By Jonathan Coppess and Scott Irwin

Department of Agricultural and Consumer Economics

University of Illinois

As discussed last week, the Environmental Protection Agency is soliciting data and feedback on the biomass-based diesel and advanced biofuels components of the Renewable Fuels Standard, including the general waiver authority (see, farmdoc daily, October 5, 2017). The Notice of Data Availability also included a request for data and comment on the other general waiver provision regarding severe economic harm. This article reviews that aspect of the general waiver authority.

Background

The Renewable Fuels Standard (RFS), first created by Congress in 2005's Energy Policy Act, included a general waiver provision with authority to reduce the mandate in whole or in part if the Administrator determined that either: (1) "implementation of the requirement would severely harm the economy or environment of a state, a region, or the United States;" or (2) "there is an inadequate domestic supply" (45 U.S.C. §7545(o)(7)(A)). When Congress substantially increased the RFS in 2007 it amended the waiver provisions but only as applied to advanced biofuels, cellulosic ethanol and biomass-based diesel (BBD), which had been added to the RFS (see, farmdoc daily, January 7, 2016).

EPA's recent Notice of Data Availability (NODA), reviewed in part last week, requests comment and data for EPA to evaluate in determining whether the previous interpretations of that provision were appropriate. As noted in last week's review, the NODA indicates that it is based entirely on comments from the oil industry. In response to those comments, EPA is seeking "input on whether there is information indicating that severe economic harm is occurring under the current standards or would occur for any volume requirement that could be established in the" proposed rule for 2018 and 2019.

Legal Perspective on the Waiver

EPA has considered the severe economic harm waiver twice before. In 2008, Texas requested a fifty percent waiver from EPA. The basis of the waiver request was the negative impact the RFS was having in terms of increasing the cost of corn fed to livestock and increasing food prices (see, Denial of Waiver 2008). In 2012, Governors from ten States requested a waiver reducing the RFS. The basis of their request was the "negative impact on their respective State economies based on this period of severe drought conditions by diverting corn from other markets to the production of ethanol" to meet the RFS (see, Denial of Waiver 2012). In both instances, EPA rejected the request and did not apply the waiver, finding that there was not sufficient economic harm.

Out of these two denials of requests for waiver, EPA established a fairly clear and thoroughly articulated standard for a waiver based on severe harm to the economy. First, a determination to use the waiver had to be based on a finding that the implementation of the RFS, itself, is the cause of the severe harm to the economy. Second, EPA must conclude with a high degree of confidence that there will be severe harm from implementation. Third, use of the waiver required a high threshold of harm. Fourth, severe harm to the economy is broader than harm to one sector of the economy or a narrow region.

(1) RFS implementation is causing severe harm

Severe economic harm to the economy must be the result of the implementation of the RFS. This is not a question as to whether there is or has been severe harm but whether that severe harm is caused by implementing the RFS. In the 2012 decision, EPA made it clear that finding severe economic harm was insufficient; implementing the RFS must be the cause of it. This is not a conclusion made in isolation, and other circumstances in the economy can be included in the analysis but the RFS could not be merely a contributing factor. The drought in 2012 and its impact on corn prices added context but the decision had to turn on whether implementing the RFS at a time of drought was causing severe harm. Implementing it had to be the cause. As for ethanol, refiners needed it for octane purposes and infrastructure would take time to change. Accordingly, without the RFS they would continue to blend. Implementing the RFS was not the cause of any severe harm.

In both decisions, EPA was clear to distinguish the RFS waiver authority from other provisions in the statute providing waiver authority where the statutory provision causes or contributes to the harm. The RFS waiver was different and limited to cause from implementation. As discussed in previous articles reviewing EPA's interpretation of the waiver authority, EPA is on sound legal footing with its previous conclusions (see e.g., farmdoc daily, June 11, 2015). It is a basic legal principle of statutory interpretation that Congressional intent in one part of a statute can be informed by similar provisions in other parts of the statute; a view reinforced by the recent appellate court decision (see, Americans for Clean Energy v. EPA, 865 F.3d 691, 2017 U.S. App. LEXIS 13692 (D.C. Cir., 2017)). EPA's reading of the severe economic harm waiver provision clearly adheres to this principle.

(2) High degree of confidence of severe harm

Because Congress used the term "would" in the waiver provision, EPA recognized that the evidence it reviewed had to provide for a high degree of confidence that implementation was causing the harm. By comparison, EPA looked to the special waiver provision for the first year of the RFS (2006). In that provision, Congress provided for a study assessing the mandate and whether it would likely result in significant adverse impacts on consumers (45 U.S.C. §7545(o)(8)(A)). EPA concluded that this demonstrated how Congress viewed the different waivers, with the first-year waiver requiring a much lesser degree of confidence than the general waiver requires. Comparing the two, Congress clearly intended a much higher standard for the general waiver than the first-year waiver; severe economic harm, not mere adverse impacts.

