Halstrom cautioned, however, that the COVID-19 pandemic is still a major concern for the U.S. meat industry, adding uncertainty to the business climate in many export destinations. Logistical challenges, including container shortages and ongoing vessel congestion at many U.S. ports, also present significant obstacles for red meat exports.

“While conditions are improving in many key markets, the COVID impact is the most intense it has ever been in Taiwan and heightened countermeasures are also in place in Japan and other Asian countries,” he explained. “But foodservice activity is climbing back in our Latin American markets and retail demand – both in traditional settings and in e-commerce – has been outstanding and USMEF continues to find innovative ways for the U.S. industry to capitalize on these opportunities. We are also working with ag industry partners and regulatory agencies to find ways to improve the flow of outbound cargo, which is essential to maintaining export growth.”

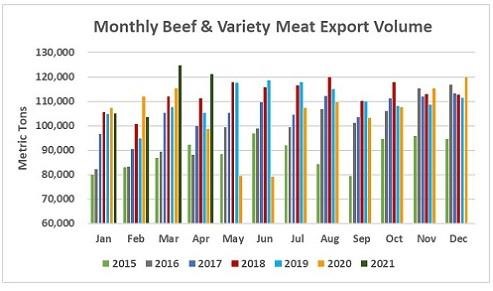

Beef exports set second consecutive value record; per-head value also highest ever

In addition to the overall value record, beef export value per head of fed slaughter also reached a new high in April at $367.45, up 1% from a year ago. Through April, per-head value averaged $343.70, up 5% from the same period last year. April exports accounted for 15% of total beef production and 12.6% for muscle cuts, each up about one full percentage point from a year ago. Through April, exports accounted for 14.4% of total beef production (steady with last year) and 12.1% for muscle cuts (up from 11.9%).

April beef exports to South Korea increased 21% from a year ago to 23,482 mt, and just missed setting a new value record at $182.7 million (up 36% and slightly below the August 2020 high). Through April, exports to Korea were up 11% in volume (92,478 mt) and 15% in value ($686.7 million). Exports were also well ahead of the record pace of 2019, when full-year export value to Korea reached $1.84 billion.

Beef exports to China continued to soar in April, reaching a record 17,233 mt (up from just 1,367 mt a year ago). Export value to China was $130.6 million – up from $11.5 million. Through April, beef exports increased more than 1,300% in both volume (48,291 mt) and value ($364.6 million). These are new annual records, already exceeding the full-year totals posted in 2020.

While Japan remains the leading volume destination for U.S. beef, April exports definitely felt the impact of Japan’s safeguard tariff, which was in effect from mid-March to mid-April. During this time, U.S. beef cuts entering Japan were tariffed at 38.5%, well above the rates imposed on major competitors. The rate for U.S. beef dropped to 25% on April 17, which is level with other major suppliers. U.S. trade officials are in consultations with their Japanese counterparts on the safeguard threshold, which USMEF expects to be exceeded every year unless it is increased. April exports to Japan were down 19% from a year ago at 25,293 mt, valued at $170.7 million (down 15%). Through April, exports were down 12% to 100,702 mt, valued at $655.9 million (down 9%).

Other January-April highlights for U.S. beef exports include:

- April beef exports to Mexico far exceeded last year’s low totals at 17,190 mt (up 70%) valued at $79.3 million (up 128%). Through April, exports were still down 2% from a year ago in both volume (68,721 mt) and value ($324.4 million), but demand is trending upward with the gradual recovery of foodservice and tourism activity in Mexico.

- Led by strong growth in Colombia and Chile, January-April exports to South America increased 13% from a year ago to 9,478 mt, with value up 30% to $47.8 million. While total exports to Peru were up only slightly, beef variety meat shipments increased 5% to 2,281 mt, with value climbing an impressive 41% to $3.4 million.

- With January-April shipments on a record pace to Guatemala, Honduras, El Salvador, Costa Rica and Nicaragua, beef exports to Central America increased 42% from a year ago to 7,139 mt, valued at $42.2 million (up 49%). Nicaragua is emerging as a strong destination for beef variety meat, with exports through April reaching 332 mt (up 261%) valued at nearly $300,000 (up 176%).

