Amid high beef prices, demand was very strong in 2024. The USDA estimates that beef consumption in the U.S. increased to 59.5 lb per person in 2024 (up 2% from 2023). This would be the highest since 2010, and comes despite beef prices being consistently higher year over year. Export demand also was strong outside the U.S. While total tons exported dropped through October, total value exported increased.

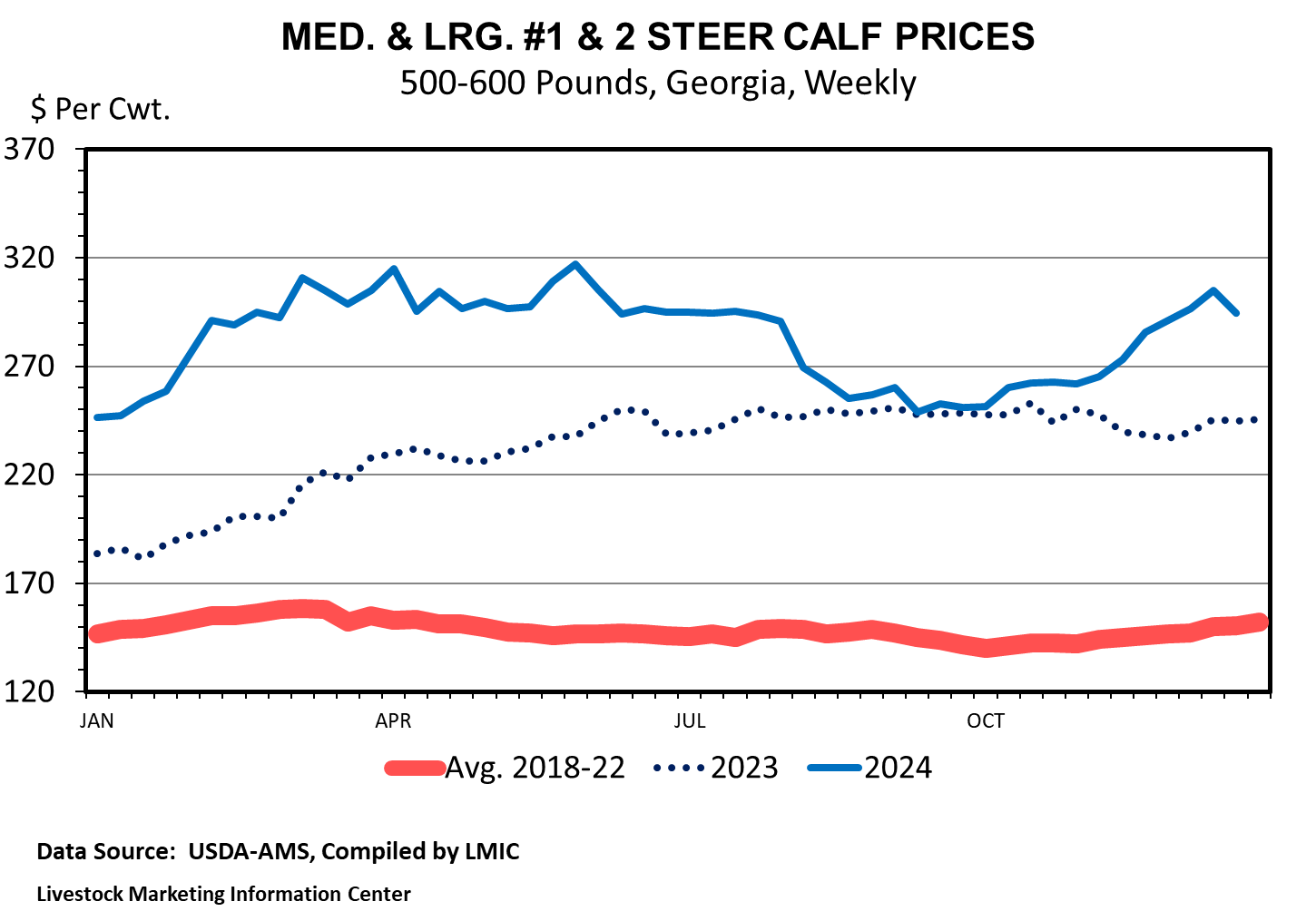

This strong consumer demand filtered back through the supply chain to beef cattle producers. Feeder cattle prices were elevated compared to last year for much of the year. However, prices slid in early fall to similar levels to last year for many areas of the country. In Georgia, feeder cattle prices followed a similar pattern (Figure 1). Medium and large steer calf prices averaged $258.65/cwt in January, 40% higher than in January 2023. In May, average prices were $304.07/cwt (up approximately 30%). In October, prices moderated in line with seasonal patterns to $259.69/cwt (up just 5%). In the fall, heavier-weight steers and heifers saw prices a little lower compared to 2023.

Figure 1. Weekly Georgia Calf Prices, 500–600 lb Steers.

Georgia's basis (i.e., Georgia cash prices minus futures prices) was also very high compared to last year and the 5-year average for lighter-weight calves. For example, from January to July, the average basis in Georgia for 500–600-lb steers was nearly $40/cwt higher than normal. Basis strength for heifers and for heavier-weight steers was smaller to negligible compared to historical averages, respectively.

2025 Outlook

The outlook for the year ahead is positive. Markets are currently pointing to another high-priced year. Futures prices are higher for feeder cattle through next year. Combined with strong basis, indications are that beef cattle producers in Georgia could see similar or higher prices in 2025.

Fundamentally, cattle supplies are likely to be lower in 2025 compared to 2024. With cheap feed and high fed-cattle prices continuing in 2025, high carcass weights will be another story in the year ahead. This will only partially help offset lower cattle supplies.

Much of the industry discussion is on herd rebuilding. All signals in 2024 indicated that the industry continued contracting. Cow slaughter in 2024 was still slightly higher than what previous rebuilding periods would suggest. Additionally, heifers as a percent of cattle-on-feed remained elevated.

In 2025, the industry may be approaching the low in cattle inventory numbers and starting to rebuild. Cow slaughter very well could dip to a point that indicates the herd is rebuilding in the year ahead. Additionally, estimated margins have been very strong for a few years and are projected to remain strong for the near future. Lastly, feed is relatively cheap, and forage is relatively abundant for much of the country. Any rebuild likely will be slower than the most recent expansion phase because of higher interest rates and the smaller base that the cattle herd is rebuilding from.

The more significant short-term risk to the outlook is from demand. With projected smaller beef production and higher cattle prices, beef prices likely will move higher, testing U.S. consumers’ ability and/or willingness to pay for beef. Additionally, any macroeconomic headwinds (e.g., global economic slowdowns or rising unemployment in the U.S.), could affect consumer demand with less-expensive animal protein alternatives readily available.

Source : uga.edu