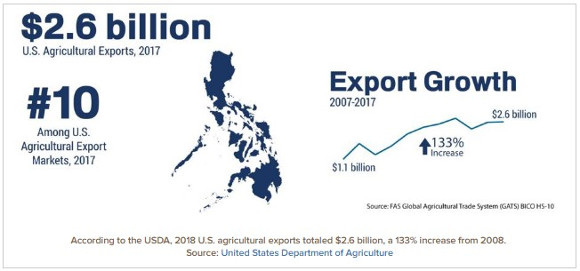

The Philippines is a group of islands located in southeastern Asia between the Philippine Sea and South China Sea. The island nation is cumulatively 116,000 square miles, which is slightly larger than the state of Arizona. With over 14,000 miles of coastline, the Philippines observe a tropical marine climate with northeast monsoon from November to April and southwest monsoon from May to October. According to the CIA World Factbook, 41% of land is used for agricultural purposes with top products including rice, fish, livestock, bananas, coconut and sugarcane. The population of the Philippines was 105.9 million in 2018. Unlike most nations, less than half of the Philippines population is classified as “urban” and populations are concentrated where the best farmlands lie. In 2018, the Philippines ranked 10th among U.S. agricultural export markets and totaled $2.6 billion in export value. Despite tariffs, export growth to the Philippines has increased 113% in the past decade.

Animal Protein Consumption and Domestic Industry

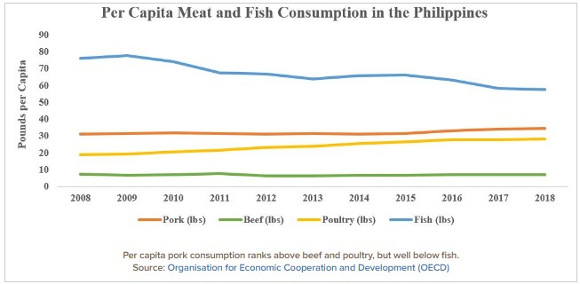

The Philippines ranks below average in per capita consumption for nearly all forms of animal protein. While fish is the most popular form of protein in the Philippines, pork ranks above both poultry and beef. Over the past ten years, per capita fish consumption has declined slightly while consumption of other animal proteins has increased. Similar trends can be observed for domestic production where fish production has declined steadily since 2014 and domestic pork and poultry production have increased. In 2018, the Philippines was 85% self-sufficient in pork production. Over the past 10 years, imports of all proteins have increased, with fish, poultry, and beef all surpassing import levels of pork.

Retail Sector

The food retail sector in the Philippines is reportedly expanding in several ways. According to the USDA Global Agricultural Information Network (GAIN), modern supermarkets and fast food franchises are increasing in quantity and popularity. GAIN also states that convenience stores are “proliferating” and creating increased opportunities for U.S. products. National chains have become prominent in the Philippines with Western-style stores dominating the retail market. Given these circumstances, U.S. brands are widely recognized by Philippine consumers and are regarded as safe, reliable and high quality. As the retail sector continues to expand, more opportunities will become available for high value products such as those imported from the U.S.

Looking Ahead

As with any export market, there are significant advantages and challenges associated with exporting to the Philippines. The expansion of the food retail and food processing sectors in the Philippines has created more opportunities for U.S. products that may otherwise struggle to reach consumers. Given the 21-day shipping time of perishable products and a lack of cold storage within the country, U.S. meat products are not always readily available or price competitive. Furthermore, 46% of the Philippine population lives in rural areas with limited access to imported goods. However, U.S. products tend to have a relatively longer shelf life and sturdy packaging that can better withstand the country’s poor distribution methods.

Click here to see more...