MFP payments for planted acres in Illinois range from a low of $53 per acre in Jo Daviess County to a high of $87 per acre in Piatt County (see Table 1). Central Illinois counties tend to have higher payment rates than northern and southern Illinois. In recent years, many counties in central Illinois have had higher yields than northern and southern counties, likely contributing to higher payment rates. Furthermore, central Illinois farmers tended to plant a higher proportion of their acreages to soybeans as compared to northern Illinois farms. Using 2018 rates as a guide, soybean acres likely contribute more to a per acre MFP payment than do corn acres. Lower percentage of acres in soybeans is likely a contributing factor in lower per acre MFP payments for northern Illinois as compared to central Illinois.

Per acre rates in Illinois are typical of the corn belt where most counties have rates between $50 and $100 per acre (green shaded counties in Figure 1). Note that these payments will not be correlated with wet and delayed planting. While the payments from MFP will be extremely useful to farms impacted by wet weather, the program is targeted at mitigating price impacts from the ongoing trade disputes. In 2018, MFP payments were made on bushels (or pounds) produced. The fact that payments are not targeted to actual production in 2019 is useful to areas severely impacted by wet weather as production is likely to be low in those areas.

Counties in the western United States, upper Midwest, and eastern seaboard tend to have rates below $50 per acre (blue shaded counties in Figure 1). Many western counties have payment rates at $15 per acre, the minimum 2019 payment rate. Payment rates over $100 per acre are concentrated in Georgia, Alabama, Mississippi, Arkansas, Texas, and Arizona. Cotton acreage likely played a role in higher rates. In 2019, cotton acres averaged 52% of all MFP-eligible acres in counties with rates over $100 per acre. Peanut acreage could also play a role in higher payments.

MFP Payments on Prevent Plant Acres: A $15 per acre payment will be made to prevent plant acres planted to MFP-eligible cover crops. To be eligible for the $15 per acre MFP payment, a cover crop must be planted by August 1. The cover crop must meet crop insurance requirements.

Other Facts about the 2019 MFP Program

Written regulations have been released by FSA. The following facts have been obtained from press reports and the

MFP website maintained by the FSA:

- Sign-up begins July 29. Farmers can now sign up for MFP payments at the FSA office. Signup will end December 6, 2019. Signing up any time before the middle of August likely will result in the same timing of the first payment (see next point).

- MFP payments will be received in three tranches, with only the first guaranteed. The first will occur beginning in middle August, the second later in 2019, and the third will be in 2020.

- The first payment will be the higher of 50% of the per acre rate or $15 per acre. For an $80 per acre payment rate, the first payment will be $40 per acre.

- For a Farm Service Agency (FSA) farm, payment acres in 2019 cannot exceed plantings of MFP-eligible crops in 2018. As we interpret the regulation, farmers who are farming more FSA farms in 2019 as compared to 2018 will receive payments on all farm acres as long as eligibility and payment limits are met.

- Besides non-specialty crops, payments will be received for:

- Milk for dairy producers in business on June 1, 2019 ($.20 per cwt based on production history),

- Hogs ($11 per head based on hogs owned on a day selected by the producer between April 1 and May 15),

- Nuts ($146 per acre),

- Cranberries ($.03 per pound at 21,371 pounds per acre),

- Ginseng ($2.85 per pound at 2,000 pounds per acre),

- Fresh sweet cherries ($.17 per pound at 9,148 pounds per acre), and

- Table graphs ($.03 per pound at 20,820 pounds per acre).

Payments on specialty crops will be made on acres bearing crops.

- To be eligible, a person’s adjusted gross income must 1) average less than $900,000 for tax years 2015, 2016, and 2017 or 2) derive 75% or more of adjusted gross income from farming or ranching. Individuals must have a farm number with FSA and be in compliance with “Highly Erodible land and Wetland Conservation” regulations.

