Sources: Statistics Canada, FCC Economics

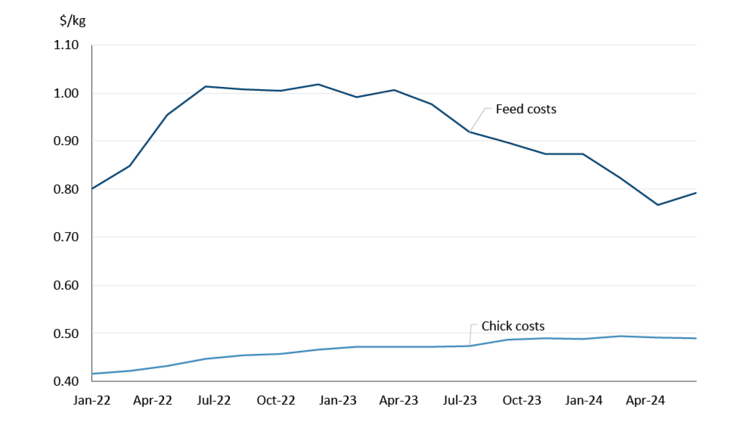

The decline in farm gate prices reflects easing feed costs. In Ontario, the feed cost component of the farm gate minimum live price rose to over $1.00/kg in the summer of 2022 but began falling in the second half of 2023 in line with lower grain and oilseed prices. Feed prices are down -22% relative to their peak in the A-180 quota period (December 2022 - February 2023). Chick costs, however, have been consistently increasing over the last two and a half years, in part a result of the supply shortage caused by the avian flu (Figure 2).

Figure 2: Ontario feed and chick costs by quota period

Source: Chicken Farmers of Ontario

Broiler production growth amid high inventories, imports

Considering the challenges brought about by avian flu, total broiler production in 2023 was surprisingly strong (3.3% growth). For 2024, the USDA is forecasting production growth to slow to 1.7% which, if realized, would be the lowest rate of growth since 2014 (excluding 2020 and the onset of the pandemic).

The Chicken Farmers of Ontario 2023 Annual Report noted that “record-high frozen inventories resulted in conservative [quota] allocations for the first four months of 2024.” With lower production at the start of the year, demand was met with chicken inventories which were drawn down -16% from January to July (Figure 3). Stocks of frozen chicken were historically high heading into 2024 and are usually drawn down in the spring and summer months, though notably last summer the opposite occurred and inventory levels surged. A return to more historical levels of frozen stocks bodes well for production in the latter half of the year and into 2025.

Source : FCC-FAC