Horticultural products have been driving the increase in agricultural imports. The Federal definition of horticultural products includes fruit, vegetables, tree nuts, wine, beer, and spirits. Imports of fresh vegetables such as bananas, avocados, strawberries, and blueberries have grown in recent years (see, Russel and Kenner). Any tariffs on these products would increase the costs of these products to consumers, as well as reduce the amount of these products imported.

Canada and Mexico are the first and third largest countries in terms of agricultural imports into the U.S. The European Union nations are between Canada and Mexico. Any tariffs on agricultural imports would likely have the greatest impact on Canada, the EU, and Mexico.

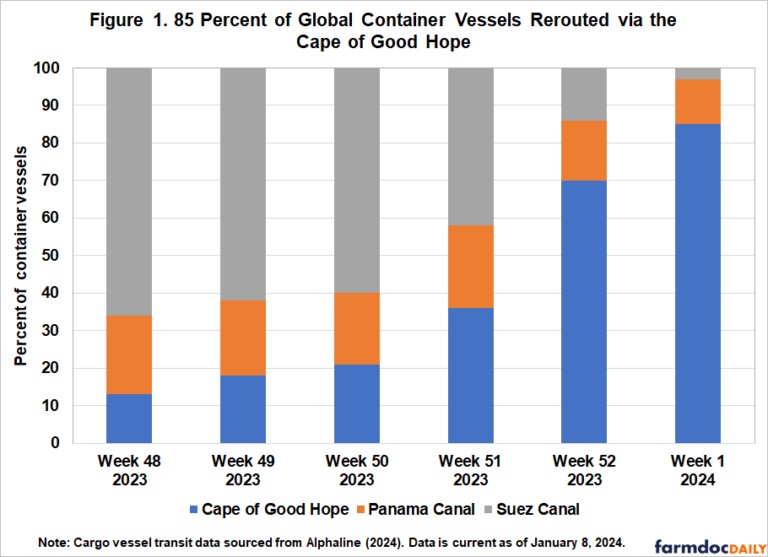

Agricultural exports reached a high of $156.8 billion in 2014 before declining (see Figure 1). Between 2015 and 2020, their value varied between $133.7 billion and $148.6 billion before increasing to $196.8 billion in 2020.

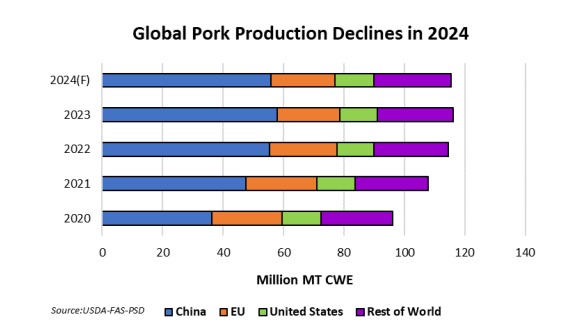

The three largest countries receiving US agricultural exports are China, Canada, and Mexico. China has used imported agricultural products to increase the quality of Chinese diets as incomes have risen. Canada and Mexico are large trading partners due to their nearness to the U.S., and the United States-Mexico-Canada Agreement (USMCA) on trade (previously the North American Free Trade Agreement or NAFTA).

Agricultural exports are diverse and cover many products. Soybeans and corn are important export products that greatly impact Illinois and other Midwest states.

Soybean Trade

Soybean exports as a percentage of U.S. soybean production averaged about 35% in the 1990s (see Figure 2). The export percentage then grew, reaching 50% in 2016 and 48% in 2017. Exports declined dramatically in 2018 to 40% of production. In 2018, President Trump instituted tariffs on US imports from China, and China responded with tariffs of its own, targeting various US imports including soybeans. Imports again rebounded, reaching 53% in 2020. Since 2020, U.S. exports have declined partly because of strong domestic crush and oilseed demand.

Three countries drive international trade in soybeans. The United States and Brazil are large soybean-producing countries, with a major export destination for both countries being China (farmdoc daily, February 20, 2024). China has continually increased soybean imports primarily to increase meat consumption in their country. Brazil has increased production to meet this demand, surpassing the U.S. in soybean production from 2017 on. Total soybean exports from both the U.S. and Brazil are large, with Brazil’s exports growing while U.S. exports have remained more stable in recent years (see Figure 3).

China is the largest destination for soybeans exported by Brazil and the U.S. In 2024, China is expected to account for 73% of Brazil’s soybean exports and 52% of U.S. soybean exports. Over time, the share of total soybean exports destined for China has been higher for Brazil than for the United States (see Figure 4). China’s share of US soybean exports has varied more over time than has China’s share of Brazil’s soybean exports. China’s share of US soybean exports has been as low as 18% in 2018 during the beginning of the trade war with China. China’s share of US soybean exports has recovered to around 50%, but has not returned to the 60% share that existed before 2018.

Corn Trade

Relative to production, a lower percentage of U.S. corn is exported than for soybeans. The share of U.S. corn exported trended down from over 20% in the early 1990s to around 15% by 2010, a level around which it has varied over the past 15 years. The export percentage of U.S. corn production was 15% in 2023 and 16% in 2024 (see Figure 5).

In 2023, the largest country receiving corn was Mexico, with a value of $5.39 billion. Japan was second at $2.07 billion. Over time, Mexico and Japan have been consistent buyers of U.S. corn. The third largest country was China at $1.63 billion. Chinese corn purchases began in 2020, reaching relatively high levels in 2021 and 2022. Those levels declined in 2023. All of these countries are important trading partners which could implement retaliatory measures if the U.S. implements tariffs on imports from those countries.

The U.S. is by far the largest corn-producing country in the world. However, Brazil has become an important exporter of corn, with corn exports exceeding those of the U.S. in 2023 (see Figure 6). Brazil has established itself as an alternative source for corn in global trade (see farmdoc daily, February 20, 2024, November 11, 2024).

Summary

Prospects of U.S. tariffs on imports from trading partners are again on the agenda. Trade is important to agriculture, and tariffs can increase the costs of imported to agricultural products to U.S. consumers, with the potential for retaliatory tariffs to reduce export demand for U.S. agricultural products and prices received by U.S. farmers. Soybeans and corn produced in the U.S. are traded extensively. Tariffs will make U.S.-produced soybeans and corn less competitive with those from other countries. As it also is a large global exporter, Brazil is an example of a country that could gain if retaliatory tariffs were implements on U.S. grains and oilseeds.

We also note that, as of this writing, tariffs on U.S. imports have only been discussed by the Trump administration during the campaign and first days in office. No specific actions have yet been implemented. This article simply highlights the importance of agricultural trade to both U.S. consumers and producers and that the impact of any trade actions which become confrontational with major trade partners could be large.

Source : illinois.edu