- Payment limits are:

- $250,000 per person/entity for non-specialty crops (those crops listed in “2019 Per Acre Payment Rates section of this paper),

- $250,000 per person/entity for milk and hogs,

- $250,000 per person/entity for specialty crops (nuts, cranberries, ginseng, sweet cherries, and table grapes),

- Total payments across non-specialty crops, milk and hogs, and specialty crops cannot exceed $500,000 per person/entity.

2019 MFP Compared to 2018 Program

The 2019 program differs from the 2018 program in significant ways. The 2018 program made payments on production of the following impacted crops: corn ($.01 per bushel), soybeans ($1.65 per bushel), cotton ($.06 per pound), sorghum ($.86 per bushel), and wheat ($.14 per bushels). For 2019, number of MFP-eligible crops increased. Within a county, the per acre rate in 2019 does not vary with MFP-eligible crops or with production per acre. The 2018 payment was based on production. Payment limits are higher for 2019 than for 2018.

To compare overall payment levels from the 2018 and 2019 programs, implied per acre payment rates for 2018 were calculated for all counties using National Agricultural Statistical Service (NASS) data. For counties having complete NASS data, NASS acreage of 2018 MFP-eligible crops were multiplied by yields per acre times the 2018 payment rates. Within the county, the sum of all payments to 2018 MFP-eligible crops where divided by 2018 acres of 2019-MFP-eligible crops. Doing so gives implied 2018 rates that can be easily compared to 2019 rates. For example, many Illinois farms in 2018 had $1 per acre in MFP payment on corn and $120 per acre payment on soybeans. If there were equal acres of corn and soybeans in 2018, the implied 2018 payment rate calculated using the above procedures is $60.50 per acre. This calculation for 2018 payment rates provides a figure that places 2018 payments on a basis that can be directly compared to 2019 county rates.

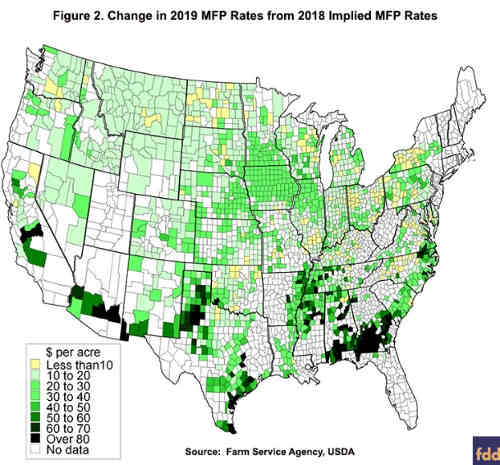

Overall, payment rates are higher in 2019 as compared to 2018 (see Figure 2). For Illinois, payment rates average $21 per acre higher in 2019 as compared to 2018. Similar values exist over much of the corn belt. Higher increases exist in some southern counties, with those higher increases strongly correlated to counties with over $100 per acre payment rates in 2019.

Impacts on 2019 Returns

Projections of 2019 returns were released for northern Illinois in a

July 2nd farmdoc daily article. In that release, MFP payments were included at estimated rates of $50 per acre for planted corn and soybeans, and $30 per acre for prevent plant acres. Based on last week’s MFP release, MFP payments were increased from $50 to $65 per acre, which will increase farmer returns by $15 per acre (see Table 1). MFP payments on prevent plant acres were decreased from $30 per acre to $15 per acre, which will decrease returns on prevent plant acres by $15 per acre. In these budgets, cover crops are assumed to be planted on prevent plant acres. In addition to MFP rate changes, price of corn was lowered. Cash corn price was lowered from $4.20 to $4.00 per bushel, which decreased corn returns by $34 per acre.

For planted crops, farmer returns are projected at -$112 per acre for corn and -$68 per acre for soybeans (see Table 2). Without MFP payments, those returns would be $65 lower. For prevent plant acres, prevent plant returns are -$30 per acre for corn and -$128 per acre for soybeans. Without MFP payments, prevent plant returns would be $15 per acre lower.