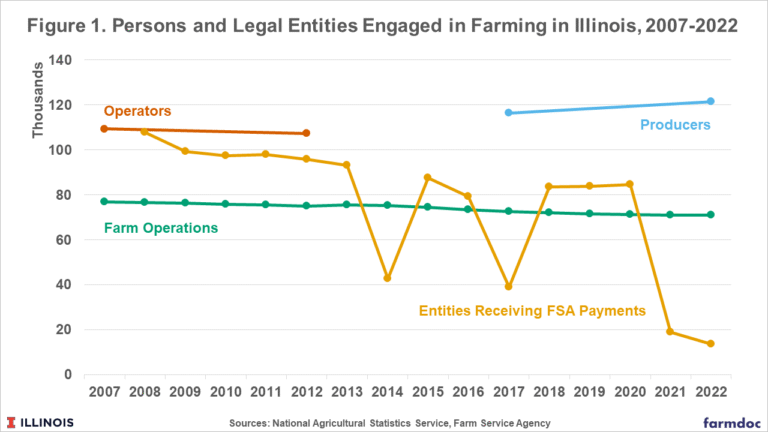

The number of farms, operations which may include multiple individuals or legal entities engaged in farming, has steadily declined in Illinois over time. However, the number of persons farming has not. Figure 1 shows the number of farms declined from 76,600 to 71,100 between 2008 and 2022. The number of individual producers is about 50% greater than the number of farms and actually rose between 2017 and 2022. Longer-term comparisons of producer numbers are complicated because USDA has changed how they measured the number of individual producers, previously termed operators, between the 2012 and 2017 Censuses of Agriculture (Pilgeram, et al., 2020). These diverging trends in farm and farmer numbers could be the result of farm operations choosing to add individuals and legal entities to maximize farm payments.

We know relatively little about the number of legal entities engaged in farming. National Agricultural Statistics Service data is usually specific to persons or farms. FSA payments data (Farm Service Agency, 2025) show the number of individuals and other legal entities receiving payments in Illinois has also declined over time. While the number of payment recipients varies from year to year, mainly because farm programs do not always trigger payments every year, the number of payment recipients has fallen over time.

Figure 1 shows the number of recipients declined from 107,800 in program year 2008 to 84,611 in 2020, a proportionally larger decline than in the number of farms. When farm programs are widely triggered, the number of payment recipients exceeds the number of farms, suggesting that a substantial number of farming operations have multiple operators. There was a substantial drop in 2021 and 2022 as fewer FSA payments were triggered during these high price years. This broad trend toward fewer recipients does not, however, connect farming operations to persons or legal entities who received payments or assess the types of legal entities chosen by individuals in response to particular economic or policy conditions.

This article seeks to demystify the complex connections between farms, farmers, legal entities, and farm payments using data from the FSA Payment Files. We begin by briefly reviewing the different types of entities that may be engaged in farming and receive farm payments. We discuss a methodology for identifying the prevalence of different entity types in publicly available FSA data and apply this method to payment data for Illinois for program years 2008 to 2022. We find significant trends, particularly in the use of Limited Liability Companies (LLCs) over time. LLCs comprise a larger share of all entities receiving farm payments and an even greater share of payment dollars over time. However, these trends are not specifically correlated with policy changes such as the passage of new Farm Bills or the rise of ad hoc farm payments that began in 2018.

Source : illinois.edu