According to the Council’s grains in all forms (GIAF) portal, supplied with information obtained by the USDA Foreign Agricultural Service’s (USDA FAS’s) Global Agricultural Trade System (GATS), the country shows total shipments of 96.9 million gallons of U.S. ethanol (2.31 million barrels) between September 2020 and March 2021.

In addition, U.S. barley can now be exported to China following the approval of a phytosanitary protocol by both countries, a market development achievement years in the making finally accomplished with the boost of the U.S.-China Phase One deal signed in 2020. Chinese brewers are also showing increased interest in U.S. barley malt.

Click here to see more...