and Todd Hubbs

Economic Research Service

U.S. Department of Agriculture

The growth in renewable diesel production capacity in the U.S. has been dramatic in recent years, with capacity in just the last two years expanding by 1.8 billion gallons, or 225 percent (farmdoc daily, March 8, 2023). The boom in renewable diesel production may be even larger in the next several years (farmdoc daily, March 29, 2023). One of the most discussed and debated aspects of the renewable diesel boom is its impact on feedstock markets, such as soybean oil. Assessing these impacts requires a clear understanding of usage trends for the various feedstocks that are used in producing renewable diesel and FAME biodiesel. The purpose of this article is to examine historical usage trends for renewable diesel and FAME biodiesel feedstocks. We first estimate implied aggregate feedstock usage and then allocate total usage to different feedstocks using data from the U.S. Energy Information Administration (EIA). This is the eighth in a series of farmdoc daily articles on the renewable diesel boom (see the complete list of articles here).

Analysis

The two main types of biomass-based diesel (BBD) fuels used to comply with the U.S. Renewable Fuel (RFS) mandates are “renewable diesel” and “FAME biodiesel.” Although renewable diesel and FAME biodiesel are produced with the same organic oils and fats feedstocks, their production process differs substantially, resulting in the creation of two fundamentally different fuels (for details see farmdoc daily, February 8, 2023).

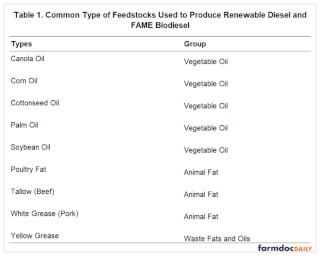

Table 1 lists the most common organic oils and fats feedstocks used to produce renewable diesel and FAME biodiesel. The first group consists of vegetable oils that are produced by crushing vegetable seeds, such as soybeans and canola. The second group consists of animal fats that are by-products of slaughtering animals. Yellow grease is a unique type of feedstock because it can be made up of various kinds of fats and oils. The main source of yellow grease is used cooking oil; hence, the category “waste fats and oils.” It is not hard to grasp the diversity of fats and oils in yellow grease when one thinks about all the different vegetable oils and animal fats that are used for cooking in retail food businesses. This makes yellow grease something of a catch-all type of feedstock. Lastly, it is important to note that the list of feedstocks in Table 1 is by no means exhaustive. For example, small amounts of algae oil are used to produce renewable diesel and biodiesel in the U.S.

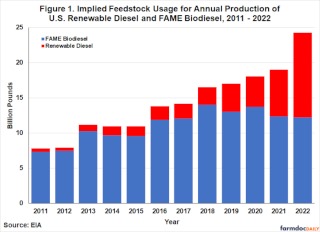

We begin our analysis by estimating total feedstock usage for renewable diesel and FAME biodiesel because of limitations on the availability of data on individual feedstock use. Until 2021, the EIA only published estimates of individual feedstock usage for biodiesel, leaving out renewable diesel completely. In view of this limitation, we estimate total feedstock usage based on benchmark estimates of the pounds of feedstock used per gallon of renewable diesel and FAME biodiesel. Xu, et al. (2022) report that an average of 8.125 pounds of feedstock is used to produce one gallon of renewable diesel, while in a farmdoc daily article (February 16, 2022) Irwin reports that an average of 7.55 pounds of feedstock is used to produce one gallon of biodiesel. Therefore, we multiply EIA estimates of monthly renewable diesel production by 8.125 to imply total renewable diesel feedstock usage. Likewise, we multiply EIA estimates of monthly biodiesel production by 7.55 to imply total biodiesel feedstock usage. The monthly production estimates are published by the EIA in its monthly Energy Review over January 2011 through December 2022. We then aggregate to the annual level by summing the monthly feedstock estimates for a calendar year.

Figure 1 presents our annual estimates of implied total feedstock usage over 2011 through 2022 for renewable diesel and FAME biodiesel. The chart highlights the huge increase in feedstock usage that has occurred because of the renewable diesel boom. As recently as 2017, total feedstock usage for production of the two biofuels was under 15 billion pounds. This surged to over 24 billion pounds in 2022, an increase of 72 percent. Total feedstock usage grew over five billion pounds in 2022 alone. For perspective, the latest USDA WASDE report for April estimates that 59.27 million metric tons, or 130.67 billion pounds, of soybean oil will be produced in the world during the 2022/23 marketing year. Total feedstock used for producing renewable diesel and biodiesel in 2022 represents 18.6 percent of this projection of global production of soybean oil, a large proportion.

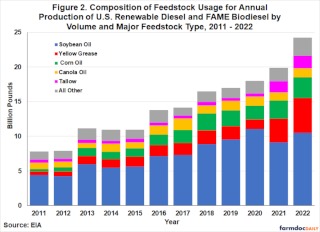

The next step of the analysis is to allocate the total feedstock estimates in Figure 1 to the different types of feedstocks. We do this based on two EIA reports. From 2011 through 2020 the EIA published the Monthly Biodiesel Production Report, which contained survey estimates of individual feedstocks used to produce FAME biodiesel. These estimates are used directly for 2011 through 2020. One issue is that the EIA biodiesel feedstock estimates for a given year usually sum to less than the total biodiesel feedstock estimates presented in Figure 1. We account for this difference by simply adding the difference to the “other” category in the biodiesel feedstock estimates found in the EIA report. In this way, feedstock usage estimates for individual categories are forced to add up to the total implied biodiesel feedstock estimates shown in Figure 1.

