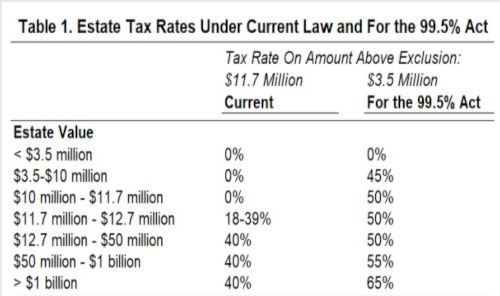

Through the For the 99.5 Percent Act (99.5% Act), bill sponsors Senator Bernie Sanders and Senator Sheldon Whitehouse, seek to reduce wealth inequality by enacting a progressive estate tax on inherited wealth and impose the tax on a larger number of estates (Sanders). The legislation would lower the federal estate tax exemption level from $11.7 million to $3.5 million per individual, resulting in a larger number of estates owing estate tax. The 99.5% Act would also establish a new progressive estate tax rate structure that would tax 45% of the value of an estate from $3.5-$10 million, 50% of the value of an estate between $10-$50 million, 55% of the value of an estate between $50 million-$1 billion, and 65% of the value of an estate over $1 billion (Sanders). These proposed estate tax rates are compared to the current estate tax rates in Table 1.

Importantly, the bill does acknowledge family farmers with a provision that allows farmers to lower the value of their farmland by up to $3 million for estate tax purposes and increase maximum exclusion for conservation easements (Sanders). Though a valuable provision for farmers, there will still be farm estates valued between $6.5 million ($3.5 million plus $3 million farmland value exclusion) and $11.7 million that do not owe estate tax under current law but would under this proposal.

As an example, consider a farmer estate valued at $10 million. Under the $11.7 million exclusion, the estate owes no estate tax under current law. Assume that estate is eligible for the full $3 million additional exclusion for farmland value, reducing the estate value to $7 million. If we assume the taxable value is also $7 million, the estate will owe $1.575 million (45% of $7 million minus $3.5 million) in estate tax under the 99.5% Act proposal.

The legislation would also impact other tax related rules, including those surrounding trusts used to pass wealth, the generation skipping tax, and valuation of assets for estate tax purposes.

STEP Act Summary

A group of Senate Democrats including Senators Chris Van Hollen, Cory Booker, Bernie Sanders, Sheldon Whitehouse and Elizabeth Warren introduced the STEP Act in March 2021. Their goal is to tax unrealized income derived from wealth accumulation, particularly when someone dies with assets that increased in their lifetime (Van Hollen). This legislation creates what is effectively a new transfer tax on unrealized capital gains (Van Hollen). The tax would apply to property transfers at death and throughout the person’s lifetime. Although this bill does propose a change in the valuation of capital assets at death by removing the step-up in basis, it does not replace the current estate tax or gift tax laws, it would be a new tax in addition to those.

The Senators claim the estates subject to estate tax would not be double taxed by the transfer tax because the transfer tax paid would be deductible for estate tax purposes (Van Hollen). However, as written it still appears to be a double tax with a deduction to partially offset the impact of the double taxation. A credit against the estate tax for the full amount of the transfer tax could be used to remove the double tax.

As currently written, the STEP ACT would discontinue the step-up in basis on assets at death. As a result, heirs who sell inherited property immediately would pay capital gains tax on the difference between the original cost basis and the sales price. Often farm families have farm assets that have been in the family for many generations. Over time the value of those assets has increased. Without a step-up basis, some farm families may be forced to sell farm assets needed to operate the farm to pay the tax bill.

The bill allows for the first $1 million in unrealized capital gains from the transfer of assets to be excluded from this tax (and retains a separate exclusion for personal residences). The $1 million exclusion for gains from the transfer of assets is notably lower than the current $11.7 million estate tax exemption. As a result, the STEP Act would add a new tax for estates with capital assets valued over $1 million but a taxable estate value under $11.7 million, which are currently not subject to such tax.

Under this proposal the transfer tax on unrealized capital gains is due at the time of the transfer and applies not only to transfers at death, but also to lifetime transfers to individuals (besides spouse) or trusts. Also important is that the proposed transfer tax does not appear to allow for a $15,000 annual gift exclusion per recipient that currently exists. Instead, the bill allows for an individual to utilize up to $100,000 of the $1 million transfer exclusion for lifetime gifts; this value is cumulative for gifts to all recipients and over all years. Once this amount is surpassed, any future gifts during a lifetime would be subject to the transfer tax. The amount of the gift would be reported by the giver in a manner as if it had been a sale at market value, therefore triggering (unrealized) capital gains on the “sale” of the gifted asset. This would impact farm families who gift assets such as machinery or grain as a way to help a future generation get involved in their farm business.

