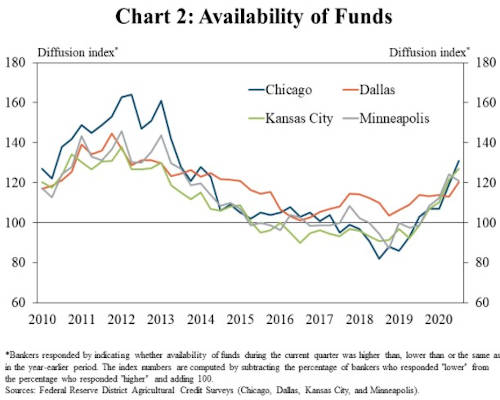

The pace of growth in available funds, however, continued to increase in most districts. In all Districts, funding at agricultural banks was likely supported by higher deposits and an influx of liquidity from Federal Reserve and government programs following the outbreak of COVID-19 (Chart 2). In fact, in the second quarter, 85% of bankers in the Kansas City District reported that deposits were higher than a year ago.\

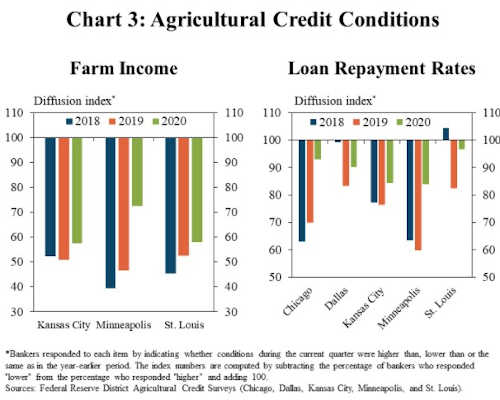

Alongside reduced lending activity, agricultural credit conditions improved somewhat in the third quarter. Although most bankers continued to report that farm income and repayments rates were lower than a year ago, the pace of decline slowed in all districts (Chart 3). Compared to last year, farm finances seemed to stabilize the most in the Chicago and Minneapolis districts, where corn and soybeans make up a larger share of farm revenues.

Click here to see more...