Post-COVID prices were estimated using Microsoft Excel spreadsheets made available by the Economic Research Service (ERS), an agency of the USDA. ERS methods begin with estimates of monthly prices (click here for spreadsheets). Actual monthly prices are used for months that NASS has published that data. For the 2019-2020 market year, prices currently are available through February. For remaining months in the marketing year, settlement prices on futures contracts are used to estimate monthly prices. The remaining months in the marketing year are March through August for corn and soybeans. Monthly marketing weights are used to calculate a weighted average of monthly prices to give an estimate of the MYA price. Futures prices were taken from April 11 in the following estimates.

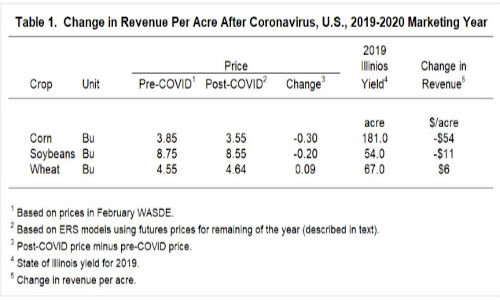

The post-COVID prices were estimated at $3.55 per bushel for corn, $8.55 for soybeans, and $4.64 per bushel for wheat. Corn and soybean prices decline by $.30 and $.20 per bushel, respectively. Wheat prices increased.

Revenue Declines on 2020 Crop

Price declines will lower revenue associated with the 2019 crop. An estimate of the potential revenue decline can be found by multiplying the price decline by yield produced in 2019. The 2019 state corn yield for Illinois was 181 bushels per acre. A -$.30 decline in corn price would result in a revenue decline of -$54 per acre. Price declines will vary across operations depending on yield and percent of the harvested crop not yet marketed. Percentages of the 2019 crop already sold or under forward contract will not experience this price decline. Farmers who have bushels hedged using futures directly may realize hedging gains, but continue to face local basis risk.

Potential revenue declines are estimated at -$11 per acre for soybeans. Wheat revenues may increase by $6 per acre. Compared to soybeans and wheat, corn has a much larger revenue decline of $54 per acre. For corn, the overwhelming uses are ethanol and livestock and both are experiencing severe difficulties in the current environment.

ARC and PLC Payments for 2019

In many cases, lower MYA prices will result in higher 2019 commodity title payments. On some farms, payments still may not be triggered with the lower MYA prices, but the probability of a payment increases as the MYA continues to fall. As a comparison to payment estimates released earlier this year, payments were re-estimated using the post-COVID prices shown in Table 1. Although program selection has not been released, it is believed that most farmers elected PLC for corn base acres and ARC-CO for soybean base acres.

Corn: The post-COVID estimate of a $3.55 MYA corn price is below the $3.70 effective reference price for corn and would result in a PLC payment. The PLC payment would equal:

.85 x PLC yield x $0.15 rate ($3.70 effective reference price – $3.55 MYA estimate (= $0.15)).

PLC yields used in this calculation are based on actual yield history on a farm and vary from farm to farm. Based on state yields from 2013 to 2017, an estimate of the PLC yield across all Illinois farms is 155 bushel per acre. This estimate results in an average PLC payment of $20 per base acre.

Given a $3.55 MYA price, ARC-CO could make payments for corn in about 50% of the counties in Illinois. The average ARC-CO payment across Illinois counties with 2019 NASS yields reported is $8 per corn base acre.

Soybeans: The post-COVID estimate for $8.55 MYA average price for soybeans is above the $8.40 effective reference price, indicating that there will not be a PLC payment expected for soybeans.

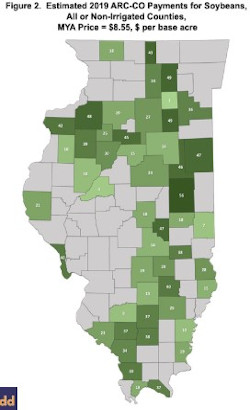

The lower soybean price would increase soybean ARC-CO payments in many cases. Even with an $8.55 MYA price, about 50% of the counties still would not have a PLC payment (see Figure 2). Other counties that were not already expected to be at their maximum ARC-CO payment will experience an increase in payments. Overall the average increase in ARC-CO payment rate is estimated at $5 per soybean base acre for Illinois Counties with 2019 yield data reported.

Commentary

Revenue declines, a result of lower prices largely due to COVID-19 and associated control measures, are projected at up to $54 per acre for corn and $11 per acre for soybeans. Although PLC and ARC payments may rise due to the lower MYA price expectations, the increase in payment rates are not expected to be large enough to offset the comparable declines in revenue. A statewide average PLC payment of $20 per base is projected for corn. Soybeans base acre payment average increases are less than $5 per base acre for ARC-CO. Note that ARC and PLC payments are made on base acres while revenue losses would be on planted acres, and hence the prospective commodity title payment cannot be added to the revenue on a planted acre. Even given this consideration, it is difficult to construct cases in which planted acres differ enough from base acres for commodity title payments to offset revenue losses.

Revenue projections are made in the middle of April. So far, corn prices have been on a steady decline since March. Soybean prices have shown more resiliency than corn prices but also have been on a declining trend. The full impacts of Coronavirus still may not have been fully reflected in markets. Hence, 2019 market year losses could be worse than those shown here.

For 2019 crop year income, farmers who had marketed grain prior to the onset of COVID-19 will not be as affected by price drops as farms with larger portions of the 2019 crop unsold at that time. But looking ahead, losses associated with the 2019 crop likely will not be the largest revenue losses felt by corn and soybean farmers. Outlook for 2020 production is bleak and, in the absence of a reversal in the price trends we’ve been experiencing or another round of significant Federal aid, could lead to serious erosions in the financial position of farms.

Source : illinois.edu