The bill would apply to transfers occurring after December 31, 2020 so, if passed, it would be retroactive to the beginning of this year. There is a provision that allows for the tax to be paid in installments, with interest, over a fifteen-year period for capital gains that apply to illiquid assets, like a farm or business (Van Hollen).

Farm Scenarios Under Current Law and Both 99.5% Act and STEP Act Proposals

The following scenarios are intended to provide examples of how potential changes could impact farmers. These are based on our interpretation and understanding of both pieces of prosed legislation as currently written. This may change as additional information becomes available that helps to clarify understanding or as draft legislation changes.

Scenario 1: Assume the fair market value of a farmer’s estate is $10 million with a collective cost basis of $4 million on property. The estate’s value includes more than $3 million of farmland that would be eligible for exclusion under the 99.5% Act. The farmer never made any gifts while alive.

Current:

- The basis in the property would step-up to fair market value at death and the estate would have a new basis at fair market value of $10 million.

- No estate tax would be owed because the estate’s taxable value (fair market value less applicable deductions) is below the $11.7 exemption level.

- Separately, if the heir sold the estate at market value of $10 million, there would be no capital gains tax owed because the sale value would equal the $10 million stepped-up basis in the property.

Proposed:

- Per the STEP Act, there would be no step-up in the basis of the estate property, the basis would remain $4 million while fair market value is $10 million.

- The estate would owe transfer tax from the STEP Act for transfers exceeding $1 million. The amount being transferred would be the $4 million basis in the property, less $1 million exclusion would result in $3 million subject to the transfer tax.

- Additionally, estate taxes would be owed. Following the proposal under the 99.5% Act, estate taxes would be owed on the estate’s taxable value of approximately $7 million ($10 million market value less $3 million exclusion for farmland and other applicable deductions) that exceeds the $3.5 million exemption level. This would result in approximately $3.5 million taxed at a 45% rate.

Separately, if the heir sold the estate at market value of $10 million, there would be capital gains tax owed on $6 million, the difference between the $10 million sale and the $4 million basis in the property.

Scenario 2: Assume the fair market value of a farmer’s estate is $13 million with a collective cost basis of $4 million on property. The estate’s value includes more than $3 million of farmland. The farmer never made any gifts while alive.

Current:

The basis in the property would step-up to fair market value at death and the estate would have a new basis at fair market value of $13 million.

Estate taxes would be owed on the estate’s taxable value ($13 million market value less applicable deductions) that exceeds the $11.7 million exemption level. The first $1 million over would be taxed at an incremental rate of 18%-39%. Anything exceeding $1 million over would be taxed at 40%.

Separately, if the heir sold the estate at market value of $13 million, there would be no capital gains tax owed because the sale value would equal the $13 million stepped-up basis in the property.

Proposed:

- Per the STEP Act, there would be no step-up in the basis of the estate property, the basis would remain $4 million while fair market value is $13 million.

- The estate would owe a transfer tax from the STEP Act for transfers exceeding $1 million. The amount being transferred would be the $4 million basis in the property, less $1 million exclusion would result in $3 million subject to the transfer tax.

- Additionally, estate taxes would be owed. Following the proposal under the 99.5% Act, estate taxes would be owed on the estate’s taxable value of approximately $10 million ($13 million market value less $3 million exclusion for farmland and other applicable deductions) that exceeds the $3.5 million exemption level. This would result in approximately $6.5 million taxed at a 45% rate.

- Separately, if the heir sold the estate at market value of $13 million, there would be capital gains tax owed on $9 million, the difference between the $13 million sale and the $4 million basis in the property.

Discussion

Proposals for new legislation that would make sweeping changes to taxes on farmer estates and inherited gains are a sign of the momentum that exists for changes to the current tax code. The legislators introducing these bills are aiming to target the nation’s largest billionaires (Sanders), but the changes could have significant impacts for some family farms. One proposal seeks to lower estate tax exemption levels and increase estate tax rates. The other piece of legislation would remove the step-up in basis provisions at the time of death and create a new transfer tax – separate from the estate tax and gift tax – that would apply to transfers of property in a farm estate at death and gift transfers made during a lifetime.

These proposals raise major philosophical questions. What should the role of the Federal government be in facilitating the transfer of business from one generation to another? What about small, family-owned businesses whose assets often surpass $3.5 million? For farmers and other small business owners those assets are also necessary for the operation of the business where the family members work and generate a labor-based income as opposed to the wealth-based income that the bills seek to target. There would be considerable impact on farms and other family businesses paying sizable capital gains tax and estate tax at each generation. Being forced to sell land or other assets needed to operate the business is likely among the implications of such changes.

In this article, we aim to summarize and inform based on our best understanding and interpretation of what is included in these bills. Farmers with estate plans created based on the current tax law should be prepared to make changes if these bills or similar legislation is passed. Seek assistance from an estate planning and tax law professionals for guidance.

Source : illinois.edu