- April was the first month of 2021 in which beef exports to Taiwan were higher than a year ago in both volume (5,311 mt, up %) and value ($51.5 million, up %). This pushed January-April exports to 17,854 mt (down 14%) valued at $169.8 million (down 7%), but exports in May and June may be impacted by COVID containment measures, including a current suspension of dine-in restaurant service.

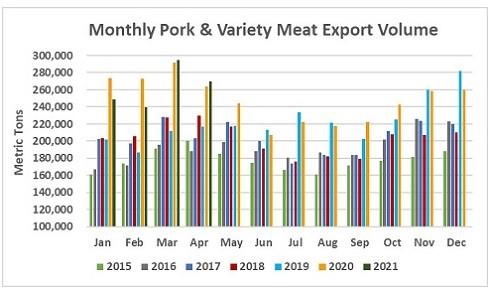

Mexico, Philippines, Central America and DR drive pork export growth

Pork export value per head slaughtered was $69.22 in April, down 5% from a year ago. Through April, per-head value averaged $63.66, down 4% from the same period last year. April exports accounted for 32% of total pork production and 28.6% for muscle cuts. These ratios were down from 36.2% and 32.2%, respectively, in April 2020, when pork production was down significantly due to COVID-related obstacles. Through April, exports accounted for 30.4% of total pork production and 27.4% for muscle cuts – each down about two percentage points from a year ago.

April pork exports to Mexico were the largest of 2021 at 67,365 mt, up 58% from a year ago, with value more than doubling to $143.4 million (up 126%). Through April, shipments to Mexico were 7% ahead of last year’s pace at 254,377 mt, with value up 18% to $488.5 million. While much of the U.S. pork entering Mexico is for further processing, retail demand has strengthened in supermarkets and emerging venues such as convenience stores.

Led by strong demand across a range of markets, Central America continued to be a growth leader for U.S. pork in April, with exports up 56% from a year ago to 10,911 mt, valued at $29.7 million (up 74%). Through April, exports exceeded last year’s record pace by 49% in both volume (46,837 mt) and value ($119.4 million). Honduras and Guatemala remain the region’s largest destinations for U.S. pork, but January-April exports doubled year-over-year to Costa Rica and achieved strong growth in El Salvador, Panama and Nicaragua.

Pork exports to the Philippines soared again in April, bolstered in part by temporary tariff rate reductions that took effect April 17. Through April, exports to the Philippines more than tripled from a year ago to 39,673 mt (up 258%), valued at $99.5 million (up 270%). The recent tariff rate reductions apply only to pork muscle cuts, a category in which U.S. exports were already up dramatically in 2021. Through April, pork muscle cut shipments to the Philippines increased 404% to 33,128 mt, with value up 325% to $88.3 million.

Other January-April highlights for U.S. pork exports include:

- Pork exports to the Dominican Republic are on a record pace through April, topping last year’s totals by 48% in volume (22,098 mt) and 53% in value ($52.2 million).

- After struggling last year, pork exports to Colombia are making a strong recovery in 2021. April shipments exceeded year-ago levels for the third consecutive month, pushing January-April exports 29% above last year’s pace in both volume (32,762 mt) and value ($73.9 million).

- April pork exports to South Korea exceeded last year for the first time in 2021 at 16,642 mt (up 10%), valued at $53.4 million (up 26%). Through April, exports to Korea still trailed last year’s pace by 4% at 63,237 mt, valued at $189.2 million (down 3%).

- While China/Hong Kong remains the largest destination for U.S. pork, January-April exports to the region were down 23% from a year ago to 318,780 mt, valued at $725.8 million. China/Hong Kong accounted for nearly 35% of U.S. pork export volume last year, but through April the 2021 ratio is down to 30%.

- After a strong March performance, April pork exports to Japan declined to 32,948 mt (down 19% from a year ago), valued at $135.7 million (down 17%). Through April, exports fell 3% below last year’s pace in both volume (137,776 mt) and value ($571.8 million). On a positive note, Japan’s import data show April imports of U.S. chilled pork were up 11% from a year ago to 20,781 mt, with January-April imports up 1% to 71,508 mt.

Click here to see more...