The USDA made changes to its US corn and soybean balance sheets in the March WASDE report shown in Table 1. The supply side of both balance sheets was again unchanged following the release of National Agricultural Statistics Service Annual Summary estimates of acreage and yield estimates back in the January report. Both corn and soybeans saw changes in projected domestic use. For corn, exports dropped by 75 million bushels. Domestic soybean crush use was dropped by 10 million bushels and exports increased by 25 million bushels for a net increase in soybean use of 15 million bushels.

Lower projected corn use was entirely reflected in increased ending stocks with the US corn stocks-to-use ratio increased 0.6 percentage points to 9.7% for corn. Soybean ending stocks-to-use declined 0.4 percentage points to 4.8%. While both stocks-to-use ratios suggest supply and demand conditions remain tight in historical terms, projected 2022/23 stocks-to-use for soybeans are low as they have been all this marketing year. Meanwhile, the old-crop corn supply and demand situation continues to slacken.

The other major changes in corn and soybean supply and demand were found in South America. USDA made significant changes to its world corn and soybean balance sheets for 2022/23. Estimated corn production for Argentina declined by 7 million metric tons to 40 million metric tons. This followed a 5 million metric tons decrease in the previous month’s report. For soybeans, Argentina production was lowered 8 million metric tons to 33 million metric tons. Coming on the heels of similarly decreases in the February WASDE report, these decreases exceeded market analysts expectations about how much USDA could drop Argentina production in March report.

Despite tightened supply from Argentina, overall changes in projected global ending stocks were small. Corn ending stocks increased, largely on the basis of higher US stocks shown in Figure 1. Soybean ending stocks declined slightly with decreases in stocks in all major exporters: the US, Argentina, and Brazil. USDA offset some of these decreases in exporter-held ending stocks with higher inventories projected for China, the world’s largest soybean importer.

In general, changes made to USDA’s corn and soybean balance sheets in the March report were in the same direct as, but more aggressive than anticipated by market analysts prior to the report. USDA’s 2022/23 corn ending stocks estimate was 1,342 million bushels, above the average trade guess of 1,303 and bigger than the highest published trade guess of 1,335. Similarly, the Argentina production figures were near the low end of analyst’s estimates. For corn, USDA’s 40 million metric ton projection was below both the average trade guess of 43.5 million and the low of 41 million. For soybeans, USDA’s 33 million metric ton figure was below the average estimate of 36.8 million and just above the low of 32 million.

What Stops the Slide in Corn Prices?

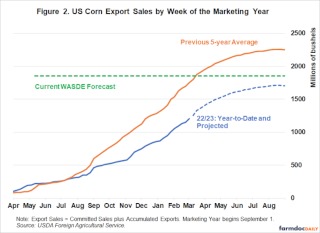

Corn and soybean markets maintained high price levels for much of the past two calendar years and price levels remain high in historic terms in early 2023. However, a bearish wave has hit the corn market recently with prices dropping about 60 cents per bushel. One major reason for this slide is pessimism about 2022/23 export sales. Figure 1 shows the progression of USDA export sales forecasts since USDA released its initial projections for 2022/23 just over one year ago at the annual Agricultural Outlook Forum. The forecast for US corn exports has been as high as 2,400 million bushels, reflecting both very high levels seen in the previous marketing year and optimism based on early export sales made prior to the start of the 2022/23 marketing year (See farmdoc daily, May 16, 2022) Since summer 2022, USDA has revised its corn export sales forecast down in almost every month’s WASDE report. Soybean export sales forecasts have also come down since summer 2022, but not by as much or as consistently as for corn. As seen in both Table 1 and Figure 1, USDA’s soybean export sales forecast actually increased in the March report.

At this point, the ability of US corn exports to rebound from the dismal pace observed to date remains more rumor than fact (See Reuters, March 3, 2023). Figure 2 shows the week-by-week accumulated US corn total export sales (both committed sales and actual exports) for 2022/23 compared to the previous five year average and the WASDE-projected level. While the US has periodically made large corn export sales in 2022/23, the current pace continues to fall further behind what is necessary to reach even the muted expectations given by the current March WASDE forecast level of 1,850 million bushels. If US corn exports were to follow the typical pace given by the five-year average for the remainder of the marketing year, total marketing year export sales would be just about 1,700 million bushels.

Market analysts will continue to closely watch export sales reports to signal a change in this bearish trend. Export sales reported in the week ending March 2, 2023 provide a glimmer of optimism for exports going forward. As shown in Figure 2, outstanding sales commitments plus accumulated exports increased by about 56 million bushels for the week. More weeks like this are necessary to reach the current WASDE forecast level, especially between now and May when US export sales typically slow down for the remainder of the marketing year.

If corn export sales are not consistently stronger in the weeks ahead, price support must come from other demand categories on the balance sheet. Domestic use in form of feed or ethanol is the logical place to look, but demand from both sectors has been to some degree restrained in the marketing year to date. Cattle numbers are down and ethanol use is below levels necessary to justify a forecast of stronger demand between now and the August 31 ending date for this marketing year. USDA will release its quarterly Grain Stocks report on March 31. Markets will look at the drawdown in stocks in the last three months for evidence of such stronger demand.

Markets are already starting to look for news in the expected new-crop 2023/24 market outlook that might boost demand for 2022/23 ending stocks. USDA will release its Prospective Plantings report on March 31. Lower expected corn acres would help justify higher 2022/23 ending stocks and boost both old-crop and new-crop prices. Specifically, projected 2023 corn acres would need to be significantly lower than the 91 million acre figure given in the recent February USDA Agricultural Outlook Forum presentation. At this point, the case for high corn prices – based on old-crop demand or new-crop market outlook – remains more theory than fact.

Source : illinois.edu