In its previous decisions, EPA acknowledged the Congressional intent in the RFS to force technology and demand given the yearly growth in the mandate. Thus, a waiver had to be used only in extraordinary circumstances where EPA was highly confident implementation was causing severe harm. Additionally, EPA understood this to include a high degree of confidence that the waiver would provide effective relief from the harm. In other words, if severe harm was likely to occur even if the RFS was waived then the RFS implementation could not be the cause.

(3) High threshold for use of waiver

EPA acknowledged repeatedly that the waiver provision established a high threshold for use. This again goes to the intent of Congress that the RFS be technology-forcing, which could well result in some degree of harm or cost. For waiver, the nature or magnitude of the harm must be beyond marginal, moderate or even serious. Severe harm falls just below extreme harm in EPA's conclusion. This is because the waiver should be used only in extraordinary circumstances to walk back the technology-forcing goal of the mandates.

(4) Broad-based Harm

Finally, the severe economic harm must be to a state, a region or to the United States. It cannot be a localized harm nor can it be harm to a single or few industries or sectors of the economy. The waiver is appropriate when harm is both severe and broad-based or widespread. The provision contemplates severe harm at an aggregation above localized or individual concerns; it must be on the state, regional or national level. EPA has understood it needed to include the full impacts of the RFS, including those harmed and those helped by it, in any determination.

Economic Perspective on Application of the Waiver

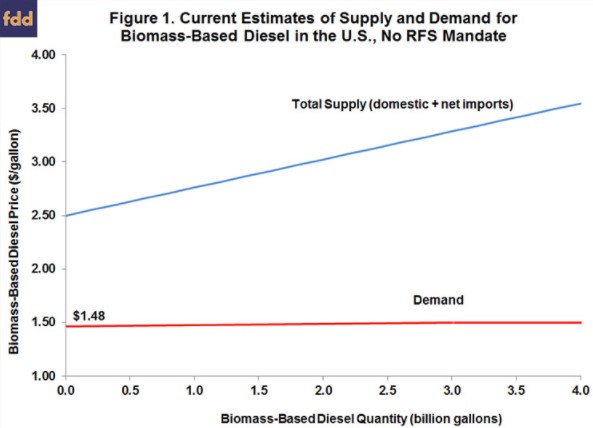

As discussed, applying the severe economic harm general waiver authority with respect to BBD begins with whether implementation of the RFS causes the BBD production and consumption. It turns out to be straightforward to establish this causal linkage. Figure 1 was first presented in the farmdoc daily article of August 30, 2017 and provides estimates of the supply and demand for BBD in the U.S. without an RFS mandate (or blender tax credit). The total supply curve is a horizontal summation of estimated BBD net import (imports - exports) and domestic supply curves, where the net import and domestic supply curves were estimated by regressing the annualized monthly net imports and domestic production in 2016 on the average monthly price of BBD. We assume that the wholesale price of biodiesel in Chicago is representative of the national price of all BBD. The estimated total supply curve also reflects soybean oil prices in the range experienced in 2016 and currently prevail. The supply curve would be expected to shift with different levels of feed stock prices. This model assumes that BBD and petroleum diesel are perfect substitutes after adjustment for the lower energy value of most BBD, so the demand curve is simply a horizontal line equal to the energy-adjusted diesel price. We assume a wholesale diesel price of $1.60 per gallon, near recent levels, which is $1.48 after adjusting for the lower energy content of most BBD (assumed to be approximately 92 percent of diesel). Since the intercept of the supply curve on the y-axis of $2.50 is substantially above the intercept of the demand curve of $1.48, the equilibrium quantity of BBD is equal to zero. In other words, in the absence of RFS mandates there would be no BBD produced or consumed in the U.S.

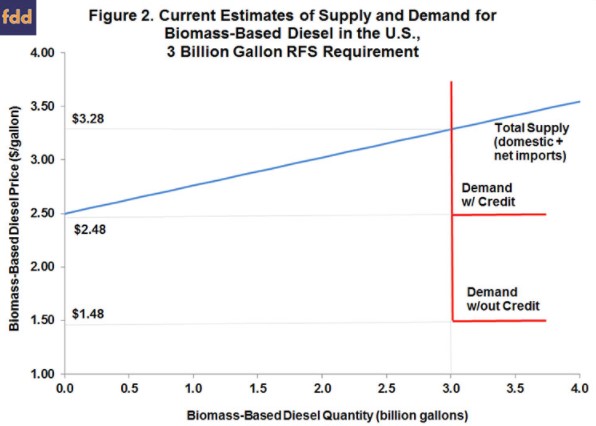

Figure 2 adds to the model "L-shaped" BBD demand curves. We assume a 3 billion gallon total RFS requirement for BBD to comply not only with the advanced mandate but also the conventional (ethanol) mandate due to the constraints on ethanol consumption presented by the E10 blend wall (see the farmdoc daily article of July 19, 2017 for further details). Since the RFS requirement is the minimum amount of BBD that can be consumed in the U.S., this creates a horizontal segment of the demand curve in Figure 2 at 3 billion gallons. Adding the blender tax credit simply shifts up the horizontal part of the demand curve by $1 per gallon. After shifting up the demand curve by this much the y-axis intercept of the demand curve is still below the y-axis intercept of the supply curve. Thus, in the absence of the RFS, the $1 per gallon biodiesel tax credit is not large enough to induce positive production of BBD in the U.S. The bottom-line is that the RFS is entirely responsible for all of the BBD consumed in the U.S. under current conditions.

