Provincial crop analyst Neil Blue looks at the factors that can affect commodity prices.

“The main price determining factors for most commodities are supply and demand, and that is true for canola prices,” explains Blue.

“Factors affecting the availability of crop or of a competing crop in the largest production areas have the greatest influence on a crop’s price. Prices tend to follow the production cycle of a crop in years of adequate available supply. To help with their pricing decisions, crop marketers should be aware of seasonal price patterns of crops that they produce.”

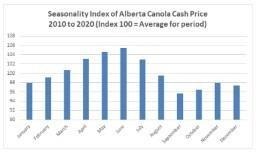

Seasonal prices are calculated by taking the average price for a certain period, such as a week or month, and comparing it to the average price over the year. Seasonal prices are often plotted on a bar graph, with the annual price average as Index 100. Generally, this type of calculation uses data from several years, which reduces the influence of contra-seasonal price moves that happen in some years - usually from a supply reduction. The 10-year canola price seasonality chart below is an example.

Blue says that in years of average or higher production, canola prices tend to make a low during the September-October period when there is abundant supply.

“Harvest progress, yield reports and buyer demand all affect timing of harvest price lows. After a harvest low, prices usually rebound as harvest selling pressure subsides and as demand again becomes evident.”

He adds that canola prices tend to level off into year-end, and they often improve during the December holiday period.

“They tend to trade sideways to lower into mid-February and then improve into spring. Canola prices tend to peak sometime in May-June and, unless production problems continue to support prices, canola prices usually erode from mid-July into a harvest low. Often that price decline into harvest is interrupted by a frost concern or event in August or early September.”

Seasonal price patterns are one factor to consider when developing a marketing plan and analyzing a market.

“Fall delivered prices tend to be the highest at the beginning of the growing season when production uncertainty is the highest. That is often the best time to forward price some expected production, considering cash flow needs and available storage for the expected new crop.”

However,” he explains, “in a year of reduced crop production in a major northern hemisphere area, prices can rise during the growing season right into harvest. Because of this possibility and that of an unexpected production shortfall on your farm, the recommendation is to only forward contract with buyers up to about 50% of expected production. To price a higher percentage of canola prior to harvest, it is prudent to use the futures or options market to avoid the additional physical delivery commitment.”

“Seasonal prices should be considered as more of a tendency than a certainty. However, of the many factors that can affect crop prices, the seasonal price pattern is still deserving of a crop marketer’s respect.”