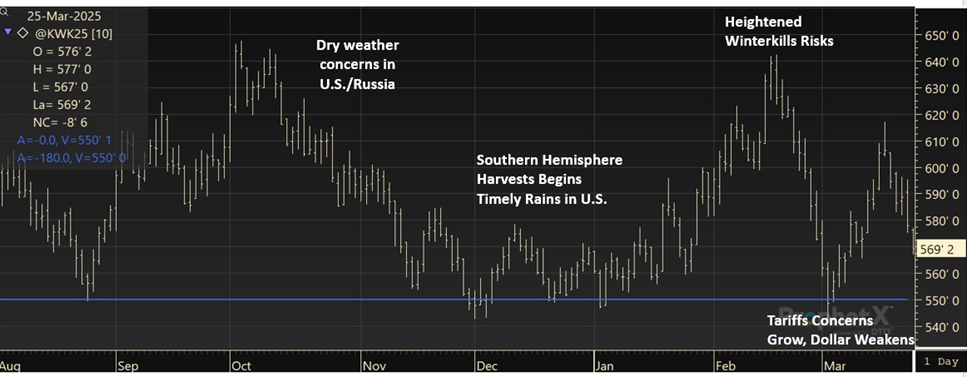

Tariffs and Trade Exert a Bearish Influence

The implementation of new tariffs has had a chilling effect on trade prospects, the full extent of which remains to be seen. This policy-induced uncertainty, coupled with the inherent market volatility, creates a complex and challenging landscape for U.S. wheat. The situation changes daily, but U.S. Wheat Associates continues to monitor the tariff landscape and evaluate its impacts on trade as information becomes available.

The U.S. Trade Representative’s (USTR) proposed Section 301 remedies against China’s maritime and shipbuilding sectors, including substantial port fees and mandated U.S.-vessel usage, have further dampened the trade outlook. U.S. Wheat Associates (USW), along with exporters, customers, farmers, and other industry stakeholders, has voiced concerns about the negative impact on U.S. wheat exports and agricultural competitiveness. While no measures have been implemented, the proposed actions are already negatively impacting the U.S. export outlook in the near term.

The USDA World Agricultural Supply and Demand Estimates (WASDE) only considers trade policies that are in effect at the time of publication. Further, unless a formal end date is specified, the report also assumes these policies remain in place. Nevertheless, the March WASDE also added to the bearish sentiment. Ending stocks in major exporting countries increased by 6% from last month to 57.2 MMT on production increases for Australia and Argentina and declines for the U.S., Russia, and the European Union. Overall, the combined impact of decreased exports and higher ending stocks weighs wheat markets as supplies remain adequate.

Positive Highlights

Despite these headwinds, a slight weakening of the U.S. dollar offers a glimmer of hope, potentially enhancing the competitiveness of U.S. grains in the global market. Additionally, recent bearish trends have aligned U.S. wheat classes more closely with global origins. The spread between U.S. HRW and the cheapest global origins are nearing their most consistently narrow margin to date. Boosted by the increased competitiveness, marketing year 2024/25 wheat sales currently sit at 20.8 MMT, a 13% increase from last year, putting them at 92% of USDA’s projected exports with just 10 weeks left in the marketing year. For the marketing year 2025/26, sales hover around 961,000 MT, a 20% increase from this time last year as many exporters swap from old crop to new crop delivery periods.

Click here to see more...