Each producer will make only one AD-3114 application for all eligible crops and livestock. Revisions to an AD-3114 might be possible, but it is highly recommended that this be avoided. As a result, having a complete and accurate AD-3114 when making the submission is important. Missing information on an application could result in a lower payment. Conversely, reporting inaccurate sales or inventory figures could result in penalties.

What types of Livestock are Eligible for CFAP?

Cattle, swine, and sheep are eligible for CFAP livestock payments.

USDA has designated 5 categories for cattle.

- Feeder cattle less than 600 lbs

- Feeder cattle greater than 600 lbs

- Slaughter Cattle (Fed): cattle with an average weight of 1,400 lbs, exceeding 1,200 lbs, and yielding average carcass weights of 800 lbs that are intended for slaughter

- Slaughter Cattle (Mature): culled cattle raised for breeding purposes, but removed from inventory and intended for slaughter

- All Other Cattle: all cattle not meeting feeder or slaughter cattle definitions; excludes beefalo, bison, and cattle intended for dairy production.

For swine there are 2 categories.

- Pigs, which are any swine less than 120 lbs

- Hogs, which are any swine 120 lbs or greater

Sheep include all lambs and yearlings that are less than 2 years of age.

The cattle and swine category distinctions are important when reporting sales from January 15, 2020 to April 15, 2020 as the payment rates vary. While the payment rates for maximum inventories from April 16, 2020 to May 15, 2020 are the same for all 5 cattle categories, FSA offices will still need livestock inventories reported by category. Similarly, the payment rate on inventories is the same for both swine categories, but inventories will need by be reported by category.

What Information for Livestock will be Needed?

Producers of eligible livestock categories need to provide two pieces of information:

- Total sales (head), by eligible species and category, from January 15, 2020 to April 15, 2020. Note that sales can only include those of animals held in owned inventory as of January 15, 2020, or the offspring of an animal held in owned inventory on that date.

- Maximum daily inventory, by eligible species and category, held from April 16, 2020 to May 15, 2020.

Note that the sales and maximum inventory figures are from two separate time periods.

Livestock Payment Calculations

The total CFAP payment provided to producers is based on the sum of:

- CARES Act payment based on total sales from January 15, 2020 to April 15, 2020

- CCC payment based on maximum inventory held from April 16, 2020 to May 15, 2020

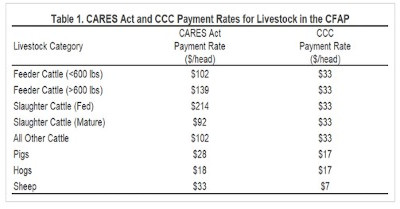

CARES Act payment rates are provided in Table 1 and available here. They vary by eligible species category. CCC Payment Rates are constant across all categories within a species. For example, cattle payments are $33 per head regardless of category.

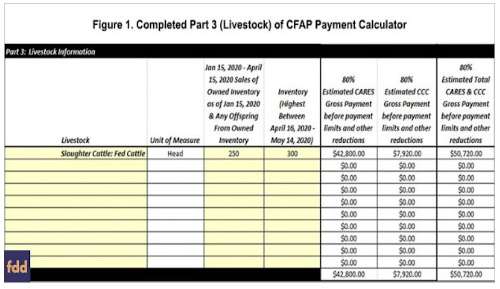

Below is an illustration using the CFAP Payment Calculator for an example producer who had eligible sales of 250 head of slaughter cattle (fed) from January 15th to April 15th, and a maximum inventory of 300 head from April 16th to May 14th.

The CARES Act payment equals $53,500 (250 head x $214) and the CCC payment equals $9,900 (300 head x $33). The total CFAP payment equals $63,400.

The producer will receive a first installment equal to 80% of the total payment, or $50,720 (0.80 x $63,400). The second installment will be made pending funding availability, and equal to $12,680 (0.20 x $63,400).

What Information for Dairy will be Needed?

