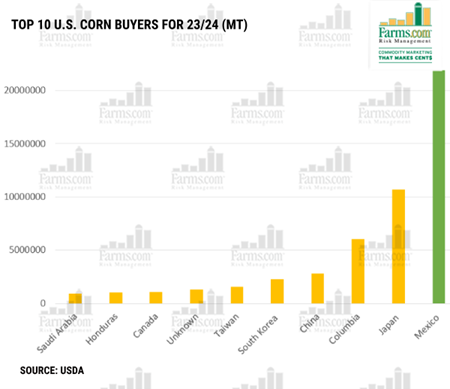

In the 2023/24 marketing year, Mexico accounts for 40% of all U.S. corn export sales -- the #1 buyer, 17% of all wheat (also the #1 buyer), and 11% of all soy -- the second largest buyer behind China. These figures highlight the dependency of U.S. agriculture on the Mexican market.

Shutting down the border would cut off a significant portion of the demand for these essential crops, leading to over-supply, reduced prices, and economic hardship for American farmers, assuming that the newly elected president does not provide another economic care package for American farmers like the ones seen during the China/U.S. trade war that happened in former President Trump's previous administration from 2014 – 2019 but we can’t bank on this type of outcome.

Former President Donald Trump’s threat to ban Mexican-made cars exemplifies the broader economic dangers of closing the border. Mexican President Andres Manuel Lopez Obrador (AMLO) dismissed Trump's threat as a bluff, noting that such a move would raise prices for U.S. consumers by $10,000 to $15,000 per car. AMLO argued that Trump’s proposal is not serious, pointing out that when Trump was in office, he supported the United States-Mexico-Canada Agreement (USMCA), which is crucial for maintaining strong trade relations between the U.S. and Mexico.

The potential shutdown of the U.S.-Mexico border would not only affect the agricultural sector but also cause widespread economic disruption. AMLO emphasized that such an action would create chaos, affecting the transit of 300,000 vehicles and a million people daily.

The restriction of trade in products vital to the U.S. economy would be catastrophic, leading to significant economic damage on both sides of the border. AMLO warned that such a step would be "tantamount to calling for a rebellion" due to the severe harm it would cause to people, industry, and commerce.

The automotive sector would also face significant challenges. Tesla’s decision to halt investment in a planned factory in northern Mexico until after the U.S. election, citing political risk from Trump’s proposal to raise tariffs on Mexican-made goods, highlights the uncertainty and potential economic fallout. The comments by Tesla CEO Elon Musk caused shares in Mexican real estate investment trusts to slump, reflecting the broader market concerns.

The USMCA is a critical component in preventing North America from falling behind China in global trade. AMLO’s emphasis on the trade agreement underscores its importance in maintaining economic stability and growth. The potential border shutdown would jeopardize these benefits, leading to long-term economic consequences.

In summary, closing the U.S.-Mexico border would be disastrous for agricultural trade and demand for U.S. goods. The dependency of the U.S. agricultural sector on the Mexican market, coupled with the broader economic implications, underscores the need for maintaining open and robust trade relations. Disrupting this relationship would lead to economic chaos, increased prices for consumers, and significant hardship for American farmers and industries.

Photo Credit: FreePik.com

For daily information and updates on agriculture commodity marketing and price risk management for North American farmers, producers, and agribusiness visit the Farms.com Risk Management Website to subscribe to the program.