Background: War and Ukraine’s Place in Global Markets

February 24, 2023 marks the one-year anniversary of the Russian invasion of Ukraine. On that date, Russian forces dramatically escalated the existing Russia-Ukraine conflict, initiating a “special military operation” intent on seizing Ukrainian territory including the capital of Kyiv. In the year since, Ukraine has resisted the invasion with assistance from European and American allies.

The war has caused significant damage to Ukrainian agriculture, particular in eastern regions most impacted by fighting. Recent estimates from the Kyiv School of Economics suggest over $6.6 billion in agricultural infrastructure has been destroyed. The war has also substantially limited the ability of Ukrainian farmers to grow and ship their crops. The same source estimates the war has imposed an additional $36.2 billion in indirect costs to agriculture, mainly in the form of foregone production and higher logistics costs for continuing agricultural exports.

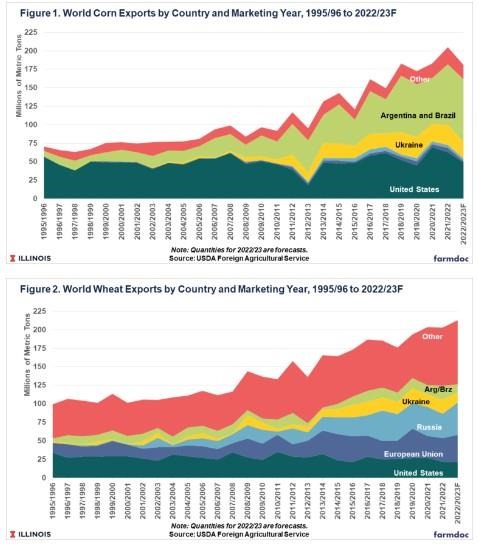

Lost Ukrainian agricultural production due to the war is of global significance because Ukraine is a major exporter of grains and oilseeds – especially corn and wheat as discussed in this article but also barley, sunflower and sun oil, and other commodities. (See: farmdoc daily, February 28, 2022) Figures 1 and 2 show how Ukraine’s share of world corn and wheat exports grew between 2000 and 2020 as international trade expanded. In this time, expanding Ukrainian exports captured an increasing share of world trade. In the three marketing years prior to the war (2018/19, 2019/20, and 2020/21), Ukraine’s exports made up 15% of world corn trade and 10% of world wheat trade. In this period, Ukraine was the world’s fourth largest corn exporting country and the fifth largest wheat exporting country.

Ukraine is widely acknowledged as a low-cost grain producer. International cost of production comparisons (See, for example: farmdoc daily, March 4, 2022; July 21, 2021) suggest Ukrainian farms have substantially lower per-acre costs and higher returns than producers in other major grain exporting countries. This allows Ukraine to compete in the most price-sensitive export markets, particularly those in the Middle East and North Africa. Losing Ukrainian grain production to the war is costly because this production can only be replaced with higher cost commodities from other production regions.

Changes in Expectations for Ukraine Corn and Wheat Production

To understand how expectations about Ukrainian crop production and exports have changed since the start of the war, consider projections made by the USDA in the world corn and wheat balance sheets published each month as part of the World Agricultural Supply and Demand Estimates (WASDE) report. WASDE estimates may be an incomplete picture of conditions on the ground in Ukraine at any given moment. However, they are constructed consistently across time so that changes in these estimates represent a good approximation of changes in market-level expectations.

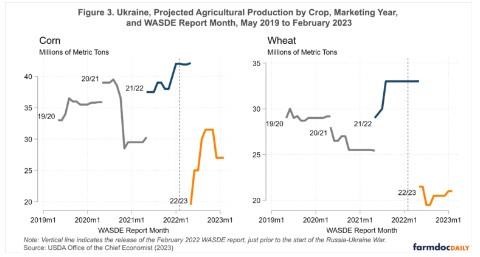

Figure 3 shows WASDE-projected corn and wheat production for Ukraine. Each line describes how WASDE-projected production has changed month-by-month for the current 2022/23 marketing year and each of the previous three marketing years. The USDA publishes initial projections for the global grain balance sheet in May prior to the start of the marketing year. (i.e. Forecasts for the 2022/23 marketing year that begins September 1, 2022 were published in May 2022.) Production estimates are typically finalized by the following May and other balance sheet quantities are finalized by the December following the marketing year. (i.e. May 2023 and December 2023 for the 2022/23 marketing year.) In between, forecasts vary as available data and expectations change.

