By Carl Zulauf, Ben Brown

Organic production is one of the most discussed forms of differentiated production within US agriculture. Differentiated production is a product with a unique set of attribute(s) demanded by a market segment willing to pay for the attribute(s). This brief article highlights some features of US farms that produce organic farm products as tabulated by the 2017 Census of Agriculture.

Census Questions and Instructions

Census respondents were asked the following yes-no question in Section 23 (“Organic Agriculture”) of the 2017 census questionnaire (Appendix B, page B-45): “During 2017, did this operation produce organic products according to USDA’s National Organic Program (NOP) standards or have acres transitioning into USDA NOP production? Exclude processing and handling.” If the “yes” box was checked, respondents were asked to check all of the following 4 response boxes that applied to their farm: (1) “USDA NOP certified organic production,” (2) “USDA NOP organic production exempt from certification (exempt is production normally less than $5,000 in sales).” (3) “Acres transitioning into USDA NOP organic production,” and (4) “Production according to USDA NOP standards but NOT certified or exempt.” Respondent were also asked, “What was the value of USDA NOP certified or exempt organically produced commodities sold from this operation in 2017?” Instructions for this last question were to (1) include gross value of agricultural sales before expenses or taxes, (2) exclude crop and livestock sales from transitioning land, and (3) exclude value of processed or value added items (Appendix B, page B-53).

Organic Farms

The 2017 Census of Agriculture reported 18,166 US farms sold organic farm products, an increase of 27% or 3,840 farms from the 2012 Census (see Figure 1). Seven states accounted for 61% of this growth. They were, with the parenthesis containing the increase in number of farms: New York (466), Pennsylvania (448), Wisconsin (357), California (327), Indiana (292), Ohio (235), and Michigan (225). California accounted for 18% of US farms selling organic farm products in 2017, followed by Wisconsin (8%), New York (7%) and Pennsylvania (6%).

Farms selling organic farm products were 0.9% of all US farms with sales in 2017. Vermont (9%), Maine (7%), California (5%), New York (4%), and New Hampshire (3%) had the highest share of farms selling organic farm products (see Figure 2 and Data Note).

Organic Sales

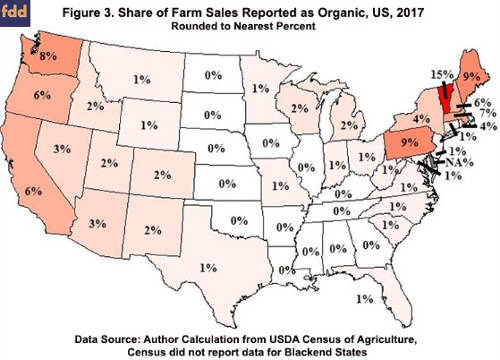

US farms reported $7.3 billion in sales of organic farm products in 2017, more than double the $3.1 billion reported in the 2012 Census of Agriculture. Organic sales more than doubled in 28 states between 2012 and 2017. California accounted for 39% of US organic farm sales in 2017, followed by Washington and Pennsylvania, each with a 10% share. Organic farm sales were 1.9% of total US farm sales in 2017, up from 0.8% in 2012. Vermont had the highest share of farm sales that were organic in 2017 at 15%, followed by Pennsylvania (9%), Maine (9%), Washington (8%), Massachusetts (7%), California (6%), New Hampshire (6%), and Oregon (6%) (see Figure 3). In contrast, 14 and 15 states had a share that rounded to 0% and 1%, respectively.

Largest percentage point (pp) increase in share of farm sales that were organic between 2012 and 2017 was +8 pp (Pennsylvania) and +7 pp (Vermont). (see Figure 4) Only 2 states had a decrease in their share of farm sales that were organic: New Hampshire (-2.7 pp) and Florida (-0.1 pp).

Average Sales per Operation

Average sales of organic farm products per US farm with organic sales more than doubled between 2012 and 2017 while average farm sales per US farm increased only slightly (see Figure 5). Thus, in 2017, average organic sales per organic farm were nearly double average sales per US farm: $400,603 vs. $217,836. Average organic farm products sold per farm with organic sales in 2017 exceeded $500,000 in 6 states: Arizona ($1,323,730), Texas ($975,797), Washington ($921,335), California ($849,369), Pennsylvania ($675,193), and Colorado ($542,761).

Summary

- Both the number of farms producing organic farm products and the share of all farm sales that are organic increased between the 2012 and 2017 Censuses of Agriculture.

- Most dramatic change however was the growth in size of farms selling organic farm products.

- Average sales of organic farm products per US farm selling organic products is nearly twice the average sales of all farm products per US farm.

- US production of organic farm products has become a large farm activity when measured by sales.

- California dominates, accounting for nearly two-fifths of US sales of organic farm products.

- Besides the Pacific Rim, other key farm organic production areas are the consumer-dense New England and mid-Atlantic regions.

Data Note

To avoid disclosing data for individual farms, sales of organic farm products were not reported for Alabama, Alaska, and South Carolina in the 2012 Census of Agriculture and for Alaska and Delaware in the 2017 Census of Agriculture.