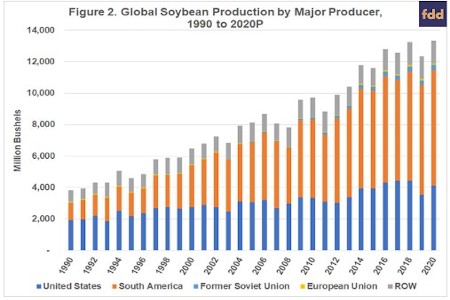

Global soybean production over the last 10 years has increased by more than 133% from 4.8 billion bushels in the 90s to an average of more than 11.3 billion bushels per year since 2010 (see Figure 2). U.S. soybean production has increased by nearly 62%, while soybean production in SA has nearly tripled. Throughout the 90s, the U.S. averaged 2.3 billion bushels of soybean production per year while SA averaged 1.6 billion bushels. Since 2010, the U.S. has averaged 3.7 billion bushels per year while SA now leads the world averaging 6 billion bushels per year since 2010, and approaching 7 billion bushels the past few years.

Yield and Harvested Area

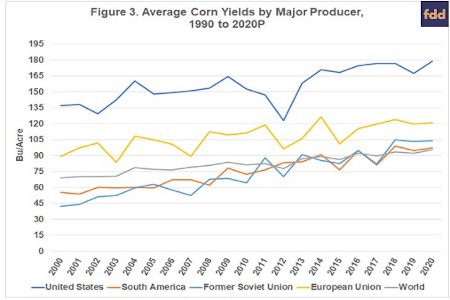

Improved yields are the primary driver of U.S. increases in corn production, as U.S. average yields are well ahead of the all world average (Figure 3). However, average corn yields are quickly improving in areas such as SA and the FSU, now exceeding the world average in both areas in recent years. Average U.S. corn yields were 31% larger in the last 10 years as compared with the 90s. Corn yields in SA (FSU) have increased by 95% (88%) over the same time period.

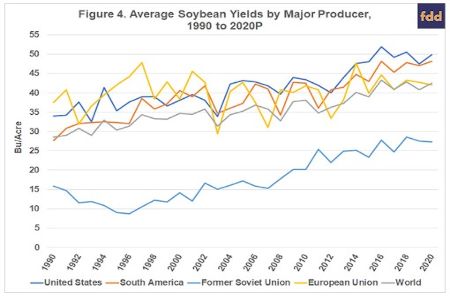

Improved yields have also been a driver of increased U.S. soybean production, increasing more than 25% since the 90s (Figure 4). Yield growth has been greater in SA, increasing nearly 32% since the 90s. Average soybean yields in SA are now effectively on par with the U.S.

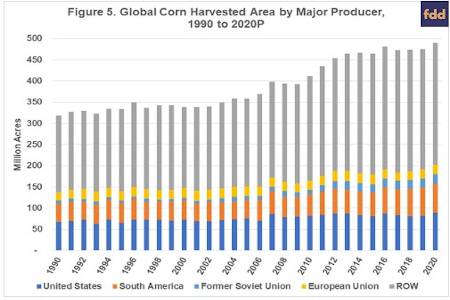

The U.S. harvested an average of 70 million acres of corn per year in the 90s, and 83.6 million acres since 2010 – an increase of 20% (see Figure 5). Over the same time periods, average harvested corn area for SA has increased from 44.9 to 58.6 million acres – an increase of more than 30%. Harvested corn acreage has more than tripled in the FSU and increased by an average of 45.2% in the ROW.

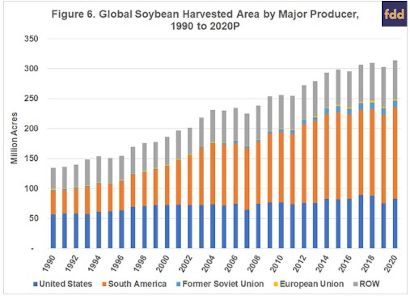

Soybean harvested area has increased by nearly 28% in the U.S., averaging 62.8 million acres in the 90s and 80.2 million acres since 2010 (see Figure 6). Growth in soybean harvested area in SA has been much more dramatic, increasing from 47.6 million acres in the 90s to 136.7 million acres since 2010 – an increase of 187%. U.S. soybean area accounted for 41% of global soybean area in the 90s, while SA accounted for 31%. Since 2010, U.S. soybean area has averaged 28% while SA has averaged nearly 48% of global soybean area.