Ukrainian corn and wheat production for 2021 was determined prior to the start of the war in February 2022 and essentially known when the conflict began. Ukraine produced about 41 million metric tons of corn in 2021, a substantial jump from the previous year when drought limited production to about 30 million metric tons. Figure 3 shows the dramatic decline in estimated corn production during the 2020/21 growing season. In that year, production estimates fell 25% from early forecast levels. Wheat production experienced a similar rebound in 2021 relative to 2020, increasing from 26 million metric tons to 33 million metric tons. Both corn and wheat yields in Ukraine for 2021 were above long-run levels, with wheat yield a record high and corn yield second only to the level seen in 2018. Thus the true loss in production is more likely to come from comparing observed production following the war to longer-run averages of pre-war levels than to outcomes for 2020.

Figure 3 shows the impact of the war on 2022/23 production expectations using the orange lines. Initial USDA estimates called for Ukraine corn and wheat production of about 20 million metric tons each. This would have been a decline of about 45% for corn and one-third for wheat compared to the previous three-year average. Since those initial 2022 production projections were published in May 2022, Ukraine corn production estimates increased substantially to 31.5 million metric tons by the fall before declining to about 27 million metric tons today. Meanwhile, wheat production estimates remained relatively stable at around 21 million metric tons.

Based on WASDE data, it appears the worst fears about lost Ukrainian corn production were not realized; corn production for 2022 is down “only” 25% from the previous three-year average rather than the initial projection of 45%. Meanwhile, wheat production declined by 28% or slightly less than the initial estimate of one-third. Different outcomes for corn and wheat are partly a function of the crop calendar with 2022 wheat production already planted and nearing harvest when initial estimates were released. Different outcomes by commodity are also a function of the location of crop production within Ukraine; wheat production is concentrated in the southeastern part of Ukraine (See: Ukraine Wheat Producatioin map) that has been most heavily impacted by fighting. Corn production is focused more in the center north (See: Ukraine Corn Production map) which was a focus of the initial Russian invasion but less directly impacted by the conflict since.

Changes in Expectations for Ukraine Corn and Wheat Exports and Ending Stocks

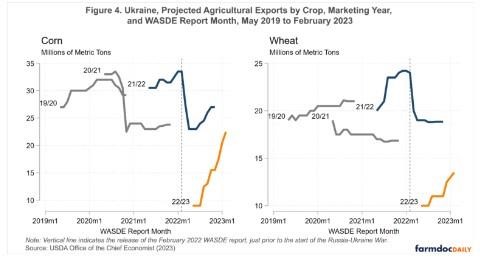

Ukrainian production could be further lost to global markets if it is trapped inside Ukraine because of logistics challenges imposed by the conflict and unavailable to importing countries. Figure 4 describes changes in projected Ukrainian corn and wheat exports. Prior to the war, Ukraine exported roughly two-thirds to three-quarters of its corn and wheat. In the initial WASDE reports following the invasion, expectations for Ukrainian exports fell. By April 2022, USDA pegged corn exports at 23 million metric tons and wheat exports at 19 million metric tons. This was down 32% and 21% compared to levels just prior the invasion in early February 2022. Corn export forecasts later recovered slightly, but wheat exports did not.

Export projections for 2022/23 have increased substantially from initial levels first reported in May 2022. USDA initially projected corn exports for 2022/23 of 9 million metric tons for corn and 10 million metric tons for wheat. This would have been a decline of roughly two-thirds and one-half of past long-run levels, respectively. While these initial predictions appear particularly dire with hindsight, it should be noted that export movement of Ukrainian grain had ground to a near halt at the time these forecasts were made. In July 2022, Russia and Ukraine agreed to reopen some Ukrainian Black Sea ports for maritime grain shipments. This Black Sea Grain Initiative has facilitated substantial export activity and improved expectations about the quantity of Ukrainian grain exports in 2022/23, especially for corn.

