Non-fed cattle marketings have been elevated for some time. Estimated Canadian cow exports to the end of August are about 12% lower than in 2020, mainly due to significantly lower exports during the April to June period. However, compared to 2019, estimated cow exports are about 9% higher this year and 3% higher than the 5-year average. Estimated Canadian cow exports during July and August were about 30% higher than in 2020 and the 5-year average.

‘Higher exports are a factor of lower than average slaughter demand for cows and high feed costs that have reduced demand for feeder cows.’

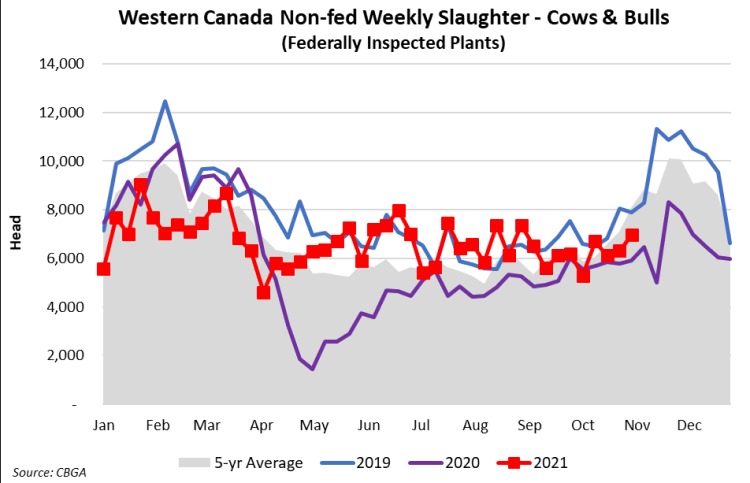

Western Canada cow slaughter is 274,079 head to the week ending October 30, up 12.7% from 2020 but 0.7% below the 5-year average. The weekly pace of cow slaughter increased in May this year and has been above the 5-year average in 18 of the last 27 weeks.

Nationally, cow slaughter is 363,633 head to the week ending October 30, up 11% from 2020 and 1.6% above the 5-year average. The impact of larger cow marketings is expected to lift the Canadian culling rate to a forecasted 14% in 2021, up from the 15-year average of 12% and the 2020 value of 11% (Gateway Livestock Exchange).

Figure 1. Western Canada non-fed weekly slaughter – Cows and bulls

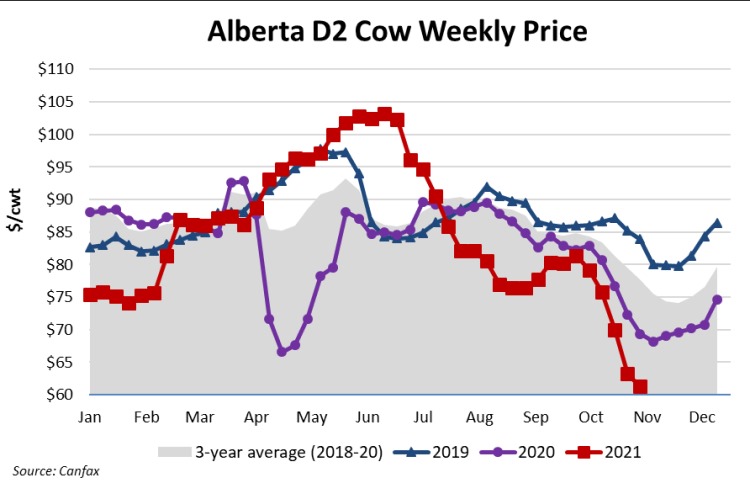

Increased culling has pressured prices with the Alberta D2 cow market seeing larger than seasonal price declines in recent weeks. Over the last 5 weeks, D2 cows have declined over 24% or $20 per hundred weight (cwt) – $280 per head on 1,400 pound cow. By comparison, the 5-year average shows a 6% decline or $77 per head for the same period.

The average monthly cow price peaked in June and has been under pressure following drought conditions and associated impact on feed supply and cost. D2 cows averaged $61.29 per cwt for the first week of November, down 3% from the previous week, 12% lower than the same week a year ago and 24% below the same week on the 5-year average. Cow sales are expected to remain elevated through the remainder of the fall run.

Figure 2. Alberta D2 cow weekly price

The Alberta cow market has been trading at a discount to the U.S. cow market since mid-July. Previously, 2014 was the last time that the Alberta cow market traded at a discount to the United States market for more than 7 weeks. Alberta D2 cows were trading at an $18 per cwt discount to the U.S. market at the start of November compared to an $8 per cwt discount the same week a year ago.

‘The price discount will continue to encourage U.S. buying. Prices usually hit their seasonal low in late November then start to seasonally strengthen into yearend’ says Wood.

Source : alberta