North Dakota

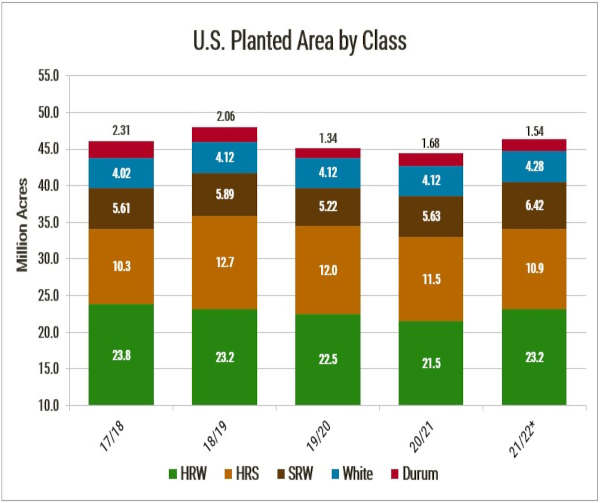

USDA expects North Dakota farmers to plant 5.60 million acres (2.27 million hectares) of HRS for harvest in 2021, down 2% from last year.

“USDA’s number came in slightly higher than our expectations at only about 100,000 acres (40,000 hectares) less than last year,” said Erica Olson, North Dakota Wheat Commission’s Market Development and Research Manager. According to Olson, HRS acres could fall below USDA’s expectations following continued strength in corn and soybean futures prices.

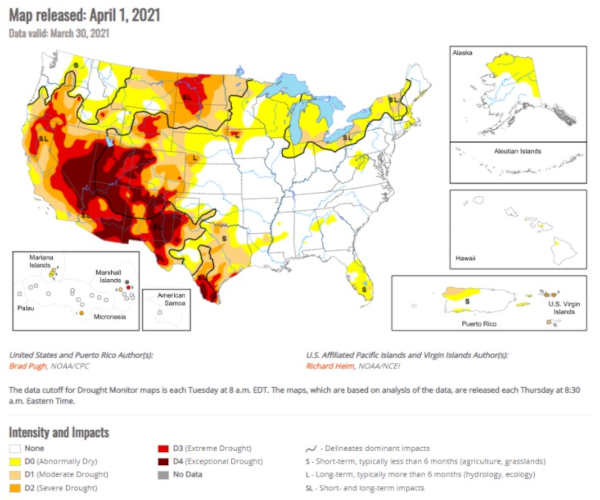

While all the state is moderately to severely dry, some areas in southeastern North Dakota do have adequate subsoil moisture to get the young wheat established.

“Farmers haven’t had good precipitation since last summer,” said Olson, “they’ll take any precipitation they can at this point.”

USDA expects North Dakota durum planted area to fall substantially in 2021 to 1.50 million acres (607,000 hectares), down 18% from last year on more competitive canola and soybean prices in the northwest region of the state. However, Olson believes North Dakota producers could plant more durum acres than USDA expects based on competitive durum cash prices which are trading at least a $1.00/bu premium to HRS in most parts of the state.

Minnesota

USDA predicts Minnesota farmers will seed 1.40 million acres (557,000 hectares) of HRS for harvest in 2021, down 3% from last year but in line with industry expectations.

Extreme dryness in Minnesota wheat country has producers concerned.

“I talk to a lot of farmers. This is the first time since 1988 that we are planting into dust with no subsoil moisture. Our farmers are not used to planting into dust and praying for rain,” said Charlie Vogel, Executive Director of the Minnesota Wheat Research and Promotion Council.

But dry field conditions help spring wheat planted area. “This year, we’re not trying to plant around wet areas, we don’t have mud or slews in the field. Given the dryness, I believe every acre can be seeded,” continued Vogel.

Vogel believes Minnesota producers could see a record crop if timely precipitation follows April planting. “We only need an early May rain to change everything. We will be planted and insured at profitable levels. And we will spend a lot of time in church praying for rain,” he said.

Montana

Montana producers intend to plant 2.90 million acres (1.17 million hectares) of HRS in 2021, down 12% from last year, but in line with the 5-year average. Montana spring and winter wheat acres typically share an inverse relationship and this year is no different. Montana winter wheat acres are up 13% on the year at 1.75 million acres (708,000 hectares).

“Producers were able to get a lot of winter wheat in the ground in fall 2020, significantly more than they could in fall 2019 due to poor weather conditions, this pressures available area for HRS come April,” said another grain trader.

According to Sam Anderson, Industry Analyst and Outreach Coordinator at the Montana Wheat and Barley Committee, dryness has producers on edge, but favorable spring wheat prices will encourage them to plant into dry soil, despite the drought risk.

However, “If the weather remains dry throughout planting, we may see some acres going fallow to conserve soil moisture for the 2022 crop year,” said Anderson.

Click here to see more...