The second criterion is a high degree of confidence of severe economic harm. One approach to defining harm would be to track the cost of RINs that obligated parties must submit for annual compliance. This approach is problematic for two reasons. First, economic theory predicts that RINs costs are largely a transfer payment between obligated parties and blenders, with a net near zero for ethanol and a few cents for BBD that is ultimately passed through to consumers at the pump. Second, the available evidence indicates that actual pass-through behaves similar to theory in many parts of the U.S. but not all (e.g., Knittel, Meiselman, and Stock, 2015; Pouliot, Smith, and Stock, 2017). For these reasons, RINs costs are not a good choice for measuring economic harm. Because the costs are passed-through to the consumer, a more relevant and simpler approach is to directly compare the cost of BBD to the petroleum diesel it displaces in the fuel supply.

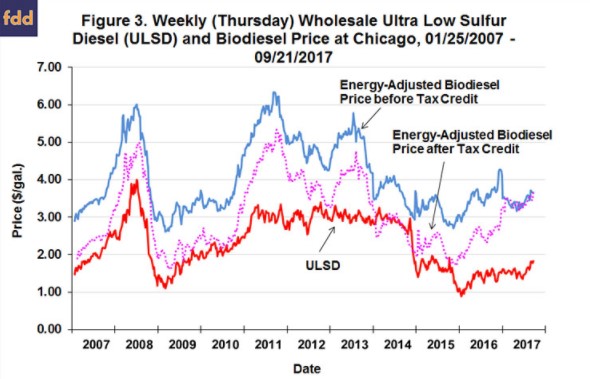

Figure 3 presents weekly (Thursday) biodiesel and ULSD prices at Chicago from January 25, 2007 through September 21, 2017. Once again, we assume that the wholesale price of biodiesel in Chicago is representative of the national price of all BBD and adjust biodiesel prices for the lower energy value of biodiesel. We present two different price series for biodiesel, one before and one after adjustment for the $1 per gallon biodiesel tax credit. Note that the credit was either in place or reinstated retroactively every year except for 2017. It is uncertain whether the credit will be reinstated again for 2017.

It is obvious from inspecting Figure 3 that biodiesel prices before considering the tax credit often exceed ULSD prices by substantial amounts. On average for the entire sample period, the unadjusted biodiesel price averaged $1.74 more than the ULSD price, or an increase of 76 percent. The price premium for biodiesel was as low as $0.20 and as high as $3.46, but generally fell in the range of $1 to $2. Taking into account the tax credit, the adjusted biodiesel price averaged $0.81 more than the ULSD price, or an increase of 35 percent.

Adding BBD to the U.S. fuel supply has clearly entailed a cost to consumers. If defining harm as the higher cost of BBD relative to diesel, then some degree of harm is caused by the BBD mandate. The key is whether there is a high degree of confidence that the harm is severe; a much more difficult matter. Consider that in 2017, the U.S. is projected by the EIA to consume 55.5 billion gallons of diesel which includes about 3 billion gallons of BBD, or an inclusion rate of 5.4 percent. If the 3 billion gallons of BBD cost $1.74 per gallon more than diesel (historical average before tax credit) the total cost would be $5.2 billion. While a large amount, it is small relative to the total cost of diesel to consumers. Assuming the average retail price of diesel in 2017 will be $2.35 per gallon ($1.60 wholesale diesel + $0.75 tax and markup), the total diesel expenditure would be $130 billion (55.5 billion gallons x $2.35 per gallon). The cost increase from the BBD component is $5.2 billion or only about 4 percent. If the biodiesel tax credit is reinstated, the BBD cost drops to $2.2 billion and the increase in total diesel expenditure is only 1.7 percent. It is difficult to see how cost increases of this magnitude rise to the level of severe economic harm.

In terms of the scale or reach of any severe economic harm, it cannot be a localized harm nor can it be harm to a single or few industries or sectors of the economy. This makes proving severe economic harm from BBD mandates even more difficult. Our analysis assumes the relative base for comparison is U.S. diesel fuel expenditure, but this is not likely consistent with the broad-based definition of economic harm in the statute. If we were to consider, say, the gross national product of a state, region, or the U.S., as a whole, the relative cost increase for BBD would be truly miniscule.

Implications

The recent NODA does not delve deeply into the other general waiver provision requiring a finding that implementing the RFS is causing severe economic harm. This is likely because EPA has twice rejected its usage in the past. EPA seeks input on whether it should reconsider these previous conclusions. A review of those decisions leads to a conclusion that EPA was likely on solid legal ground with its interpretation of its waiver authority in these earlier cases. Economic analysis of the potential application of severe economic harm to the advanced mandate and/or the biomass-based diesel mandate suggests it will be difficult for the EPA meet the high hurdles necessary to justify such a waiver. For example, the biomass-based diesel mandate increases the cost of diesel consumers in the U.S. by about 4 percent at the present time; a cost increase that would not appear to be severe.