Since the summer of 2022, Ukraine export projections for 2022/23 have increased dramatically as seen in the orange lines in Figure 4. Prospects for improved export logistics along with increased production estimates discussed above have led to higher 2022/23 export projections with corn increasing 13.5 million metric tons to 22.5 million metric tons and wheat increasing 3.5 million metric tons to 13 million metric tons. High Ukrainian corn exports put a dent in overall global feed grain market tightness; an additional 13.5 million metric tons of corn exports represents roughly 7% of global corn trade.

Data provided by the USDA Economic Research Service suggest grain movement from Ukraine under the Black Sea Grain Initiative appears to have been focused to some degree on corn rather than wheat (See: Figure 8 in Wheat Outlook: January 2023). Initial movement under the initiative sought to clear the backlog of corn stocks during the August to October period where wheat exports would typically dominate.

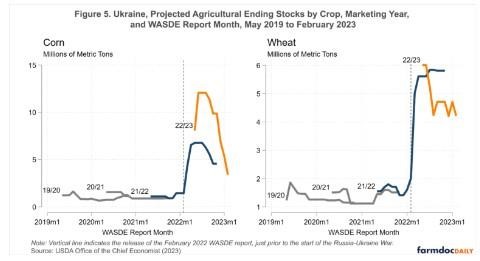

Expectations regarding the size of Ukraine grain inventories were also affected by the war, increasing substantially following the Russian invasion in February 2022. Ukraine’s agricultural economy is highly export oriented, with very low stocks levels typical at the time just prior to harvest. Figure 5 shows how projected Ukraine ending stocks for corn and wheat changed after February 2022. Old-crop corn ending stocks forecasts jumped from about 1.5 million to 7 million metric tons following the start of the war. New-crop corn ending stocks estimates were similarly high, reaching a peak of 12 million metric tons. Better than anticipated grain export movement has since dropped 2022/23 corn ending stocks estimates to just 3.4 million metric tons, much closer to long-run levels.

For wheat, the rise in projected old-crop ending stocks following the start of the war was like corn, but slightly smaller in absolute magnitude. Wheat ending stocks for 2021/22 rose from about 2 million to 6 million metric tons. New-crop ending-stocks estimates were similar to final old-crop levels but have since declined. However, the drop in forecasted wheat ending stocks is much less dramatic than the change for corn. When and how Ukraine reduces stocks to long-run levels remains an outstanding question.

Impacts on Global Commodity Markets

Changes in Ukrainian agricultural production in the past year illustrate the severe impacts of war on market volatility. In the immediate aftermath of the Russian invasion of Ukraine, agricultural commodity prices soared. (See: farmdoc daily, March 7, 2022) The May 2022 corn futures price for old-crop delivery increased by $1.32 per bushel or 19% between February 24 and April 18. Old-crop May 2022 wheat futures price increased by $2.36 per bushel or 27% over the same period, briefly touching a high of over 13.60 per bushel in early March. Since the Spring of 2022, prices have moderated with current old-crop futures prices near those levels observed prior to the start of the war. The combination of improved prospects for Ukrainian exports and production responses elsewhere have cooled the market, though current price levels remain high in historic terms. In general, the Black Sea Grain Initiative appears to have had a significant impact on the market’s perceptions of the global supply and demand balance.

Moderating prices and increased Ukrainian exports do not imply the impact of the Russia-Ukraine war is over. First, the situation on the ground remains tenuous. The ability for Ukrainian exports to flow from Ukrainian Black Sea ports is limited by the continued maintenance of an agreement between the warring states. The Black Sea Grain Initiative has been continued in 120-day intervals but there is no guarantee Russia will agree to allow further exports the next time the agreement is due for renewal in March 2023.

Going forward, corn and wheat markets will balance the supply response to high prices occurring in other major production regions with continued war-induced supply losses in Ukraine. Prospects for 2023 Ukrainian production may be poorer than in 2022 and much more uncertain. Ukraine’s 2022 wheat crop was already planted prior to the start of the war. Logistics required to get necessary agricultural inputs like seed and fertilizer to Ukrainian farms may be more difficult now than in 2022 when some inputs were already on farms prior to the invasion. Finally, the market must also consider how elevated Ukrainian grain stocks will be incorporated into the world market if peace does break out. All these factors point to continued market volatility in the year ahead.

Source : illinois.edu