By Dr. Don Shurley

For the entire month of June, prices (December 2016 futures) have been “range bound,” mostly between 64 and 66 cents. In light of the June 30 USDA acres planted numbers, it would have to be considered good news if prices can remain at or above 64 cents.

Prices (December 2016 futures) were around or above 66 cents most of the morning of June 30. After the USDA report was released at noon, prices immediately dropped triple digits and closed at 64.17 cents – down 168 points.

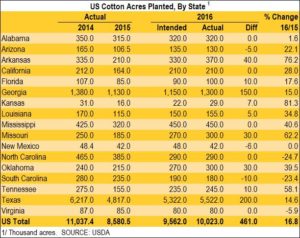

In March, farmers said they intended to plant 9.562 million acres of cotton this year. Actual acres planted are estimated at 10.023 million acres – 461,000 acres more than earlier intentions and 17% more than last season. An increase from last year (which we knew first from the March numbers) was not unexpected. What’s a bit of a surprise is this increase, or really the magnitude of the increase above the March intentions.

Of the 461,000 additional acres, 150,000 comes from Georgia and 200,000 from Texas – 76% accounted for by those two states alone. Actual acres planted were higher than intentions in nine of 17 states. Actual acres planted were less than intentions in only three states.

Planting decisions are influenced by many factors including relative prices and net returns, farm program payments and incentives, weather, crop rotations, financing, and risk. Since the earlier March report, cotton prices have improved, but corn and soybean prices have also improved. Although cotton prices have improved, with prices still in the 60s, a higher price is simply a trade-off for a lower LDP/MLG.

Compared to last season, acreage is expected to decline in only three states – North Carolina, South Carolina and Virginia. County Extension agents say the decline in acreage is due to crop and financial losses and lingering bad feelings from last season, higher expected net returns from other crops (especially corn and peanuts), lower cost and risk in other crops, and weather delays this season.

Percentage-wise, big increases in cotton acreage are seen in Arkansas and Missouri, where there was a big increase in grain sorghum acreage last year – due to high price and, as I recall, the inability to get cotton and other crops planted on time.

In Georgia, cotton acreage is forecast at 1.3 million acres – 150,000 acres higher than March intentions and up 15% from last season. The increase or magnitude of increase is somewhat surprising, as corn is also up (70,000 acres). Peanuts, soybeans, and grain sorghum are all down (15,000, 60,000, and 15,000 acres respectively).

The 2016 U.S. crop is currently estimated at 14.8 million bales. This is based on the March intended planting of 9.56 million acres, abandonment of 8%, and yield of 807 lbs/acre. The July supply/demand report will be released on July 12 and will be revised based on the new 10.023 million acres number and updated crop conditions. Expectations are that the U.S. crop could now be in the neighborhood of 15.5 to 16 million bales.

A larger U.S. crop could be bearish for prices, but there are so many other factors in play. Looking ahead to the July report, other factors will include expected production in China, India, Pakistan and Turkey; projected Chinese imports and mill use; and World use.