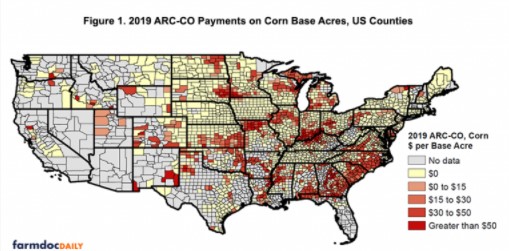

Figure 1 maps ARC-CO payments for corn base acres for counties in the US. Payments are reported for “non-irrigated” acres for counties with separate ARC-CO programs for irrigation practices, and for “all” acres otherwise. Payment amounts are adjusted to account for the 85% payment rate for ARC-CO, and are thus given on a per base acre basis.

As discussed last week, ARC-CO payments are determined by actual county level revenue as compared to a county level benchmark. Actual revenue in each county is equal to actual county yield times the 2019 national MYA price of $3.56 per bushel. The ARC-CO payment is then equal to the difference, if positive, between 86% of benchmark revenue and actual revenue. Given the 2019 benchmark price for corn of $3.70, the actual corn yield in a county would need to be less than 89% of the county’s 2019 benchmark yield to trigger an ARC-CO payment.

In most corn-producing states at least some counties had 2019 yields low enough to trigger ARC-CO payments for 2019 for “non-irrigated” or “all” practice types. Notable exceptions include Nebraska, and also Iowa where very few counties triggered ARC-CO payments.

Regions of relatively large ARC-CO payments on corn base exist in:

- Counties in the eastern portions of North and South Dakota,

- Counties in southern Minnesota,

- Counties running from eastern Kansas through northern Missouri through north-central Illinois,

- Counties a along the Ohio River in Indiana and Kentucky,

- Counties along the lower Mississippi River,

- Counties from Alabama to Georgia, and

- Counties in eastern North Carolina.

Payments are in the $20 to $35 per base acre range for the majority of counties throughout the Midwest where payments were triggered. Some Midwestern counties triggered payments exceeding $50 per corn base acre.

Relatively large payments for corn base outside of the corn belt and surrounding states were triggered in parts of the southwestern US, southern Kansas and eastern Oklahoma, and in areas of the southeastern US.

2019 ARC-CO Payments for Soybeans

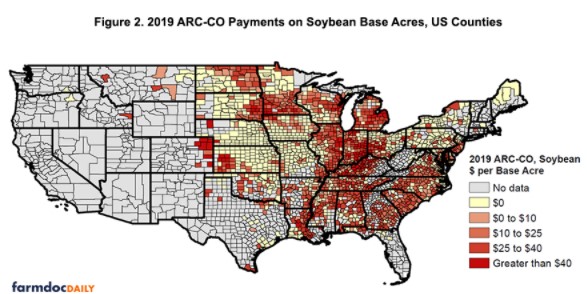

Figure 2 maps ARC-CO payments for soybean base acres for counties in the US. The 2019 MYA price for soybeans is $8.57, compared with an ARC benchmark price of $9.63. This implies that ARC-CO payments for soybeans are triggered in counties where actual yields are less than 97% of the county’s benchmark yield.

Payments on soybean base are triggered in:

- The majority of counties in the eastern corn belt in Illinois, Indiana, and the western regions of Ohio. Areas close to the eastern corn belt were impacted including Michigan and Kentucky.

- Upper Midwest in southern Minnesota and eastern North and South Dakota.

- The Delta region of Arkansas, Louisiana, and Mississippi.

- The southern region in Alabama and Georgia

- Both North and South Carolina

Summary

With county yield information being released by FSA, ARC-CO payments can now be computed for the 2019 program year. For corn, ARC-CO payments will be made in some areas of major corn-producing states in the Midwest as well as states in the western and southeastern US. For soybeans, ARC-CO payments were triggered in a greater number of counties due to the MYA price for soybeans being lower relative to its benchmark as compared to corn. Thus, county soybean yields did not need to be as low, compared with the county benchmark yields, to trigger payments. The majority of counties in the major soybean producing states of Illinois and Indiana triggered ARC-CO payments for soybeans, while a number of counties in other parts of the US will also receive ARC-CO support for enrolled soybean base.

Source : illinois.edu