Genetics continue to play a bigger role, but so does better management practices, technology, more tiling more irrigation etc. It’s a combination of factors. Despite the dry conditions early and late with a poor finish the lack of extreme heat saved the U.S. crops in 2023!

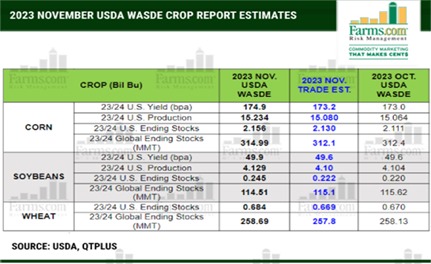

The USDA's corn estimate of 174.9 bushels per acre is 1.9 bushels higher than the previous month's figure and well above the trade estimate of 173.2 bushels per acre. Illinois, a major corn-producing state, is now projected to yield 203 bushels per acre, up from 200 bushels per acre last month.

Other states have also seen notable increases, with North Dakota experiencing a 5.1% boost, Missouri a 4.3% rise, and Wisconsin a 3.6% uptick. Globally, the USDA raised 23/24 global corn carryout expectations to 315 million metric tons, up from 312.4 million in October vs. up 15.78 mmt vs. 22/23. Notably, the report left South American crop estimates unchanged despite a drought as its still early, but increased corn production forecasts in Ukraine and Russia.

Despite the larger supplies, the USDA used the opportunity to revise its demand forecasts, raising exports and feed/residual by 50 million bushels from October, and ethanol by 25 million bushels. The U.S. carryout estimates were only slightly increased to 2.156 billion bushels, a 55 million bushel rise from the previous month, but the oversupply narrative which is old news continues to place a cap on futures for the foreseeable future.

However, the most surprising revelation came with the increase in soybean yield estimates. The soybean crop is now anticipated at 49.9 bushels per acre, a 0.3 bushels per acre increase from the previous month. Unlike corn, pre-report estimates showed no change, catching the market off guard and causing 2023 January soybean futures to close the day 22.2 cents lower on November 9, 2023. This signified that the funds did not have the increase priced in, adding to the overall market uncertainty.

In the grand scheme of things, the additional 45 million bushels of U.S. corn and 25 million bushels of soybeans, to keep things in perspective is small in comparison to the potential loss in production due to the ongoing drought in South America. Coupled with an improving demand outlook, and rising soybean meal futures the soybean futures market has taken the lead in the grain complex and will be the first to retest the 2023 summer highs.

For daily information and updates on agriculture commodity marketing and price risk management for North American farmers, producers, and agribusiness visit the Farms.com Risk Management Website to subscribe to the program.