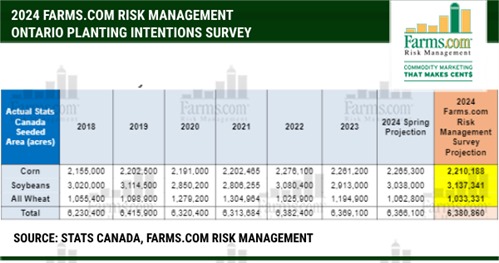

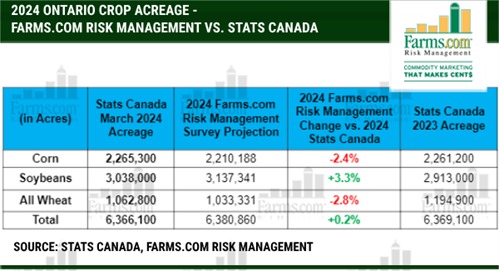

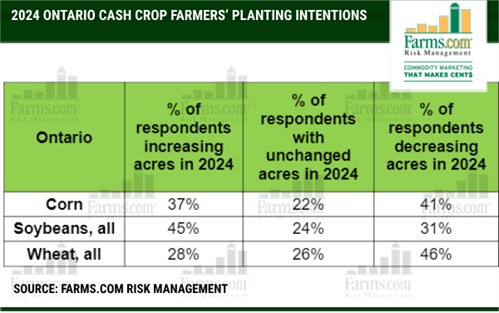

Intended Ontario corn acres in 2024 are expected to fall 2.26% to 2.210 million acres slightly below the 5-year average vs. 2024 but soybean acres are up 7.7% at 3.137 million acres to a new record high! Lower inputs in soybeans with an IP premium of $5 - $6/bu is attracting more acres in 2024.

Wheat acres are down 13.53%. Wheat acres are down due to a challenging 2023 soybean harvest, lower economics and it was a wet fall.

The Farms.com Risk Management survey is projecting more corn, soybean and less wheat acres than Statistics Canada.

“Corn acres in Ontario are holding despite being forecasted lower following a record yield in 2023, the second in three years with above average yields," says Moe Agostino, Chief Commodity Strategist with Farms.com Risk Management. The highlights in the survey show HRS wheat up 30%, oat acres +33.95% and SRW wheat down 13.30%.

“Farmers in most areas had a good corn crop last year and that is holding corn acres on many farms where soybeans tend to be more variable on sand to variable soils,” explains Stephen Denys, Director of Business Management, Maizex Seeds.

“In more clay soil-based counties like Essex, Lambton, Haldimand we have heard about more acres to soybeans versus corn given yield potential. This also applies to farmers who do not own a corn dryer and where drying costs were high last fall and not likely to change this year with the carbon tax. That said, corn will still pay the bills on many farms given the yield potential in a normal year. “

Lower inputs and higher premiums are attracting more soybean acres.

Many smaller farmers are looking at switching to soybeans due to lower input costs and higher IP soybean premiums at $5-6/bu. “2024 Ontario wheat acres are down because of economics with a -$40+/acre loss without straw does not pay the bills,” explains Henry Prinzen, Chief Agronomist for Maizex Seeds. “Any borderline corn acres will go to soybeans, and to a large degree most farmers are sticking to a rotation but the $5-$6/premium to grow IP soybeans remains a sweet deal. If you do not own a planter or combine acres will switch to soybeans.”

According to Agronomist Peter Johnson (aka Wheat Pete), “many of the farms with heavy soils are switching to soybeans due to better yield potential.” Although the survey is projecting more intended HRS wheat acres in 2024, Johnson says “the trend in eastern Ontario has been to move more acres toward winter wheat over the years. He goes on to say, paying high rent rates of $400 to $600/acre in some regions does not pencil with falling crop prices.”

In 2024, Ontario farmers are expected to plant less corn acres year over year with losses in Southern, Western and Eastern Ontario. Soybean acres are up across the entire province. All wheat acres in 2024 are down across the province except in Eastern Ontario where spring wheat acres are up.

Will a looming La Nina weather pattern attract more corn acres post planting?

The weather forecast is calling for a hot/dry weather pattern, aka La Nina, to return by May and that could get farmers to plant more corn acres. A price rise in new crop December corn futures above $5.00/bu from a fund induced dry weather scare could see more acres of corn.

The USDA March Intentions report surprised followiers by predicting U.S. farmers intending to plant 5% less corn acres in 24 vs. 23. The bottom line is that weather and price will still have the final say, but total productioin is determined by yield. Will it be a 4th consecutive year of above average yeilds in Ontario?

For daily information and updates on agriculture commodity marketing and price risk management for North American farmers, producers, and agribusiness visit the Farms.com Risk Management Website to subscribe to the program.

The acreage estimates in this report are based primarily on surveys conducted during January – March 2024. The 2024 Farms.com Risk Management Planting Intentions Survey is a probability survey that includes a sample of farmers from across Ontario. This survey used to make acreage estimates is subject to sampling and non-sampling errors that are common to all surveys. Sampling errors represent the variability between estimates that would result if many different samples were surveyed at the same time. Sampling errors for major crops are generally between 1.0 – 3.0% but they cannot be applied directly to the acreage published in this report to determine confidence intervals because the official estimates represent a composite of information from more than a single source.