Dairy producers will need to provide total milk production, in pounds, for the months of January, February, and March of 2020. Total production should include both sold and dumped milk. The CARES Act portion of the CFAP payment is based on total first quarter production. The CCC portion of the CFAP payment is based on an adjustment applied to total first quarter production.

Dairy Payment Calculations

A single CFAP payment is calculated for dairy as the sum of payments from CARES Act funds and CCC funds. The CARES Act payment is equal to $4.71 per hundred weight ($0.0471 per lb) of milk production (including any dumped milk) during the first quarter of the 2020 calendar year. The CCC payment is equal to $1.47 per hundred weight ($0.0147 per lb), paid on first quarter production, adjusted by a factor of 1.014.

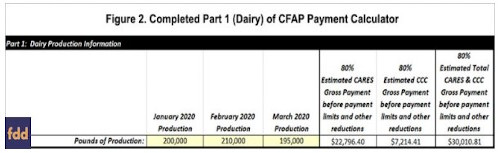

Below is an example dairy payment calculation provided by the CFAP Payment Calculator spreadsheet. Reported production was 200,000 lbs in January, 210,000 in February, and 195,000 in March for total of 605,000 lbs in the first quarter. The CARES payment is $28,495.50 ($0.0471 x 605,000 lbs), and the producer would receive a first installment of $22,796.40 (0.80 x $28,495.50), or 80% of the CARES payment. The CCC payment is $9,018.01 ($0.0147 x 1.014 x 605,000 lbs), and the producer would receive a first installment of $7,214.41 (0.80 x $9,018.01).

The total CFAP payment in this example is $37,513.51 ($28,495.50 + $9,018.01), and the producer would receive a total first installment of $30,010.81 (0.80 x $37,513.51). The second installment of $7,502.70 (0.20 x $37,513.51) would be provided later pending funding availability.

If livestock was purchased and sold during the qualifying period (January 15, 2020 to April 15, 2020) do those sales count?

To be included as an eligible sale, the livestock must have been in the applicant’s ownership on January 15, or offspring of livestock in the applicant’s ownership on January 15th. Consider several examples related to this:

- If five head of cattle were purchased on February 1 and sold on March 1, the sales of those five head of cattle cannot be counted as sales in the period because the applicant did not have ownership on January 15th.

- If a cow owned by the applicant on January 15th has a calf on February 1st and the calf is sold on March 1st, the sale of the calf is eligible to be counted as a sale in the period because the calf is offspring of livestock in the applicant’s ownership on January 15th.

- If a feeder calf is sold on either end date of the period, January 15th or April 15th, the seller can count the calf as a sale in the period.

- If a feeder calf is purchased on January 15th and sold on April 1st, the applicant can count the sale because the calf was in ownership of the producer or seller at some point on January 15th.

What about offspring of breeding stock held on January 15, 2020?

Animals born from breeding stock are eligible for CFAP payments if the animals are subject to price risk. Take a wean-to-finish operation that has 500 sows in inventory on January 15th. These sows give birth to 4,500 pigs in the first week of February. If those 4,500 pigs were sold prior to or on April 15th they could be included in reported sales and eligible for the CARES Act payment. If those 4,500 pigs continued to be owned after April 15th and were subject to price risk, they could be included in the maximum inventory reported for the CCC payment.

What livestock can be included in maximum inventory from April 16, 2020 to May 14, 2020?

The highest livestock inventory held between April 16th and May 14th will be reported on the CFAP application. The livestock included in inventory numbers must have been subject to price risk at the time. Livestock with a price contract in place for future delivery should not be included. For example, a farmer’s peak inventory was 100 head of cattle on April 20th, but at that time 20 were priced for delivery to processing on May 1st. This results in an eligible inventory of 80 head of cattle on April 20th.

