Key Highlights from the USDA Report

The USDA raised U.S. corn exports to a record 3.2 billion bushels (+125 Mbu), driven by stronger export inspection data and global demand. This increase led to lower corn ending stocks at 2.029 billion bushels (-125 Mbu), which was more bullish than many traders had expected (2.150 Bil Bu avg estimate). For U.S. production and yield, estimates were unchanged from November’s figures (not uncommon), consistent with consensus forecasts for the final WASDE report of the calendar year.

Soybeans had a steady outlook. Soybean supply and demand projections remained mostly unchanged, with ending stocks in the U.S. holding steady at 0.290 Bil bu, and production estimates unchanged at 4.253 Bil Bu. With neutral to bearish signals, wheat ending stocks increased more than expected globally, reflecting good demand but higher supplies globally.

The glut of global wheat supplies from a record crop in Canada and Argentina and the 3rd largest in Australia will weigh on futures into yearned and will not change the bearish fund sentiment. No changes were made to the U.S. balance sheet with this report.

Global Outlook and South America

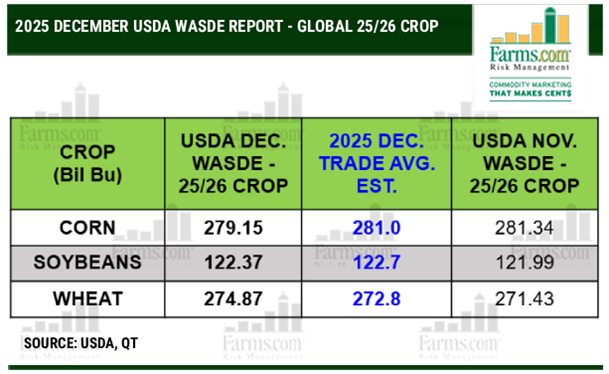

The USDA reported global ending stocks changes, with corn stocks lowered (-2.19 Bil Bu), soybean stocks higher (+0.38 Bil Bu), and wheat stocks having the greatest change from last month and increased above expectations (+3.44 Bil Bu).

Global wheat stocks saw many individual country increases such as Argentina +2 mmt, Australia +1 mmt, Canada +3 mmt, Russia +1 mmt and EU +1.7 mmt. No change on 25/26 China soybean/corn/wheat imports.

The USDA left its projections for major South American crop production unchanged from the November estimates, underscoring steady expectations for Brazil and Argentina as it’s still too early. Brazil’s soybean production was still forecast at a record high of about 175 mmt, reflecting strong yields and large harvested area, while Argentina’s output also remained stable and unchanged (48.5 mmt).

Corn production in both Brazil and Argentina was also left unchanged at 131 mmt and 53 mmt respectively.

Market Reaction and What's Next

The USDA December crop report provided fundamental support for corn prices due to stronger export forecasts and tighter ending stocks. Soybeans and wheat showed more neutral to slightly bearish signals, as unchanged or increased ending stocks do not elicit strong market movements.

The January WASDE crop report will be the next opportunity to address the weak pace of U.S. soybean exports, although China is buying. Could the USDA provide another lower than expected yield surprise like last year and gift to farmers to start 2026 with some fireworks.

For daily information and updates on agriculture commodity marketing and price risk management for North American farmers, producers, and agribusiness visit things; Farms.com Risk Management Website to subscribe to the program.