By Josh Maples

A few key USDA monthly reports were released last week relevant to cattle and beef markets. The monthly Livestock and Meat International Trade dataset was released last Wednesday. The monthly World Agricultural Supply and Demand Estimates (WASDE) report was released on Thursday. Additionally, the Meat Price Spreads dataset was released last Friday. In this week’s article, I want to touch on some of the data from these reports.

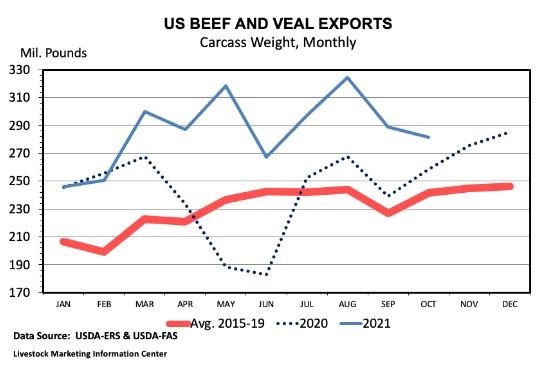

First, from the trade data, the graph above shows beef and veal exports through October. Beef exports have been exceptional throughout 2021 and are on pace for the strongest export year on record. The latest WASDE projects 2021 beef exports at 3.46 billion pounds which, if realized, would be about 9 percent larger than the current record in 2018. Exports to Mainland China were down from their high point in August 2021, but were up 144 percent over October 2020.

The WASDE report also includes forecasts for the 5-area direct live cattle prices. The December WASDE increased the 2022 annual price projection for live steers to $135 from the projection of $130 in the November WASDE. For context, the annual average in 2020 was $108.51 per cwt and the projection for 2021 is $122.56. A 2022 annual price in the mid $130s, if realized, would be the highest average price since 2015.

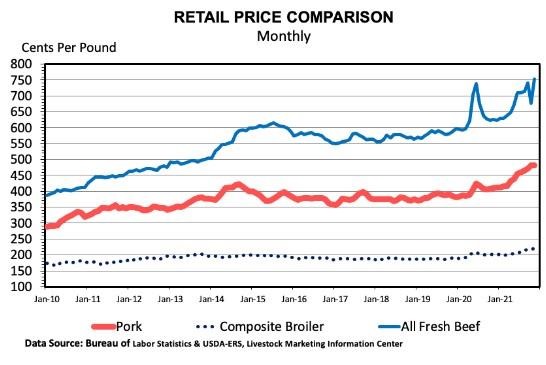

Finally, the meat price spread dataset sheds light on average retail prices using data from the Bureau of Labor Statistics (BLS). One measure reported is the all-fresh beef retail price which was reported at $7.52 per pound during November. This was a few cents below the October level but still about 21 percent above the same month a year ago. Pork and chicken retail prices were also higher as compared to a year ago. Retail pork prices were up about 18 percent and chicken prices were up about 10 percent compared to November 2020. The chart below shows monthly retail prices for beef, pork, and chicken since 2010.

Source : osu.edu