Exports

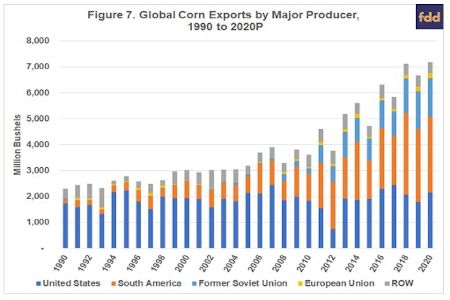

U.S. corn exports have not experienced significant growth over the past 30 years, while SA and FSU exports have grown considerably (see Figure 7). U.S. corn exports averaged just under 1.8 billion bushels per year in the 90s, accounting for nearly 70% of global corn exports. Since 2010, U.S. corn exports have averaged just over 1.8 billion bushels. Although exports in the last decade were close to the same quantity as in the 90s, it was only 34% of global exports. As a comparison, SA corn exports averaged 307 million bushels in the 90s representing less than 12% of global exports. Since 2010, SA corn exports have grown to more than 2 billion bushels per year, representing 38% of the global corn export market. The FSU has also become a major corn exporter, accounting for an average of 17% of global corn exports since 2010.

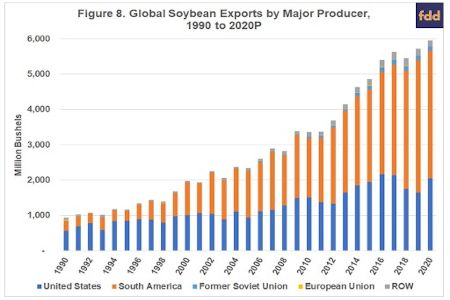

U.S. soybean exports averaged 783 million bushels per year through the 90s, more than doubling to an average of 1.7 billion bushels since 2010 (see Figure 8). SA soybean exports have grown from 395 million to 2.6 billion bushels per year (an increase of more than 500%) over the same time period. During the 90s, the U.S. accounted for 64% of global soy exports, while SA exports accounted for 32%. Since 2010, the U.S. has accounted for 37% of global soy exports while SA’s share has increased to nearly 57% of the global soybean export market.

Conclusions

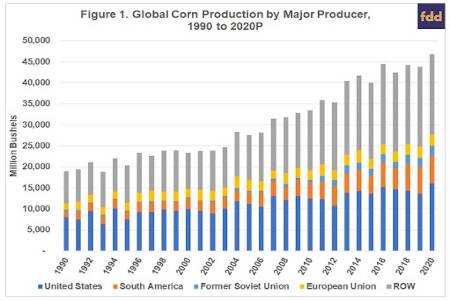

Over the past 30 years global production of corn and soybeans has increased dramatically. While the U.S. remains the world’s leading corn producer, the U.S. share of world production has fallen from over 40% in the 90s to 33% since 2010. Corn production has increased at a faster rate than in the U.S. in most other areas of the world. For soybeans, the U.S. share of global production has fallen from 48% to 33%, with SA now accounting for just over 53% of global production since 2010. Yields have been the primary driver of production growth for corn. Improved yields and expanded acreage of soybeans have increased U.S. production. Other major production areas in the world have increased both yields and harvested area of both crops, and at faster rates than in the U.S.

The global export market has a similar theme. The U.S. was the dominant corn exporter throughout the 90s, accounting for 70% of global exports, but now accounts for just over one third of global corn exports. In the 90s, the U.S. held a 64% share of global soybean exports while SA accounted for 32%. Since 2010, SA has been the leading soybean exporter with 57% of global exports with the U.S. accounting for 37%.

Low commodity prices since 2013, coupled with the added negative shock to prices since 2018 brought on by trade conflicts and the impact of COVID-19 and associated control measures, have led to increased interest in the return to supply management policies to help raise prices for U.S. farmers. These types of policy approaches have been used throughout history but have largely been abandoned since the 1996 Farm Bill.

The changes in the global markets shown here illustrate the declining role of the U.S. as a leading producer and exporter of corn and soybeans over the past 30 years. Supply management policies, such as acreage set asides or land retirement programs, implemented here in the U.S. would be less effective now than when the U.S. played a more dominant role worldwide.

Any positive price effects achieved by U.S. supply reductions would likely be short-lived, as the other major production areas of the world would likely respond with increased production. The ability of production regions in the southern hemisphere to quickly adjust production within the U.S. marketing year highlights this issue, and was further discussed in Part II of this series (farmdoc daily July 1, 2020). Furthermore, the combination of reductions in U.S. acreage and production, and any resulting increased production in other parts of the world would result in additional losses in global production and export shares for U.S. producers.

Source : illinois.edu