What does the Safrinha corn crop refer to. Safrinha refers to Brazil's 2nd corn crop which is planted right after soybean harvest. Safrinha is normally planted in the midwest and center-south regions of Brazil in January and February. Safrinha means “little harvest” in Portuguese, as initially this harvest was smaller than the first harvest.

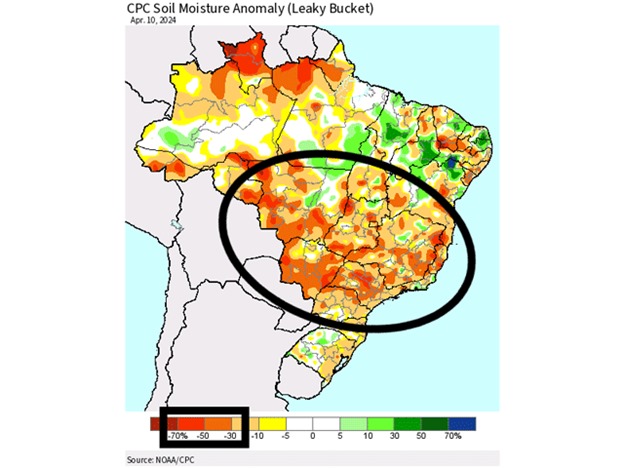

According to NOAA as of April 10, 2024, nearly all regions within Brazil's Safrinha corn cultivation areas exhibited soil moisture deficits ranging from 30-50%. While some areas in southern Goias and Mato Grosso experienced comparatively milder dryness, they too remained below typical moisture levels.

The 1st planted corn crop that pollinates by mid-April to mid-May could survive the less than desirable sub soil moisture as we enter the dry season in May, but the 2nd planted corn crop may not. History shows that a drought with a lack of moisture could result in lower yields by as much as 15 to 20 percent and take production lower, potentially pushing Brazil production below 100 MMT for the world's largest corn exporter.

Adding to the mix, Argentina's corn harvest faces further significant cuts due to an unprecedented outbreak of leafhopper insects spreading spiroplasma disease. The weather has not been ideal either and losses in the worst-hit regions are reaching a staggering 40-50%.

USDA is reducing the Argentine corn harvest to 55 MMT, but remains well above both the Rosario grain exchange and the Buenos Aires exchanges which have cut their harvest estimates to 50.5 and 52 mmt.

A record harvest seems no longer possible for the world's 5th largest corn producer and 3rd largest exporter after last year’s drought-stricken corn crop at 36 mmt. The USDA decided to kick the can down the road in the April crop report and left the Brazil corn crop unchanged at 124 mmt respectively vs. Conab at 110.9 mmt. (Conab is the Brazilian National Supply Company (Conab).)

The big debate on the street is who is wrong? USDA says their satellite imagery is showing more corn acres in Northern Brazil, but Conab is saying those corn acres were planted to a different crop. At the end of the day, we may never know but the trade will want to know from the “gold standard” or the “gospel truth” the USDA whether its 124 or something much lower.

The current difference is 13.1 mmt or 516 million bushels and a game changer if Conab is right and will move the needle on corn prices in the coming months. The next scheduled USDA May crop report is May 10th, 2024.

Combined, these factors could lead to a shortfall in the total South American corn crop by as much as 30 million metric tons or about 1 billion bushels at 140 mmt vs. last year’s total at 173 mmt. The funds have ignored the news thus far and have continued to defend their short positions due to USDA’s optimistic forecast but look for a fund short squeeze and higher prices as we enter the month of May.

China remains the low-cost buyer, but the U.S. is not the low-cost seller. But if the 23/24 or 24/25 U.S. corn export pace surges and China starts buying it will be a sign that the USDA is too high in their projections.

For daily information and updates on agriculture commodity marketing and price risk management for North American farmers, producers, and agribusiness visit the Farms.com Risk Management Website to subscribe to the program.