While in the United Kingdom, NPB and USMEF representatives met with leadership from two of the largest pork producing and processing companies in the U.K. Both companies own several farms throughout the country and were willing to discuss their production practices and challenges facing their domestic industry.

Pork production in the U.K. is unique due to the wide variety of production styles and standards related to animal welfare. Over 40% of the sow herd is housed outdoors, with “outdoor-bred” becoming an expected standard in fresh pork retail. Of the pigs housed indoors, 90% are kept on straw. The U.K. has also banned gestation stalls, castration and the use of Ractopamine hydrochloride, a feed additive designed to promote leanness.

While the EU is the U.K.’s primary pork trading partner, its standards are slightly less demanding. By EU standards, some gestation stall use is permitted, and most pigs are kept indoors on slatted floors. In the case of a “no-deal Brexit”, a portion of the U.S. industry could likely adjust to meet EU standards and become eligible for export to the U.K. Many U.S. producers are already making changes, like eliminating the use of Ractopamine, to increase their eligibility in various markets.

Animal Protein Consumption

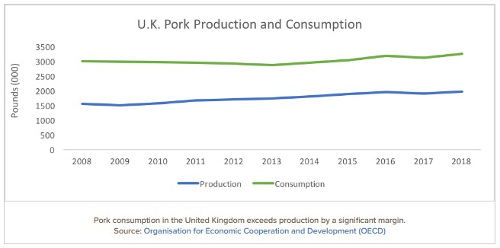

According to the Organization for Economic Cooperation and Development (OECD), the EU ranks highest in per capita pork consumption at 78 pounds per person. However, the per capita consumption rate in the U.K. is around 38 pounds per person, which is below the OECD average of 52 pounds. Industry stakeholders in the U.K. expressed concerns about a decline in red meat consumption, however OECD data shows that total pork consumption has remained steady over the past decade.

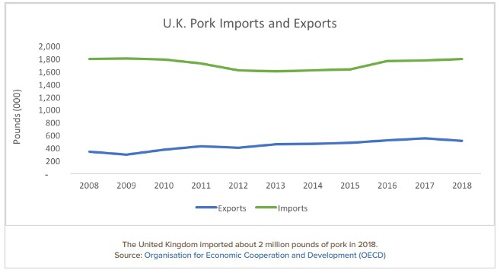

U.K. pork processors and the British Meat Processors Association report that, consumers may be eating less pork, but increased demand from forces like African Swine Fever have helped support the market. The gap between U.K. pork production and consumption has slightly narrowed, yielding a self-sufficiency measure of 61%. This gap is currently filled by 2 million pounds of pork imports, 99% of which come from EU countries.

Implications

Given a “no deal” Brexit, U.K. pork industry stakeholders would have minimal reservations about importing U.S. pork into the U.K. processing sector. There was a consensus among these groups that under the right economic and logistic conditions, U.S. pork could supplement the U.K.’s supply of loins and hams destined for further processing. According to the USDA Global Agriculture Information Network (GAIN), the U.S. is already the United Kingdom’s largest food and ag product trading partner outside of the European Union. Furthermore, U.S. products benefit from a positive brand image.

Click here to see more...