Also note that livestock purchased from April 16th through May 14th can be included in the eligible inventory as long as it was subject to price risk. Continuing from the example above, if 10 head were purchased on May 5th, the farmer would have 90 head of cattle in inventory (100 – 20 delivered May 1st + 10 purchased May 5th) on May 5th and all 90 would be eligible inventory for CFAP. Although the farmer only has possession of 90 head on May 5th versus 100 head on April 20th, the farmer would select 90 head on May 5th as the maximum eligible inventory.

In the case where livestock sales transactions occur during the inventory period, the same cattle may be counted in inventory by more than one completely separate farmer. Consider the farmer in the previous example to be Farmer A and assume the 10 head of cattle purchased on May 5th were purchased from Farmer B. If Farmer B’s maximum eligible inventory occurred on May 1st prior to selling those 10 head of cattle, both Farmer A and Farmer B would count those 10 head in the maximum eligible inventory.

What if a price contract was in place for livestock in the applicant’s physical possession from April 16, 2020 to May 14, 2020, but the livestock is still in physical possession and there is concern the contract may be canceled?

As of now that livestock cannot be counted as eligible inventory in the maximum inventory figure for April 16th to May 14th because it was not subject to price risk at that time. If at some point before the end of the CFAP application period (August 28, 2020) the contract is canceled, the livestock could be counted in inventory.

Applicants can only submit a single application for all covered crops, livestock, and dairy. If the status of eligible inventory could change due to a cancellation or voiding of a price contract, applicants may want to wait until later in the application period to apply. However, there are downsides to waiting to apply. For one, payments will not be issued until the application is submitted so this means a delay in getting what is likely necessary financial relief. And although USDA is paying only 80% in the first round of payments in an effort to ensure funds are available for all applicants throughout the application period, there is no guarantee. Applicants in this situation will have to weigh these options.

How are numbers certified and what documentation should I have?

During the application process, all values reported to FSA are self-certified. All applicants should have documentation to support sales and inventory figures reported readily available for future audits or spot checks. Sales receipts can be utilized to document sales figures. Breeding records, feeding records, and vet records are examples of documentation that may be used for inventory.

What steps should be taken before submitting a CFAP application if livestock is farmed by a different name or entity that hasn’t worked with FSA in the past?

Often livestock is owned by a different entity than the grain farm, even if owned by the same person or group of people. For people or entities that haven’t worked with FSA in the past, FSA will first have to determine eligibility criteria. This can take some time and should be started before submitting the CFAP application to ensure there are no problems in the application process.

How should inventory and sales be reported on an individual’s application for livestock jointly owned by more than one person?

Each person jointly owning the livestock will submit their own application and report half of the qualifying jointly owned sales and half of the qualifying jointly owned inventory. However, only whole numbers may be reported on the CFAP application. In the case where the total sold or total in inventory is not evenly divisible by the number of joint owners, the parties jointly owning the livestock will have to divide into whole numbers that each will report accordingly. For example, if two people jointly owned 25 head of cattle as the qualifying inventory, they cannot each include 12.5 head on the application because that would not be a whole number. One person would report 12 head on their application and the other would report 13 head on their application. They would have to settle the resulting difference in payment among themselves later, if desired.

Can a farmer count dairy heifers being raised for milking as cattle inventory?

If feeding or raising dairy heifers to milk or to sell to a dairy for milking, these head do not qualify for livestock payments. Cattle must be intended for slaughter to be eligible as cattle inventory.

Summary

The CFAP application process is relatively straightforward. Livestock farmers will need to report total head sold between January 15, 2020 and April 15, 2020 and the maximum inventory between April 16, 2020 and May 15, 2020. Livestock included as sold must have been owned (or offspring of owned) livestock as of January 15th. Livestock included as inventory must have been subject to price risk at the time. Dairy producers will need to report total milk production for the months of January, February, and March of 2020. Total production should include both sold and dumped milk. General eligibility requirements need to be addressed within 60 days of applications, and thus should be considered before the CFAP application is submitted. This is especially important for livestock and dairy farmers who may not have worked with FSA in the past, or may be operating as a different entity than has worked with FSA in the past.

Source : illinois.edu