Since there is no data available in the public domain on renewable diesel feedstock usage prior to 2021, we estimate usage based on the proportions used to produce biodiesel. Specifically, each year over 2011-2020 we compute the percentage of total biodiesel feedstock used for each of the individual feedstock categories. We then apply these same percentage estimates to the total implied renewable diesel feedstock for that year (see Figure 1) to estimate pounds of individual feedstock usage for renewable diesel. In essence, we assume that feedstock proportions for renewable diesel and biodiesel are identical each year over 2011 through 2020. We argue this is the best assumption that can be made, but it means that individual feedstock usage estimates over this period should be viewed with some caution.

Starting in 2021, the EIA began releasing a new report called the Monthly Biofuels Capacity and Feedstocks Update, and it includes monthly survey estimates of feedstock usage for both renewable diesel and FAME biodiesel. One complication is that the report also includes feedstock usage for relatively small amounts of other biofuels such as renewable heating oil, renewable jet fuel, renewable naptha, and renewable gasoline. Since the EIA report does not break out feedstock usage by fuel type, and the production of these other biofuels is not large, we treat the feedstock estimates as reflecting only renewable diesel and biodiesel production.

Figure 2 presents our estimates of the allocation of total implied renewable diesel and FAME biodiesel feedstock volumes to individual feedstocks over 2011 through 2022. Note that the height of each bar in Figure 2 is the same as in Figure 1. The only difference is that total feedstock usage is allocated by feedstock type in Figure 2, while it is allocated by fuel type in Figure 1. The estimates show that soybean oil has been the largest source of feedstock for renewable diesel and biodiesel production since 2011. Soybean oil usage peaked in 2020 at 11 billion pounds, and then fell back to 10.5 billion pounds in 2022. Through 2020, the next two largest feedstocks were corn oil and yellow grease, with annual usage in the one- to two-billion pound range.

There was an interesting change in feedstock usage that parallels the renewable diesel boom that began in earnest during 2021. The usage of both yellow grease and tallow increased substantially as the boom progressed in 2021 and 2022. Yellow grease use reached five billion pounds in 2022 and tallow rose to 1.8 billion pounds. These shifts make sense given the relatively low carbon intensity (CI) scores given to renewable diesel made from yellow grease and tallow in California’s Low Carbon Fuel Standard (LCFS) program. The lower CI scores translate into higher dollar credit values per gallon. However, we also should point out that the abruptness of the shift towards these two feed stocks in the last two years may also reflect the method we used to estimate renewable diesel feedstocks prior to 2021. It is possible that more yellow grease and tallow has always been used in the production of renewable diesel due the incentives provided by the LCFS, but our estimation method forces the proportions of feedstock usage to be the same for renewable diesel and FAME biodiesel. This may exaggerate the jump in yellow grease and tallow feedstock usage between 2020 and 2021. While recognizing this as a possibility, it is undoubtedly also true that the renewable diesel boom drove a major increase of low CI feedstocks like yellow grease and tallow.

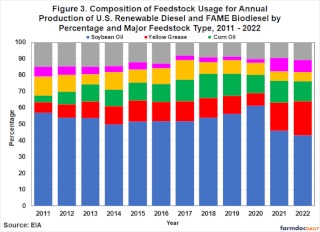

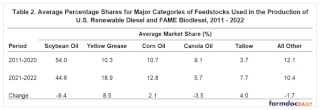

Figure 3 presents the allocation of feedstock usage in percentage terms to provide direct evidence on market shares. This chart clearly shows how soybean oil represented around 50 percent of feedstock usage until 2019, rose briefly above 60 percent in 2020, and thereafter declined to a little more than 40 percent in 2022. At the same time, the market share of yellow grease increased sharply, from about 12 percent to over 20 percent in 2022. Table 2 provides additional information in this regard by presenting average percentage shares for 2011-2020 versus 2021-2022. The big loser was soybean oil, whose average percentage share dropped 9.4 percent between the two periods, while the big winner was yellow grease, whose average percentage share increased 8.5 points. Tallow was also a winner, with its share increasing four percentage points. Canola oil lost percentage share, while corn oil bucked the trend for vegetable oils and gained percentage share.

Figure 4, Figure 5, and Table 3 repeat the previous analysis with individual feedstocks collected into four major groups: vegetable oils, animal fats, waste fats and oils, and other. The dominance of vegetable oils as a feedstock for renewable diesel and FAME biodiesel can be easily seen in these charts. Vegetable oil represented at least 70 percent of total feedstock use each year over 2011 through 2019 and reached nearly 80 percent in 2020 (Figure 5). This was sharply reversed in the last two years. More specifically, the average share for vegetable oils declined by 11.3 percentage points between 2011-2020 compared to 2021-2022, while the average share for waste fats and oils increased by almost the same amount, 10.3 points.

Implications

This article examines trends in feedstock usage for renewable diesel and FAME biodiesel over 2011 through 2022. As recently as 2017, total feedstock usage for production of the two biofuels was under 15 billion pounds. This surged to over 24 billion pounds in 2022, an increase of 72 percent. Total feedstock usage grew over five billion pounds in 2022 alone. For perspective, the 2022 total represents slightly less than 19 percent of projected global production of soybean oil. In terms of individual feedstocks, soybean oil represented around 50 percent of feedstock usage for renewable diesel and FAME biodiesel until 2019, rose briefly above 60 percent in 2020, and thereafter declined to a little more than 40 percent in 2022. At the same time, the market share of yellow grease increased sharply, from about 12 percent to over 20 percent in 2022. These shifts make sense given the relatively low carbon intensity (CI) scores given to renewable diesel made from yellow grease in California’s Low Carbon Fuel Standard (LCFS) program. The lower CI scores translate into higher dollar credit values per gallon.

The next article in this series will examine the profitability of FAME biodiesel production.

Source : illinois.edu